Top analysts from Cannacord and Cantor recently weighed in semi-conductor company QUALCOMM, Inc. (NASDAQ:QCOM), internet giant Yahoo! Inc. (NASDAQ:YHOO),and semiconductor company Avago Technologies Ltd (NASDAQ:AVGO), following licensing announcement, the potential sale of a core business, and a stellar earnings release, respectively.

QUALCOMM, Inc.

Analyst Michael Walkley of Cannacord weighed in on QUALCOMM after yesterday’s license agreement announcement with Xiaomi and Hizhou TCL Mobile, 2 leading Chinese OEMs. The analyst states that Qualcomm’s additional licensing agreements with companies Huawei and ZTE will help the company “improve collection issues with Chinese OEMs.” Related, the analyst believes that the companies Qualcomm is working with in China will consolidate market share from smaller, more fragmented OEM’s, further improving collection issues. The analyst believes these recent deals, as well as the potential to sign new ones, will help the company reach the higher end of its guidance for 2016 and is therefore increasing his estimates for 2016. He states that although “near-term high-tier smartphone chipset share dynamics negatively impacted F2015 estimates,” the analyst is hopeful that QCT trends will recover during F20156, mainly because of the $1.4 billion cost savings program and improved sales of Snapdragon, due to the early design for the Snapdragon 820. The analyst also expresses positive sentiment about future management announcements regarding cost reduction measures due to “its strategic review to further bolster the return to mid-teens or higher QCT operating margins.”

Walkley reiterated a Buy rating and $65 price target for the stock. According to TipRanks’ statistics, Walkey is ranked #15 out of 3,685 analysts. He has a 63% success rate recommending stocks with an average return of 16.6% per recommendation. Out of the 12 analysts who have rated QCOM in the last 3 months, 7 gave a Buy rating while 5 remain on the sidelines. The average 12-month price target for the stock is $64.88, marking a 25% upside from where shares last closed.

Yahoo! Inc.

Cantor analyst Youssef Squali weighed in on Yahoo after the company announced its board will discuss a potential sale of its core internet business. The analyst believes there are 3 equally likely scenarios that will result from the discussions. Averaging the likelihood of the 3, the analyst believes the fair value of the stock is $476, a 31% upside from yesterday’s close price. Assuming that the company adopts one of the 3 scenarios before now and early 2016, the analyst will most likely re-rate the stock, driving the price higher in the set time frame. This is also the time frame for which management anticipates the conclusion of the Aabeco spin-off.

Squali believes the first scenario is the company selling its stake in Alibaba in a fully taxed transaction. The analyst is not sure whether the sale would be fully-taxable at the time or if the IRS will send the company a tax bill after its completion. He believes this scenario will result in a sum-of-the-parts $37.41 fair value for the stock, a 3.9% upside from where shares last closed. The second scenario is that the company would sell its BABA stake tax-free, the favorable option of management and the board. Although the IRS did not issue a Private Letter ruling for this plan, management proceeded anyway due to an anticipated positive opinion from the company’s tax counsel, Skadden Arps. According to the analyst, this scenario would result in a sum-of-the-parts $51.22 fair value, up 42.2% from where shares last closed. The third and best scenario according to the analyst is the company selling its core internet business in a fully taxable transaction. Squali believes this scenario would yield the highest value for shareholders while minimizing the company’s tax bill in addition to the benefit of reducing uncertainty regarding the BABA tax bill. The analyst states that this scenario would result in a sum-of-the-arts $53.14 fair value, a 47.5% upside from where shares last closed.

The analyst concludes, “By late October (3Q:15 results), the Board authorized pursuit of a tax-free spin-off without a PLR from the IRS, but the expected timing was pushed to early January. Given this short time frame for a BABA spin-off, and pressure from activist investors to act, we believe one of the three scenarios outlined should emerge as early as January 2016.” Squali reiterates his Buy rating and price target of $44.

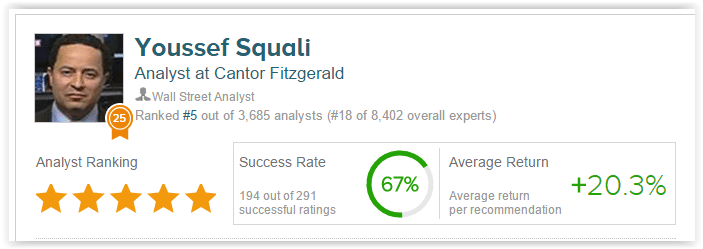

According to TipRanks’ statistics, Youssef Squali is ranked #5 out of 3,685 analysts. He has a 67% success rate recommending stocks with an average return of 20.3% per recommendation. Out of the 26 analysts who have rated YHOO in the past 3 months, 15 gave a Buy rating while 11 remain on the sidelines. The average 12-month price target for the stock is $41.61, marking a 17% upside from where shares last closed.

Avago Technologies Ltd

Analyst Michael Walkley also weighed in on AVGO following the company’s Q4/2015 earnings release. The report issued better than feared guidance for Q1/16 despite investor concern regarding“slower smartphone trends and potential order reductions from leading customer Apple.” The analyst states that company management issued positive sentiment regarding the Broadcom acquisition and anticipates “strong execution in meeting to achieving synergy targets given the strong track record in integrating acquisitions.” Walkley states that this deal will expand the company’s TAM and better positions the company as a leading international diversified semiconductor producer with a wide variety of best in class products. The acquisition will also provide the company with a “leading customer base addressing the wireless and wired infrastructure, enterprise & data center networking and storage, IP traffic routing, Home/IoT and Industrial verticals.” He continues by stating that the deal aligns with his belief that the “company’s proprietary technologies, strong IP, and diverse customer base in several growth markets” will result in “solid long-germ sale and earnings growth with industry-leading margins”. The analyst reiterates his BUY rating and increases his price target to $179 based on his new F2017 estimates.

According to TipRanks’ statistics, out of the 11 analysts who have rated AVGO in the last 3 months, 10 gave a Buy rating while 1 remains on the sidelines. The average 12-month price target for the stock is $165.55, marking a 13% upside from where shares last closed.