Analysts from BMO Capital and Roth Capital recently weighed in on technology companies Nokia Corporation (ADR) (NYSE:NOK) and Glu Mobile Inc. (NASDAQ:GLUU) after both companies posted Q4 earnings last week. Both are bullish on each company due to the success and integration of Alcatel Lucent, and increases in stock ownership and game launch, respectively.

Nokia Corporation (ADR)

Analyst Tim Long of BMO Capital recently weighed in on Nokia after the company posted better than expected revenue and EPS for its fourth quarter. The analyst credits part of this win to a recent arbitration involving Samsung, resulting in a hefty licensing payment to the company. While “networks revenue was slightly below [the analyst’s] expectations,” Alcatel Lucent’s revenue, recently acquired by Nokia, surpassed the analyst’s expectations. As a result of the acquisition, he provides new EPS estimates for 2016 and 2017.

While Long cites positive earnings figures, the analyst believes these strong earnings will be tough to follow for the company’s March quarter, especially due to “a difficult wireless capex environment.” Although “management has been executing well on the acquisition,” the analyst is cautious on the industry as a whole, and expects “flat revenue for this year and next.”

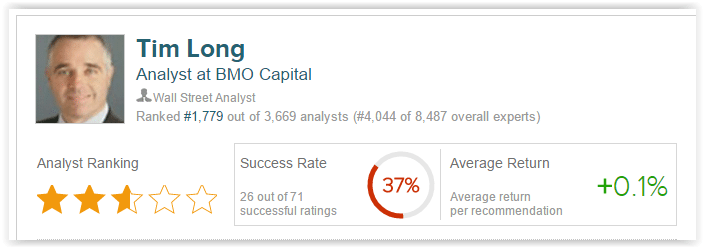

On February 11, 2016, the analyst reiterated his Outperform rating on the company, lowering his price target to $8 from $10. Tim Long has a 37% success rate recommending stocks with an average return of 0.1% per recommendation on TipRanks.

According to TipRanks’ statistics, out of the 8 analysts who have rated the company in the past 3 months, 6 gave a Buy rating while 2 remain on the sidelines. The average 12-month price target for the stock is $9.60, marking a 64% upside from where shares last closed.

Glu Mobile Inc.

Roth Capital analyst Darren Aftahi weighed in on Glu after the company posted its Q4 earnings last week. According to the analyst, the earnings reflected three major catalysts.

The first highlight includes the $50 million worth of stock buyback last month, resulting from a strong balance sheet. Second, Tencent Holdings, Gluu’s largest shareholder, added 2.3 million shares to its portfolio, increasing its stake in the company from 15% to 19%. Finally, the company plans on releasing the game Kendall and Kylie next week, which according to the analyst will be a “solid” launch. He explains, “We believe K&K could be contributory to 2016’s top-line.”

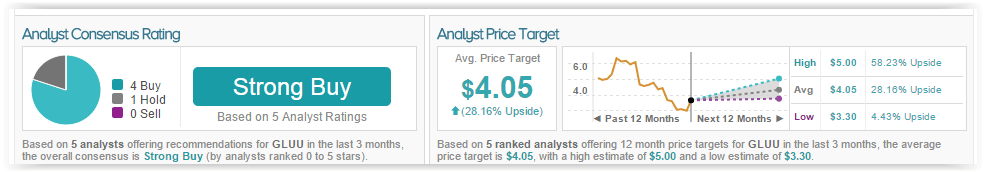

On February 11, 2016, the analyst reiterated a Buy rating on the company with a $4 price target. Darren Aftahi has a 48% success rate recommending stocks with an average loss of (4.1%) per recommendation.

According to TipRanks’ statistics, out of the 5 analysts who have rated the company in the past 3 months, 4 are bullish and 1 remains neutral. The average 12-month price target for the stock is $4.05, marking a 28% upside from where shares last closed.