FBR analysts provide their opinions on mining giant Freeport-McMoRan Inc (NYSE:FCX) and telecommunications company AT&T Inc. (NYSE:T), following first-quarter earnings results from each. Let’s take a closer look.

Freeport-McMoRan Inc

Analyst Lucas Pipes weighed in on Freeport McMoRan following the company’s Q1:16 earnings release yesterday. The company posted better than expected adjusted EBITDA of $873 million vs estimates of $761 million and in-line EPS estimates of $(0.16). The analyst attributes the better than expected earnings “primarily due to the cost containment and generally higher commodity pricing.”

The company reduced its 2016 copper sales guidance to 5.0 billion pounds from 5.1 billion pounds due to the anticipated closing of one mine and equipment failure at another. Related, the company decreased its consolidated net cash guide for 2016 copper to $1.05 per pound (down from $1.10 per pound) due to rising gold prices. Higher commodity prices also caused the company to “significantly” increase its operating cash flow estimates to $4.8 billion. The company provided more clarity on asset sales going forward in the earnings release. According to the analyst, the company indicated a high likelihood of such a sale by the end of Q2 and predicts another $1.6 billion in asset sales by the end of the year “to reduce its debt obligations.” The analyst explains further, “Freeport also alluded to “other alternatives” should current negotiations not be successful.” However, “royalty and streaming deals do not currently make sense” for the company.

The analyst reiterates a Market Perform rating on the stock with an $8.00 price target.

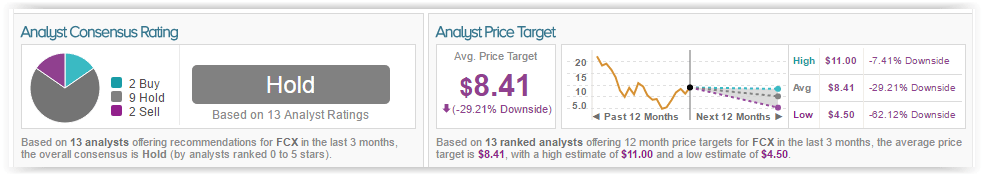

According to TipRanks, out of all the analysts who have rated the company in the past 3 months, 15% gave a Buy rating, 15% gave a Sell rating, and 70% remain on the sidelines. The average 12-month price target for the stock is $8.41, marking a 30% downside from current levels.

AT&T Inc.

Analyst David Dixon provided his insights on AT&T following the company’s Q1:16 earnings release yesterday after market close. The company reported consolidated revenues of $40.5 billion and earnings of $0.63 per share, in line with the analyst’s revenue estimates of $40.8 billion but below Dixon’s EPS estimates of $0.71.

While the analyst highlights “impressive” total wireless net adds of 2.3 million, he notes that this was largely from Mexico, “which has a much lower wireless penetration and profitability than the U.S market.” The analyst notes that U.S. domestic postpaid sub growth came in at a mere 129,000 vs Mexico’s 529,000, and points to a 70.8% y/y decline in the U.S. consumer mobility segment. Dixon attributes this miss to rising competition from T-Mobile. He states, “We believe this corroborates with T-Mobile’s very strong 1.75 porting ratio against AT&T during the quarter, the highest among T-Mobile’s competitors.”

Related, T mobile is “ahead of schedule” to extend LTE on 700 MHz A block spectrums and plans to acquire more A Block spectrums, representing another competitive headwind for T. However, he expects the company to also increase its investment in fiber networks. He states, “We think management is exploring additional consumer access line sales, given the looming wireless access substitution risk, higher costs, and a negative NPV profile to upgrade copper plant to fiber, in our view.” Dixon also mentions to the company’s recent shit towards wireless and TV bundling of 2 year contracts, as it recently acquired DirecTV. However, he believes its bundling offers have “not yet resonated with consumers”

The analyst reiterates his Market Perform rating on the company with a $38 price target. He states, “While we believe T will continue to reap the benefits of an under-penetrated Mexican market and cost synergies and cross-selling opportunities with DTV, competition from TMUS will likely continue to weigh on wireless subscriber acquisitions in the medium term.”

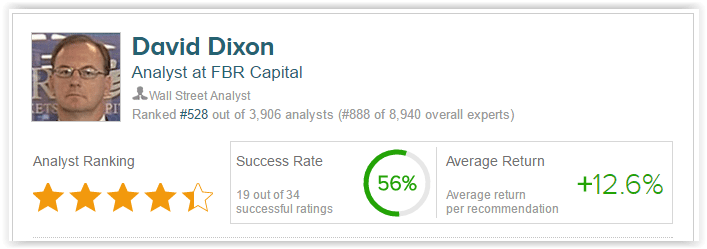

According to TipRanks, David Dixon has a 56% success rate and an average return of 12.6% per recommendation.

Out of all the analysts who have rated T in the last 3 months, 77% gave a Buy rating, 8% gave a Sell rating, and 15% remain on the sidelines. The average 12-month price target for the stock is $41.92, marking a 9% upside from current levels.