Thursday is a big day for biotech as Gilead Sciences, Inc. (NASDAQ:GILD), Celgene Corporation (NASDAQ:CELG), and Keryx Biopharmaceuticals (NASDAQ:KERX) will all be posting first quarter earnings. Analysts will be looking for sales figures across the companies’ flagship products while bracing for foreign exchange headwinds. Let’s take a closer look:

Gilead Sciences, Inc.

Gilead will post first quarter earnings on Thursday, April 28 after market close. Analysts expect the biotech giant to post quarterly revenue of $8 billion, a 5.5% increase from the same quarter of last year but down from $8.51 billion in the previous quarter. Analysts expect adjusted EPS of $3.13, marking a 13.4% y/y increase but down from last quarter of $3.14.

While Gilead has a strong history of beating expectations, analysts are bracing for quarterly declines as the company encounters competition in its hepatitis C franchise. Gilead is most known for Harvoni and Sovaldi, its HCV regimes that comprise more than half of the company’s overall revenue. New competition, specifically from Merck’s Zepatier and AbbVie’s Viekira Pak, are new and cheaper alternatives. To offset this new competition, analysts are looking to the company’s growing HIV franchise. Two more HIV treatments, Odefsey and Descovy, recently earned FDA approval and analysts expect these therapies to garner $3 billion in sales by 2020.

Analyst Brian Skorney of Baird weighed in on Gilead on April 11, 2016, modeling HCV revenue at $2.32 billion, “roughly flat” from the previous quarter of $2.37 billion. However he remains optimistic in the company’s HCV market share, noting, “This quarter’s Hep C scripts are indicative of Gilead’s continued stronghold in Hep C, and leveling off of the Hep C market in the U.S.” The analyst has an Outperform rating on the company with a $135 price target.

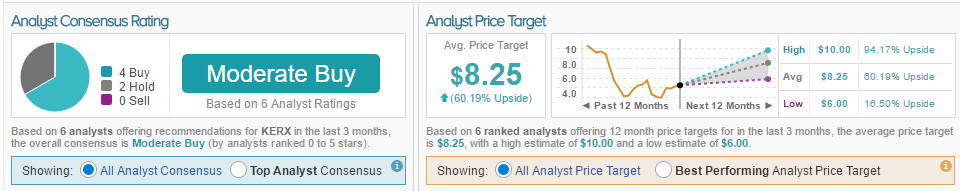

According to TipRanks, 75% of analysts covering the stock are bullish on the company while 25% remain neutral. The average 12-month price target is $114.69, marking a 13% potential upside.

Celgene Corporation

Celgene will post first quarter earnings on Thursday, April 28 before market open. Analysts expect the company to post earnings per share of $1.28, in-line with the company’s range of $1.27 and $1.30, and revenue of $2.58 billion.

All eyes will be on Revlimid and Abraxane sales, though analysts are bracing for FX headwinds. Revlimid is approved to treat multiple myeloma while Abraxane is approved to treat specific forms of lung, pancreatic, and breast cancer. Due to FX headwinds, the company lowered its Revlimid estimates from $6.9 billion down to $6.64 billion.

Alethia Young of Credit Suisse commented on the stock on April 19, 2016, reiterating an Outperform rating but lowering her price target from $144 to $140. The analyst calls Celgene one of her “top picks due to growth quality and number of clinical catalysts 2017 and beyond.”

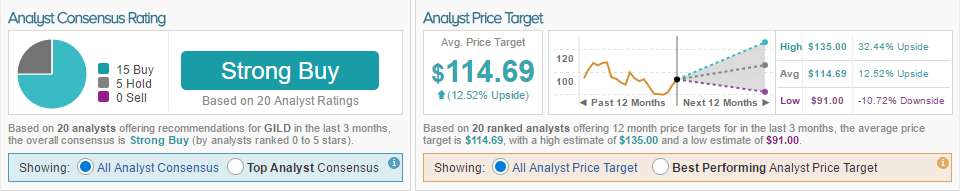

According to TipRanks, 90% of analysts covering the stock are bullish while 10% are neutral. The average 12-month price target is $146.50, marking a 32% potential upside.

Keryx Biopharmaceuticals

Keryx will post first quarter earnings on Thursday, April 28 before market open. Analysts expect the company to post a loss of $(0.26), compared to a loss of $(0.44) in the same quarter of last year.

Analysts will be focused on Auryxia sales, the company’s only approved drug indicated to treat patients with chronic kidney disease who are on dialysis, which is also available in Japan. The company announced positive results in late March in a study to use Auryxia, or ferric citrate, for an alternative indication. The study highlighted that the drug met its primary endpoints in adults with non-dialysis dependent chronic kidney disease. Keryx estimates that there are 1.6 million people living with this condition and there is currently no FDA-approved tablet for iron treatment for these patients.

Maxim analyst Jason Kolbert weighed in on the company following these positive results, which led him to raise his price target from $5 to $7. He explained that the drug for this indication could launch in 2017, if approved.

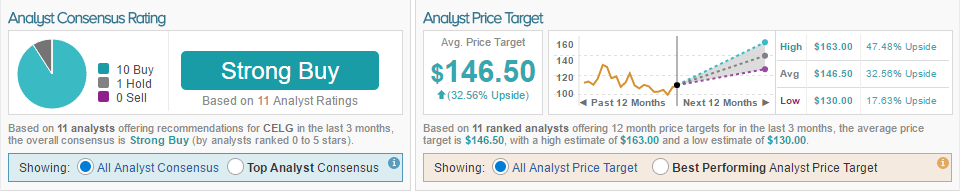

According to TipRanks, 67% of analysts covering Keryx are bullish on the stock while the remaining 33% are neutral. The average 12-month price target between these analysts is $8.25, marking a 60% potential upside.