CES continues to dominate headlines as the technology conference is underway in Las Vegas. In light of new announcements and developments, Gene Munster of Piper Jaffray weighs in on both Facebook Inc (NASDAQ:FB) and Amazon.com, Inc. (NASDAQ:AMZN). He believes both companies will remain dominant in their respective areas, thanks to Oculus Rift for Facebook and AWS for Amazon.

Facebook Inc

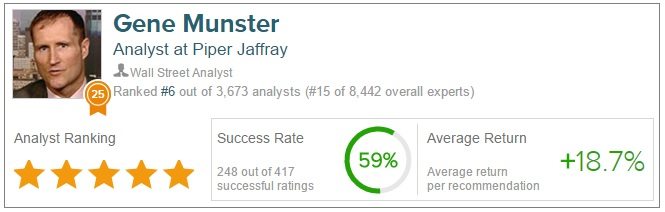

Munster continues to tell investors that 2016 will be the year of virtual reality. However, he warns that since most are just getting exposed to this cutting edge technology, Facebook’s VR platform, Oculus Rift, will not see substantial profit this year. In light of several CES announcements and developments in VR, Munster reiterated his Overweight rating on Facebook with a $155 price target.

The analyst notes that although the $599 price tag for Oculus Rift is higher than expected, “pre-order demand outpaced [his] expectations as evidenced by delivery dates quickly moving from March to June.” He explains that content for Oculus Rift will be ramped up with NextVR and Jaunt, “the Netflix of VR.” Munster comments, “From NextVR we expect more live streaming of NBA, soccer and NHL. From Jaunt we expect more premium content coming in line with partnerships that created ‘Inside North Korea’ by ABC and ‘It’s a Small World Holiday,’ a view inside Disneyland.”

Munster also touches on Qualcomm’s announcement of its first VR optimized mobile processor, commenting, “Although computer driven VR gets the majority of press, we expect mobile driven VR and later on wireless all in one headsets to ship with more volume over the next 10 years.” The analyst expects this new technology to “allow for better experiences” in VR headsets.

According to the 34 analysts polled by TipRanks in the last 3 months, 33 are bullish on the social media company while one remains neutral. The average 12-month price target between these 34 analysts is $125.33, marking a 29% potential upside from where shares last closed.

Amazon.com, Inc.

Munster weighed in on Amazon today, reiterating his Overweight rating with an $800 price target after Piper Jaffray’s recent survey of 135 CIOs. The results of the survey bodes well for Amazon, which demonstrated that its cloud platform, Amazon Web Service, came out on top.

Munster explains, “Despite having over a third of mindshare among CIOs, AWS took an additional 130bps of mindshare from competitors according to the 2016 survey, after taking 170bps in 2015. Also, 87% of CIOs intend to spend more on AWS in 2016 than in 2015.” The analyst believes AWS is a superior platform to its competitors due to its “superior functionality, scalability, faster pace of innovation and developer loyalty.”

Munster also mentions Azure as a competitor, explaining that it is “the only meaningful threat to AWS.” Ultimately, the analyst sees the space becoming “a duopoly of sorts, with AWS and Azure taking the two largest positions.” He concludes, “We continue to believe the cloud storage and compute industry will be a duopoly, with AWS remaining the dominant player.”

According to TipRanks, 24 analysts are bullish on Amazon and 6 remain neutral. The average 12-month price target for the stock is $755.36, marking a 24% potential upside from where shares last closed.