With all the attention on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) lately it has reminded me of Buffett’s Salomon adventure. No, I am not saying these two situations are “exactly” the same but there are a ton of similarities. For those who want the crib notes:

1- Buffett made his largest single investment ever in a company when he put $700M into Salomon (~$1.25B today)

2- That was 1987 and Buffett also took a seat on the Board

3- In 1990-91 Salomon traders broke the law in rigging Treasury auctions

4- Where it not for Buffett agreeing to help run it, Salomon would have probably filed Chapter 11 as the NY Fed was about to cut it off and his entire investment then lost as it was levered ~33-1 at the time (Lehman at its collapse was only 30-1).

Solomon recovered and was later sold to Travelers for $9B in 1997 (Buffett’s stake more than doubled).

It matters here because Valeant, for all of it issues has not broken any laws. We can make moral judgements all we want about drug pricing but the fact remains laws were not broken and they are at very little risk of a Chapter 11 filing. Sure, the media will make a huge deal out of the April 29th deadline but they will file before then and this risk is removed.

Remember folks, the media cares very little about the reality of any situation, they care most about ratings and nothing gets ratings like potentially huge drama.

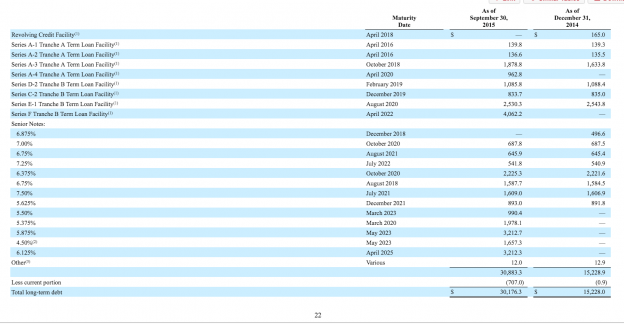

So, Valeant files it 10k and default risk is removed. So, where are we then? They have ~$1B in cash and practically no debt maturing in 2016, none in 2017 and ~$3.5B in 2018. Along the way they bring in ~$6B in EBITDA in 2016 and let’s call the annual number for 2017, 2018 flat so they earn roughly $15B EBITDA between now and before the first debt is due in August 2018 ($1.6B). Even if results fall, it would have to be an utter collapse for there to be debt issues. Additionally, all of this assumes they do not sell something between now and then to pay down debt early.

Then they have nothing until 2020.

The bottom line is that they have a very long time to get their act together.

Valeant is looking compelling here. The stock collapse has stopped, the largest investor in on the Board now and there is a new CFO and CEO coming in. A top notch CEO with industry cred (think Hunter Harrison at Canadian Pacific) could turn sentiment about the company around instantly. We have to remember, even with its current issues, it is still a very profitable company for those buying shares here.

Whenever a big investor takes a hit, there are those who love to pile on and take their shots at them. From those who manage a pittance compared to these guys who even after their worst year have track records that soundly trounced those piling on, to the media who only manage maybe a checkbook to those bloggers whose sole existence in the world is telling us how everyone and everything just sucks (fortunately these are the minority of bloggers) it is their “Super Bowl of Schadenfreude”. It comes with the turf for those who manage billions. If you want to be at the top, you have to deal with those who only mission in life is to try to knock you off. Your choice is that or essentially hide like Seth Klarman does (anyone know his $LNG investment is down ~50% the last year?). They are no different that QB’s in football, when they do well, they are heros, when they stumble, they are bums. They are blamed for every action within the company when things go wrong. If a football team loses because a safety blows a coverage in the final seconds and the opponent scores to win the losing team’s QB “can’t win the big one”.

Likewise we are told Ackman should have known this or that about Valeant (even though he did not have a board seat until yesterday) and had social media been as pervasive in 1991 as it is today, these same people would have been claiming that since Buffett was on the Board at Salomon he must have known about the Treasury bid rigging and probably even endorsed it. At the very least these same folks would have painted him as utterly incompetent and derelict for not catching it. This of course would have been in spite of 99% of them having never stepped foot inside a corporate boardroom.

All that said, for value investors this piling on does provide opportunity. The cascade of opinion and coverage drives prices well below where they would have fallen without the incessant negative drumbeat (and conversely higher when everyone loves something). In times of fear or confusion, every negative article is given a “fact first” opinion until otherwise proven wrong. Separating the credible from the junk takes time and effort and selling a stock is far easier. So people sell. But again, this creates opportunity.

Wading in at prices far far below even a reasonable valuation gives one a huge safety net. People are convinced that default is a probable risk for Valeant now. I think in the case of Valeant simply filing a 10k by April 29th could be a huge positive for the stock. We do not even at this point have to get into debt repayment in 2020, drug pricing in 2017 and beyond or potential divestitures. At prices where they are, just hiring a CEO who has respect and filing a 10k can make you money.