Analysts from FBR & Co. and Canaccord weighed in on QUALCOMM, Inc. (NASDAQ:QCOM) and Under Armour Inc (NYSE:UA) after both companies released earnings. While one analyst cites neutral sentiment on Qualcomm due to weak guidance, the other is bullish on Under Armour, citing growth across all sectors.

QUALCOMM, Inc.

FBR analyst Christopher Rolland weighed in on Qualcomm following its Q4:2015 earnings release. The analyst states better than expected top line results due to 3G/4G device units, but weaker than expected guidance for the next quarter. This weak guidance is a result of low QCT revenue, resulted from “fewer expected shipments into iPhones,” as Apple is one of the company’s main customers. Rolland states QCOM did not comment on lower QCT revenue for the second half of 2016 in its report, explaining that the company “recognizes iPhone royalties one quarter in arrears.”

He also expressed bearishness on an “ongoing royalty dispute with LG, requiring the company to defer certain revenue until the dispute is settled.” He continued, “We are only slightly lowering our 2016 and 2017 EPS estimates, as deep opex cuts in 1Q16 and beyond help to mitigate $0.15–$0.20 of damage annually.” Although the analyst believes the company is the “gold standard” in cellular technology, “the mobile innovation treadmill has slowed.”

The analyst reiterated his Market Perform rating on the company with a $56 price target.

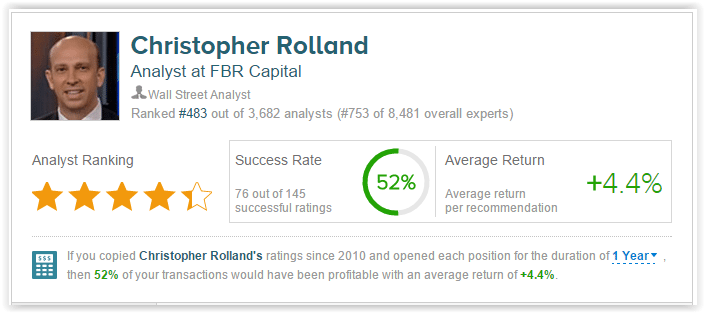

Christopher Rolland has a 52% success rate recommending stocks with a 4.4% average return per recommendation on TipRanks.

Out of the 13 analysts who have rated the company on TipRanks, 13 are bearish while 6 remain on the sidelines. The average 12-month price target for the stock is $60.97, marking a 37% upside from current levels.

Under Armour Inc

Analyst Camilo Lyon of Canaccord weighed in on Under Armour today after the company posted a strong Q4 earnings report. As a result, the analyst states that “concerns around UA’s ability to deliver solid top-line growth should be quelled.” The company posted growth across all sectors for the quarter, surpassing the analyst’s own estimates. Additional positives included the company’s lower tax rate and unchanged 2016 guidance.

While inventory levels were slightly above his estimates, the analyst will keep an eye on levels going forward, as “the company has been planning to carry more product to better meet on-time deliveries.” Due to concern regarding stalled growth and discounting, the analyst believes shares will have “a meaningful relief rally as the brand’s momentum has not ebbed, the quarter was not as bad as fears, and 2016 guidance was unchanged.” The analyst is bullish on the company and views it as a “once in a generation brand.”

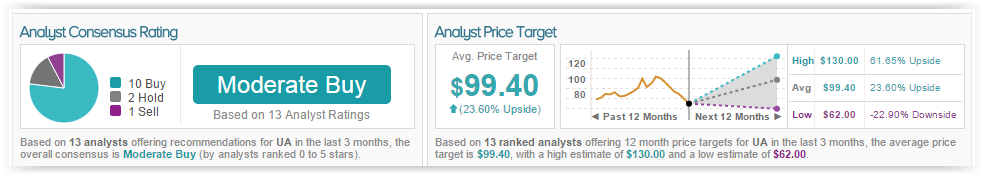

The analyst reiterates a Buy rating on the company with a $130 price target. Camilo Lyon has a 37% success rate with an average loss of 5.4% per recommendation.

According to TipRanks’ statistics, out of the 13 analysts who have rated the stock in the past 3 months, 10 gave a Buy rating, 1 gave a Sell rating, and 2 remain on the sidelines. The average 12-month price target for the stock is $99.40, marking a 24% upside from current levels.