Wall Street analysts weighed in on smartphone component maker Skyworks Solutions Inc (NASDAQ:SWKS), security firm Palo Alto Networks Inc (NYSE:PANW) and Chinese search engine giant Baidu Inc (ADR) (NASDAQ:BIDU). One analyst from Oppenheimer is bullish on Skyworks, citing competitive advantages and high demand. Another analyst from Nomura remains positive on Palo Alto, citing increased security spending and a strong product portfolio. Finally, a Brean Capital analyst remains on the sidelines for Baidu, citing earnings success but a challenging road ahead.

Skyworks Solutions Inc

Analyst Rick Schafer of Oppenheimer weighed in on Skyworks Solutions following meeting with VP of Investor Relations Stephen Ferraniti at the World Mobile Congress in Barcelona. The analyst believes that “Overall the tone was positive as SKWS looks to gain content on all leading platforms this year.” Of all the new product announcements at the conference, the analyst was particularly bullish on Skyblue, a “proprietary PA architecture that exceeds envelope tracking in performance and efficiency,” believing it makes the company a viable competitor for high-band applications. He also expresses bullish views on increasing RF demand, capacity expansion in Japan, and strong FCF.

Schafer states, “With the company’s focus on the “systems approach” and leading position in integrated modules, we believe SWKS remains uniquely positioned to benefit from rising RF content trends and the move toward systems-level solutions. We would expect to see RF content up another 20% in 2016.”

The analyst also comments on M&A. In November, management terminated the merger with PMC Sierra, stating that it did not make sense strategically. Despite strong FCF reported in earnings, Schafer believes “M&A is still on the table.” However, “if mgmt is unable to find a suitable target, we could see an accelerated buyback.”

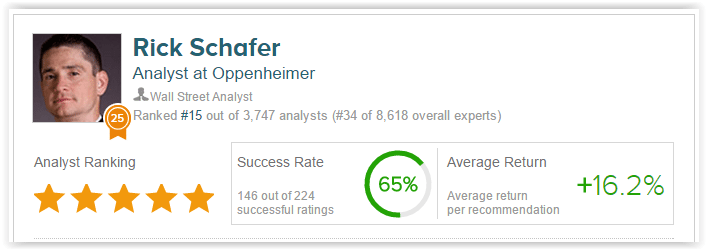

Schafer reiterates his Outperform rating on the company without a price target. He explains, “We look for multiple expansion from here as investors begin to turn their sights on content-driven growth and upside potential in CY2H.” Rick Schafer is ranked #15 out of 3,747 analysts on TipRanks. He has a 65% success rate recommending stocks with an average return of 16.2% per recommendation.

According to TipRanks’ statistics, all 12 analysts who rated the company in the past 3 months gave a Buy rating. The average 12-month price target for the stock is $92.44, marking a 42% upside from where shares last closed.

Palo Alto Networks Inc

Analyst Frederick Grieb of brokerage firm Nomura weighed in on Palo Alto following the company’s F2:16 earning last Thursday. The company announced 62% y/y billings growth, ahead of both the analyst’s and Street estimates, causing him to raise his overall FY16 revenue estimates. The company also posted slightly better than expected revenue guidance for the next quarter. While Grieb offers conservative guidance, the company has a history of surpassing its guidance by 6% on average.

The analyst notes that the company decreased its operating margin guidance in Q4 to 18-19% (from 22-25%) as a result of higher than expected subscription adoptions. Although the “ratable revenue recognition for subscription” creates “little revenue in period to offset these additional costs,” the analyst believes the expected increase indicates “value creation” for shareholders.

The analyst also points to concern regarding a decrease in overall security spending due to recent trends. However, the analyst does not believe these trends affected Palo Alto. He states, “We believe Palo Alto’s 2Q results (as well as our recent CSO survey) suggest that the security spending environment remains robust – a positive for our covered security software vendors.”

