William Blair analysts are tipping hats off to internet giants Amazon.com, Inc. (NASDAQ:AMZN), Facebook Inc (NASDAQ:FB), and Netflix, Inc. (NASDAQ:NFLX). With Amazon’s race to dominate the e-commerce world looking good, Facebook’s convincing odds to achieve share upside ahead of earnings, and Netflix’s captivating second quarter guidance, William Blair is instilling its utmost confidence in these three key stock players. Let’s take a closer look:

Amazon Squares Up to Rule in B2B E-Commerce Arena

After hosting a call last week with two experts, Applico CEO Alex Moazed and head of Applico platform Nicholas Johnson, William Blair analyst Ryan Domyancic sees more reason to back Amazon’s surge in the B2B e-commerce playing field. Expecting the online auction and e-commerce giant to keep capturing shares in the sphere of suppliers and manufacturers as well as the B2C e-commerce sector, the analyst reiterates an Outperform rating on shares of AMZN without listing a price target.

Where does the Applico puzzle piece of it all factor in the big picture of betting on Amazon? From the analyst’s eyes, considering that Applico offers consulting and application assistance to “traditional” B2B firms and companies who offer logistics to fight “the growing threat” posed by Amazon, the situation looks “fairly bleak” for these traditional companies. However, what might have firms of age-old tradition on edge should they not welcome and adapt to the winds of change bears only encouraging tidings for Amazon shareholders.

Domyancic notes, “We continue to believe that Amazon will remain a leader in the B2C e-commerce space and will ultimately be a key B2B marketplace. In our opinion, within the B2B e-commerce market specifically, the ability to reduce customer support costs (especially among smaller customers), streamline ordering processes, and increase the average value per order are all reasons an increasing number of companies will gravitate toward cloudbased e-commerce providers. We suspect that there will be a number of vertical-specific marketplaces, many of them powered by SaaS platforms like CloudCraze, akin to how retail e-commerce sites were powered by companies like Demandware. We believe in commoditized and heavily fragmented markets, Amazon will be able to garner material share.”

“We remain bullish on Amazon’s opportunity to continue growing at a healthy clip in its overall e-commerce business and at a very rapid pace in its AWS segment,” contends Domyancic, who sizes up the stock price as “an attractive entry point.”

According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, three-star analyst Ryan Domyancic is ranked #1,421 out of 4,557 analysts. Domyancic has a 100% success rate and garners 16.9% in his annual returns. When recommending AMZN, Domyancic gains 15.8% in average profits on the stock.

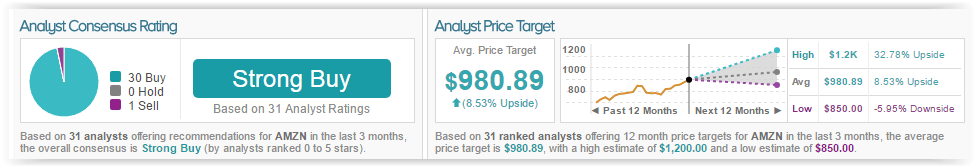

TipRanks analytics show AMZN as a Strong Buy. Out of 31 analysts polled by TipRanks in the last 3 months, 30 are bullish on Amazon stock while 1 is bearish. With a return potential of nearly 9%, the stock’s consensus target price stands at $980.89.

Facebook Could be a $200-Plus Stock By Next Year

With Facebook preparing to post its first quarter results in two weeks on May 3rd, William Blair analyst Ralph Schackart is out with a bullish note, previewing heightened investor awareness turned to ad load coupled with expense growth and signs that show “dynamic ad performance [is] strong and improving.”

Therefore, the analyst reiterates an Outperform rating on FB without suggesting a price target.

After discussions with industry officials, the analyst anticipates an “in-line” advertising revenue result for the quarter at bare minimum, with space for a beat, considering the Street’s projection of $7.66 billion that already would mark a 47% year-over-year climb. Additionally, the analyst points to ad revenue around this time last year that shot up 57%, or 63% at constant currency.

Schackart underscores, “Facebook’s ad revenue beats have averaged about 4% over the last eight quarters, and we think the buy-side is a point or two above the sell-side’s ad revenue growth rate, based on our conversations with investors. We expect revenue growth to decline throughout 2017 as ad load becomes a less significant growth driver. Investors are still trying to quantify the impact of the ad load growth pullback on overall ad revenue growth and determine where 2017 operating expense growth will come in relative to the 47%-57% non-GAAP range (40%-50% GAAP).”

