Recent developments in the technology sector place both tech giant Apple Inc. (NASDAQ:AAPL) and online payment giant Paypal Holdings Inc (NASDAQ:PYPL) on center stage. Analyst Gene Munster of Piper Jaffray weighs in on Apple’s innovation initiative in the face of new Virtual Reality (VR) and Mixed Reality (MR) market potential, and Paypal’s reaction to Apple’s reported move into the mobile-browser payment market.

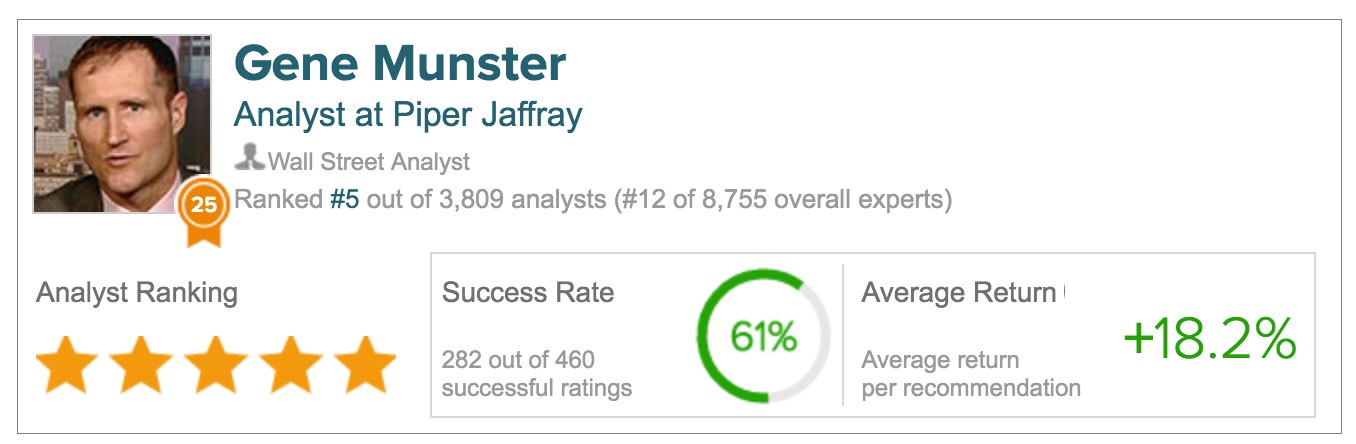

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Gene Munster has a total average return of 18% and a 61% success rate. Munster has a 22% average return when recommending AAPL, and is ranked #5 out of 3748 analysts.

Apple Inc.

The rapid development of Virtual Reality (VR) and Mixed Reality (MR) is compelling Apple and its competitors to revise strategies and re-focus on new unfamiliar markets in the midst of their current profitable market, a situation otherwise termed as ‘The Innovator’s Dilemma.’ Munster from Piper Jaffray weighs in with his thoughts on Apple and how the company will deal with this dilemma.

Although the consequences of The Innovator’s Dilemma for VR and MR are approximately a decade away, says Munster, the important decisions need to be made today. Munster believes Apple is inherently prepared for the technology transition. He states, “We believe Steve Jobs created a culture that embraces the Innovator’s Dilemma… Second, we believe Apple is exploring both VR and MR and expect it to begin working with third parties to enable iPhone-powered VR headsets in the next two years. Third, considering the failures of Nokia and Blackberry, we believe an OS built specifically for VR and MR platforms will be a key component of success.”

Munster suggests that the key point to understand in a major transition of technology is that some products and markets must be sacrificed in order to move forward towards newer markets. The analyst notes that Apple has already done this with its products; the iPod was cannibalized with the iPhone, and Macs by iPads as well. In regards to VR/MR, Munster states, “While Apple has yet to launch a product that cannibalizes the iPhone franchise, we believe that the company realizes that the smartphone as we know it won’t last forever.” He continues, “To this end, we believe Apple continues to explore mixed reality and virtual reality, which in our opinion will be the future of computing.” The analyst gives Apple a Buy rating and a $172.00 price target.

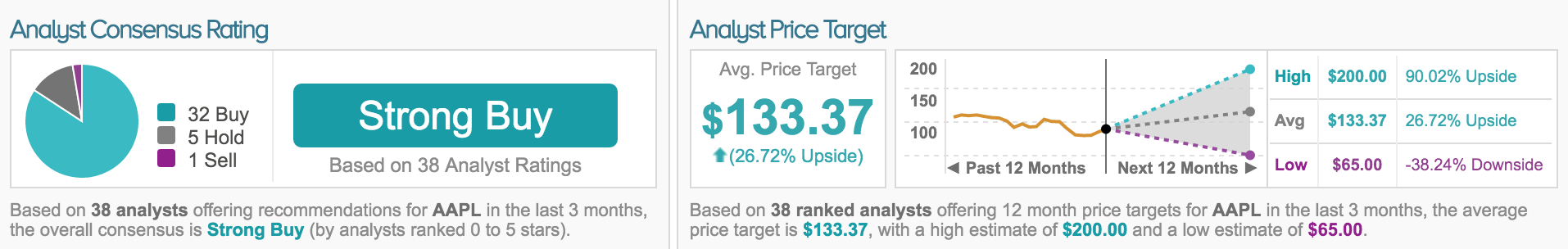

According to TipRanks, analysts continue to be overwhelmingly bullish on Apple. Currently, 32 analysts are bullish on Apple, 1 is bearish, and 5 remain neutral. The average 12-month price target between these 38 analysts is $133.37, marking a 26% potential upside from current levels.

Paypal Holdings Inc

A recent report from the technology news source ‘Re/code’ stated that Apple is making its payment platform, Apple Pay, available to use in mobile-browsers by the end of the year. Munster is quick to point out that this move is contentious in regards to the online payment service company, Paypal. The analyst states that Apple’s move puts PayPal’s mobile online payments in jeopardy. He explains, “The addition of Apple Pay for mobile in-browser payments will represent the first overlap between Apple Pay and PayPal.”

According to the analyst, Paypal’s market dominance in the online mobile payments sector is on the line. Munster notes, “PYPL’s mobile payments were ~30% of total payments volume (TPV) in ’15; we estimate at least 20% of TPV was conducted on iPhone/iOS mobile devices. We believe this portion of PYPL’s TPV is at risk over the next several years.” Munster also believes Apple will offer peer-to-peer payments in Apple Pay, which will threaten Paypal’s Venmo P2P payments.

The analyst concludes, “While investors have discounted the threat from Apple Pay because of its historical confinement to POS transactions, we believe this confirms our belief that Apple Pay’s evolution will ultimately impact PayPal’s business.” Munster reiterates an Underweight rating on Payal with a price target of $33.00

According to TipRanks, in the past 3 months, 13 analysts have given Paypal a Buy rating, and 4 other analysts remain on the sidelines. Overall, the ratings set an average 12-month price target of $41.94, marking a 3.50% upside.