Analysts from Morgan Stanley and Canaccord provide optimistic outlooks on Microsoft Corporation (NASDAQ:MSFT) and Alphabet Inc (NASDAQ:GOOGL) prior to reporting earnings this evening. Let’s take a closer look:

Microsoft Corporation

As Microsoft is scheduled to release earnings today after market close, Morgan Stanley analyst Keith Weiss remains bullish on the company, forecasting growth despite PC weakness. The analyst forecasts EPS of $0.63, in-line with consensus estimate of $0.64.

The analyst believes the company will benefit from several trends, including strong drivers such as Azure, which he expects to grow by 125% year-over-year, data center, and Office 365. Weiss points to the Cloud segment, which he expects to drive $2.7 billion in revenue, up 70% year-over-year. He notes that PC weakness will result in a 2.7% year-over-year decrease in More Personal Computing revenue, which he guides at $9.06 billion, below the guidance of $9.1-$9.4 billion. A weaker PC environment is already priced into his estimates.

Despite falling PC figures, Weiss expects improving “gross margins in Azure, O365, Surface, Bing, Xbox and Enterprise Services to help offset the downward margin pressure from revenue mix shift towards those lower gross margin businesses.”

Looking forward, Weiss expects Microsoft to continue returning capital to shareholders. He explains that the company returned $6.5 billion to shareholders in the previous quarter through share repurchases and dividends. While Weiss notes it is unlikely that management will provide future guidance on the conference call, he models FY2016 EPS at $2.72 and FY17 EPS at $3.10 thanks to “strong Public Cloud positioning, data center share gains, pricing uplift in the Office franchise, cloud gross margins improving and FX headwinds lifting.”

Keith Weiss reiterates an Overweight rating on Microsoft with a $66 price target, marking a 20% potential upside from current levels.

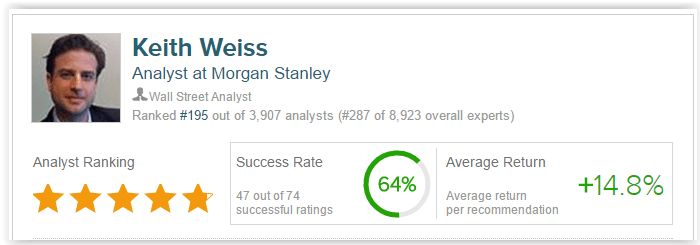

According to TipRanks, Keith Weiss has a 64% success rate recommending stocks with a 14.8% average return per rating. He is ranked in the top 5% of all analysts on Wall Street.

Out of the analysts who have rated the stock in the last 3 months, 68% are bullish, 22% are neutral, and 10% are bearish. The average 12-month price target between these analysts is $58, marking a 4% potential upside.

Alphabet Inc

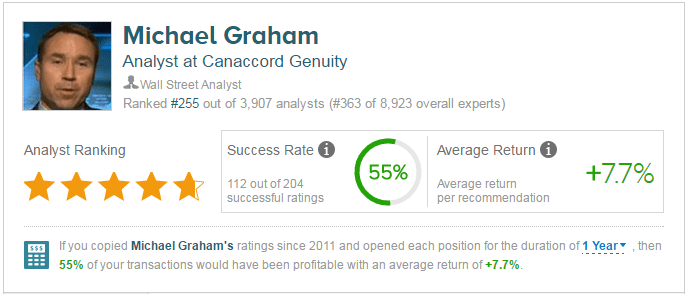

Canaccord analyst Michael Graham was out pounding the table on Alphabet Tuesday, reiterating a Buy rating and price target of $900, as the company is set to release first-quarter earnings results today.

Graham opined, “We think 2016 will be a solid year for Alphabet as these non-core businesses grow and lead to accelerating top-line growth. In Q1, we estimate that Google Websites revenue will grow by 18% y/y, above the 2015 growth rate of ~16%. There continues to be several enhancements to ad products that are leading to sustained advertiser demand and increasing ad spend.”

“Late 2015 into 2016, we have seen and anticipate continuing to see benefits from Product Listing Ads expansion and enhancement, along with greater mobile monetization. On profitability, we expect investments to continue to be disciplined with Google’s operating margin remaining at a high of 38%. We believe this could moderately expand throughout the year and that EPS growth will continue to outpace revenue growth. Other equityfriendly moves like share buybacks can only enhance this positioning,” the analyst continued.

Out of all the analysts who have rated GOOGL in the last 3 months, 97% gave a Buy rating while 3% remain on the sidelines. The average 12-month price target for the stock is /4926.18, marking a 20% upside from current levels.