The analyst reiterates a Buy rating on Palo Alto with a $200 price target. He states, “We remain positive on Palo Alto as the company has product offerings that are consistently well rated in our checks, and the company has shown a consistent ability to take share (Palo Alto was shown as a top IT Security budget gainer in our most recent CSO survey).” Frederick Grieb has a 50% success rate recommending stocks with an average return of 13% per rating.

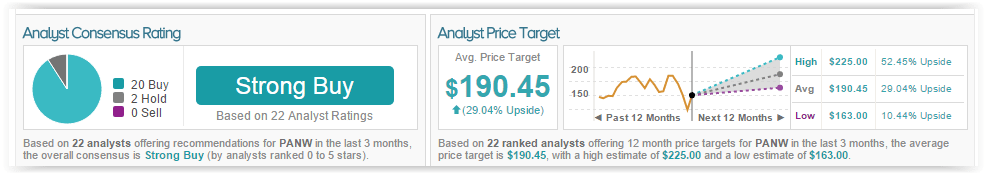

Out of the 22 analysts who have rated the company in the past 3 months on TipRanks, 20 gave a Buy rating while 2 remain neutral. The average 12-month price target for the stock is $190.45, marking a 29% upside from where shares last closed.

Baidu Inc (ADR)

Analyst Fawne Jiang of Brean Capital recently weighed in on Baidu after the company posted Q415 earnings last Thursday. The company posted revenues of RMB 18.7 billion, surpassing analyst estimates of RMR 18.55 and marking 33% y/y growth. The company also significantly beat non-GAAP estimates of $1.20, posting earnings of ~$11.10. The company also posted non-GAAP operating margins of 20.7%, nearly 50% higher than consensus estimates of 11.9%. The analyst attributes these solid quarter results to the share exchange between Baidu and travel company Ctrip in late October, where the company sold its stake in search engine Qunar for $3.4 billion. Another factor attributable to earnings success was “less aggressive” O2O (online to offline) quarter spending.

Despite earnings success, the company guided lower than expected revenues for next quarter, which the analysts attributes to “partial inconsistency with consensus in regards to QUNR modeling; [and] core search growth deceleration.” While core search remained “solid” in the quarter, marking 56% of total revenue and about 2/3 of the company’s total search traffic, Jiang is cautious on growth going forward. The analyst explains, “While we are positive on Baidu’s overall positioning on core search, we expect it could face some growth challenges given deconsolidation of QUNR, increasing competition from in-app search on mobile and potential macro slowdown headwind.”

The analyst remains cautious on the company’s O2O segment, stating a competitive playing field. Jiang believes October’s Meituan/Dianpig merger, the largest Chinese provider of on demand services, will likely cause the company to more heavily invest in its O2O segment in the upcoming years to stay competitive. As a result, Jiang believes the company will not have “any meaningful margin recovery, particularly factoring its revenue growth will be dampened as a result from the departure of high growth segments” and her predicted challenges for core search.

The analyst reiterates a Hold rating without a price target. She states, “We would become incrementally more positive should we see the company having delivered: 1) stabilizing/accelerating core search growth; 2) participation in O2O markets consolidation.” Fawne Jiang has a 44% success rate recommending stocks with an average return of 3.9% per recommendation.

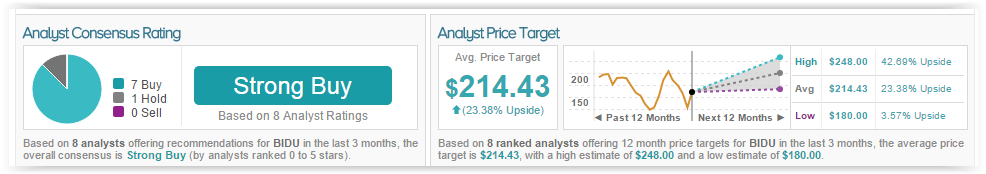

According to TipRanks’ statistics, out of the 8 analysts who have rated the company in the past 3 months, 7 gave a Buy rating while 1 remains on the sidelines. The average 12-month price target for the stock is $214.43, marking a 23% upside from where shares last closed.