Furthermore, upon hosting meeting with a Facebook ad buyer various times throughout the first quarter, the buyer likes Facebook for a persistently “positive” experience that rides “steady trends,” with customer spending tracking ‘solidly.” The buyer finds no fears of client budgets waning any time soon.

Overall, “We believe the shares have near-term upside to roughly $160-$165, based on a 15 times 2018 EV/EBITDA multiple, with EBITDA forecast to grow 27%. We still believe Facebook can be a $200-plus stock based on 2018 valuation framework first published in our January 2016 industry presentation, Proprietary Report on TV Dollars Shifting to Internet Video,” Schackart concludes.

According to TipRanks, Ralph Schackart is ranked #513 out of 4,557 analysts. Shackart has a 67% success rate and realizes 12.0% in his yearly returns. When recommending FB, Schackart yields 29.9% in average profits on the stock.

TipRanks analytics indicate FB as a Strong Buy. Based on 37 analysts polled by TipRanks in the last 3 months, 35 rate a Buy on Facebook stock while 2 maintain a Hold. The 12-month average price target stands at $163.06, marking a nearly 16% upside from where the stock is currently trading.

Netflix Leaves Investors with Room for More Excitement for Round Two

Joining the earnings conversation on back of Netflix’s first quarter showing for the year, William Blair analyst Ralph Schackart sings the video streaming giant’s praises particularly with regards to promising second quarter subscriber guidance that “buoys [the] stock.”

In reaction to the print, the analyst reiterates an Outperform rating on shares of NFLX while suggesting a base case of approximately $165 per share and a bull case of roughly $205 per share, which marks between a just under 15% increase and a close to 43% increase from current levels.

For the first quarter of 2017, NFLX posted domestic streaming net sub adds that beat consensus expectations by 5% with international streaming net sub adds outclassing consensus by 4%. Where does these solid results arise? The analyst opines, “Management noted the quarter was unusually back-end loaded, perhaps driven by more season 1s versus sequels.” Operating income, EPS, and EBITA all outperformed the Street’s forecasts, with “in line” revenue.

The real strength of the print lies in guidance for net sub adds for the second quarter of the year, which rose “well above expectations” when considering the domestic streaming segment outlook for 600,000 handily trouncing the Street’s expectations for 364,000 and international guided to 2.60 million compared to the Street’s 2.09 million. Moreover, the analyst expects further success to keep on coming, as “A strong sequel slate is anticipated to drive stronger-than-expected second-quarter subscriber additions.”

Meanwhile, “Netflix continues to expect to burn around $2 billion in 2017, which should alleviate near-term investor concerns that it would burn more than previously forecast,” adds Schackart, who continues to ride the bullish train for the giant full steam ahead.

Netflix shares rallied on the heels of the print that promptly left investors raring to support the stock, which from the analyst’s stance largely comes down to second-quarter subscriber guidance performance that was far better than anticipated.

Schackart highlights, “Management also noted it does not expect increased competition from a growing list of OTT pay-TV packages, as it believes these packages compete more directly with cable than with Netflix’s simple, on-demand commercial free viewing service. On the call, management noted it does not expect any material direct competition with Amazon […]”

Ultimately, “Since we upgraded Netflix shares in August 2016, the company has shown solid quarterly execution and its original programming lead gives us added confidence it can reach our updated 2020 estimates,” Schackart surmises.

According to TipRanks, when recommending NFLX, Ralph Schart earns 27.0% in average profits on the stock.

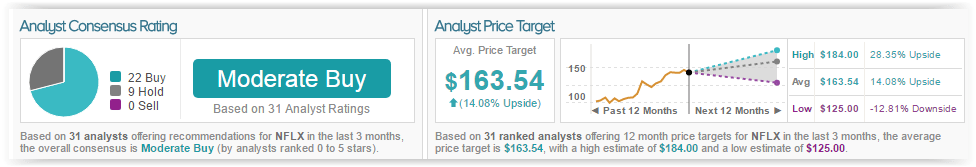

TipRanks analytics demonstrate NFLX as a Buy. Out of 31 analysts polled by TipRanks in the last 3 months, 22 are bullish on Netflix stock and 9 remain sidelined. With a return potential of 14%, the stock’s consensus target price stands at $163.54.