In light of a new contract obtained by a subsidiary of Freeport-McMoRan Inc (NYSE:FCX) and earnings from Akamai Technologies, Inc. (NASDAQ:AKAM), analysts from FBR weighed in both stocks. However, it seems the bull days are over as neither analyst is enthusiastic about either stock.

Akamai Technologies, Inc.

Akamai reported 4Q15 earnings yesterday, prompting David Dixon to weigh in on the stock. The company posted quarterly revenue of $579.2 million, marking an 8% year-over-year increase and beating the analyst consensus of $569 million. The company posted Adjusted EPS of $0.72, beating the analyst consensus of $0.62. The stock is currently up 23% in trading.

The analyst attributes the earnings beat to “double-digit growth in the performance and security and the service and support solutions segments.” He also points out that “the media delivery solutions revenue decline of 1.8% YOY was better than feared.” He remains bearish on the company, commenting, “We see greater DIY (and repricing) risks in the CDN business as foundational datacenter and fiber assets are established for more players today than in 2011, providing low incremental cost opportunity. An intense sales focus has the performance and security solutions business ramping nicely, but we see secular challenges with the enterprise segment bifurcating.”

Aside from strong earnings, the company announced weak guidance, estimating first quarter revenue between $554 million and $570 million, compared to the consensus of $567.9 million. The analyst attributes this disappointing forecast to “aggressive pricing and revenue declines from its top two customers (13% of revenue, heading to 6% by mid 2016) as they migrate to DIY platforms.”

As a result of the earnings release and future guidance, the analyst is maintaining an Underperform rating on the stock but lowering his price target from $49 to $42.

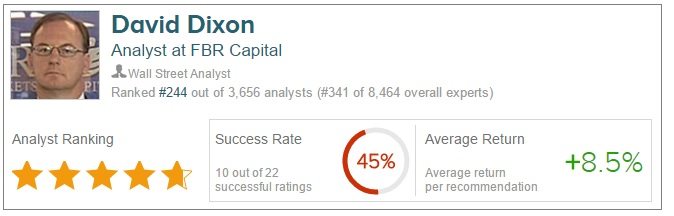

Dixon has a 45% success rate recommending stocks with a +9.5% average return per rating. According to TipRanks, 6 analysts are bullish on the company; 2 are bearish; and 2 remain neutral. The average 12-month price target between these 10 analysts is $62.30, marking a 28% potential upside from current levels.

Freeport-McMoRan Inc

Metal giant Freeport-McMoRan received welcomed news yesterday upon learning that its Indonesian subsidiary company received a 6-month export permit. Lucas Pipes comments on the development, explaining, “This development is a welcome positive for Freeport, and we believe that the company’s concentrate sales from Grasberg are most likely not impinged by this brief period without an export license.”

Although the analyst highlights this good news, he quickly acknowledges the challenges that remain ahead. Pipes elaborates, “We remain cautious on our outlook for both copper and oil pricing where we anticipate prolonged oversupply.” In addition, “although this morning’s issuance of the Indonesian export permit is encouraging, [the analyst] believe[s] that the underlying interests still leave room for future uncertainties.”

In light of the newly obtained permit, Pipes is maintain a Market Perform rating on the company with a $3 price target, marking a nearly 40% downside from current levels.

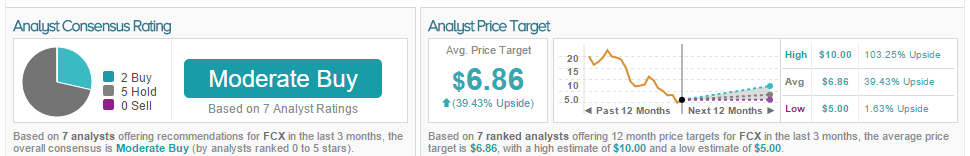

According to TipRanks, 2 analysts are bullish on FCX while 5 remain on the sidelines. The average 12-month price target between these 7 analysts is $6.86, marking a 38% potential upside from current levels.