Analysts weigh in on two biotech stocks, Novavax, Inc. (NASDAQ:NVAX) and Neuralstem, Inc. (NASDAQ:CUR) in light of recent events. Some may believe that Novavax is jumping the gun by making commercialization preparations for a drug that is still in Phase 3 trial, but the company’s optimism could be a reason to be bullish. Neuralstem, on the other hand, just appointed a new president that is likely to prioritize the company’s most valuable asset.

Novavax, Inc.

Novavax is already making preparations to commercialize its Respiratory Syncytial Virus (RSV) vaccine in the elderly since management anticipates positive top-line Phase 3 data this summer. In light of this positive outlook, analyst Heather Behanna of Wedbush recommends buying shares of the company during the recent market pullback and ahead of the pivotal data release.

The analyst explains, “Although there is inherent risk in commercializing the first RSV vaccine, we believe the flu vaccine sets a clear path forward.” In the flu season of 2014-2015, 67% of the elderly population received flu vaccines, according to CDC data. Behanna explains that the elderly population regularly visits physicians and are advised to get vaccinated.”

Behanna notes that potential commercialization success for the vaccine rests upon the recommendations from the Advisory Committee on Immunization Practices (ACIP). The analyst explains that the recommendation is only given to approved products, but Novavax is already working with the CDC and gathering relevant research to “begin a dialogue and to educate the ACIP on the need for RSV vaccination.” Ideally, Novavax’s RSV vaccine will launch ahead of the 2018 flu season.

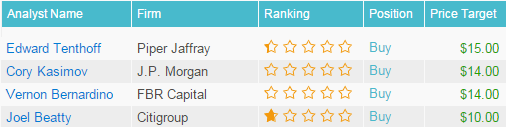

Based on the positive outlook for the company’s RSV vaccine in the elderly, Behanna reiterated an Outperfrom rating on Novavax with a $14 price target on February 16. According to TipRanks, four other analysts currently has a buy rating on Novavax.

Neuralstem, Inc.

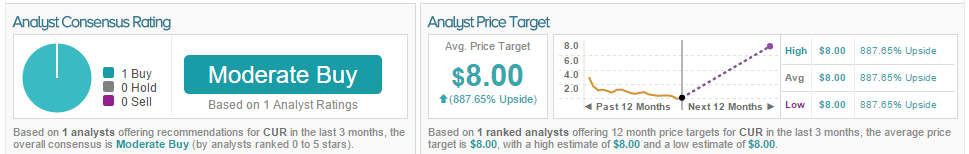

Jonathan Aschoff of Brean Capital reiterated a Buy rating on Neuralstem with an $8 price target after the company announced the appointment of a new CEO, Richard Daly. Aschoff approves of this decision “given the extensive experience Mr. Daly has gained over his 25 years of commercial pharmaceutical leadership, which includes strategy, sales, marketing, and operations.”

Aschoff specifically points to how Daly will impact the company’s pipeline. The analyst believes NSI-189, a pipeline drug for depression, is the company’s most valuable asset. He comments, “Mr. Daly has exactly the type of experience that can assist in the necessary eventual partnering of this asset, given the requirement for large Phase 3 trials and its large primary care indication. We believe that his fresh perspective on the company will result in the clear prioritizing of NSI-189 over NSI-566,” the company’s pipeline drug for ALS and other indications. Aschoff comments that prioritizing NSI-189 over NSI-566 should please investors.

The analyst has a 29% success rate recommending stocks with average loss of 14.5% per rating. He is the only analyst on TipRanks who has recently covered Neuralstem.