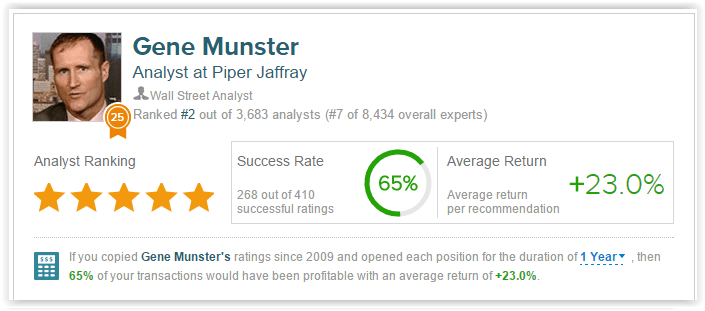

Piper Jaffray analyst Gene Munster yesterday weighed in on technology giant Apple Inc. (NASDAQ:AAPL) and social network giant Facebook Inc (NASDAQ:FB), following investor concern that iPhone sales will go into decline and an anticipated virtual reality launch, respectively. According to TipRanks’ statistics, analyst Gene Munster is rated #2 out of 3,683 analysts. He has a 65% success rate recommending stocks with an average return of 23% per recommendation. Let’s take a look and see what Munster has to say about AAPL and FB.

Apple Inc.

Munster weighed in on AAPL following recent investor iPhone concerns. The analyst cites “measurable cuts to analyst estimates” and supplier guidance revisions as the main reasons for these concerns. Earlier this week, Dialog Semiconductor, one of Apple’s suppliers, reduced its Q4 sales guidance by 11%. Despite this revision, the analyst agrees with Apple’s previous statements that “individual component suppliers are not indicative of health of the overall iPhone business.” Also, assuming the lowered guidance was for iPhone units, the revision would mark a 9% y/y decrease, better than analysts’ 15% y/y prediction.

The analyst does not believe these events will have a negative effect on the company’s upcoming December 15 quarter, citing CEO Tim Cook’s positive sentiment regarding the iPhone in the company’s 2015 earnings call. These included “a high switcher rate from Android (30% in Sep-15), a low percentage of the base that has upgraded ex-iPhone 6/6 Plus (30% in Sep-15) and low penetration in emerging markets in China and other Asian countries.” In light of these positive developments, the analyst states an increased risk to the company’s next quarters due to difficulties in predicting iPhone demand prior the next upgrade cycle. Munster believes that investor feedback indicates the next few quarters will “appear less significant to the broader iPhone story” and questions “whether the iPhone will grow during the iPhone 7 cycle.” Overall, the analyst believes the upcoming iPhone 7 will have 4% cycle growth, and remains a “top large cap pick for 2016.”

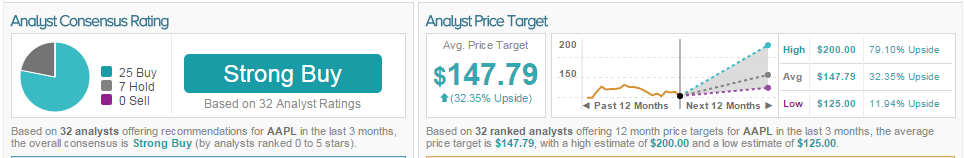

Out of the 32 analysts polled by TipRanks in the last 3 months, 25 rate Apple stock a Buy, while 7 rate the stock a Hold.With a return potential of 32.35%, the stock’s consensus target price stands at $147.79.

Facebook Inc

Munster also weighed in on Facebook prior to the company’s launch of its Oculus Rift virtual reality platform. The analyst expects this release to have a positive impact on shares, introducing investors to virtual reality. The analyst expects the “Oculus ramp to be slow initially,” echoing comments made by CEO Mark Zuckerberg during the company’s 2015 earnings call. The analyst previously expected Facebook to sell 3.5 million units of Oculus in the first year. However, Zuckerberg’s expectations are much lower, in the “few hundred thousand range,” causing Munster to decrease his estimates. Despite expected slow demand, the analyst “[sees] compelling VR content starting to emerge with Millennials and Generation Z,” which he believes are the product’s initial target market. The analyst also points to an increase in the amount of VR centered games and experiences set to release in the next year for both Oculus and its competitors, where “there has been overwhelming interest in previews of this content.”

Munster believes the delay in competitor launches for similar products will cause Oculus to not only “be the first VR platform released in 2016,” but also lead in the category. He states that overall, “the start of generating consumer excitement around the [VR] category, particularly in gaming,” is more important than first year sales. The analyst cites Zuckerberg’s beliefs that the more people start to use VR, the easier it will be for the company to “deliver and monetize new social experiences in virtual reality.” Munster reiterated his Overweight rating on FB with a price target of $155.

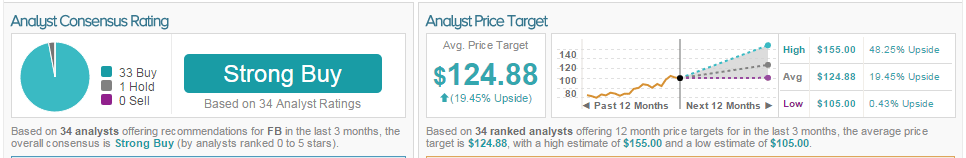

Out of the 34 analysts polled by TipRanks in the last 3 months, 33 are bullish on the stock a Buy, 4 are neutral, and 1 recommends is berish. With a return potential of 19.45%, the stock’s consensus target price stands at $124.88.