Tesla Motors Inc (NASDAQ:TSLA) shares are trading up nearly 3% in early morning trading after analyst Dan Galves of Credit Suisse reiterated an Outperform rating and a $325 price target for the company. The analyst believes that the company’s Q4 guidance is achievable, while on the right path towards a $4 EPS in 2016. The analyst mentions that short term issues are mainly affecting TSLA stock, such as increased Model X production. He believes that the company will produce 17k units in Q4, based on orders of 15k from Q3. He states,“The biggest future catalyst we see is Tesla generating significantly higher earnings and reducing the cash burn.” He continues, “From $2.30 annualized loss in 3Q15, we estimate 36k incremental Model X units will drive $7 of incremental EPS. This, plus better Model S margin, offset by lower-than-consensus SG&A / R&D growth means that $4 EPS (vs consensus $1.86) and a reduction in full year FCF burn to ~$500MM is achievable…although we think even hitting consensus numbers in 2016 would be a substantial catalyst.”

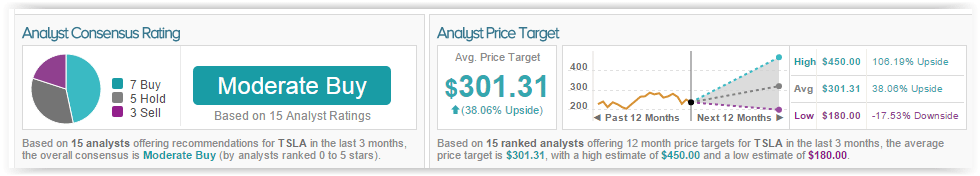

According to TipRanks’ statistics, out of the 15 analysts who have rated TSLA in the last 3 months, 7 gave a Buy rating, 3 gave a Sell rating, and 5 remain on the sidelines. The average 12-month price target for the stock is $301.31, marking a 38% upside from where shares last closed.

Sarepta Therapeutics Inc (NASDAQ:SRPT) shares rose 3.42% to $38.60 in early morning trading today after an FDA panel gave negative feedback regarding rival BioMarin’s drug drisaperson, involved in the treatment of DMD. Following the panel, Jefferies analyst Gena Wang weighed in, reiterating a Hold rating and increasing her price target to $38 from $28. Wang states, “We view negative AdCom outcome for BMRN’s drisapersen in Duchenne muscular dystrophy as positive for SRPT given 1) strong biomarker data, 2) consistent clinical data and 3) solid safety profile for its eteplirsen. While some open questions remain, we see increased prob of approval (70%) and potential first to market for eteplirsen with higher penetration.”

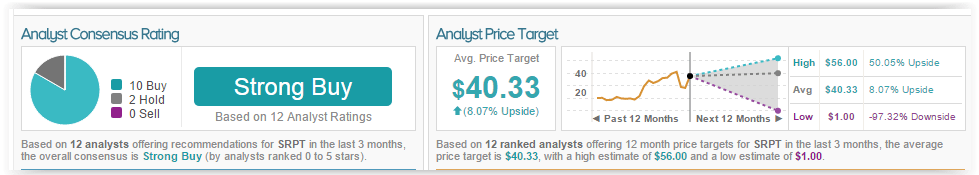

According to TipRanks’ statistics, out of the 12 analysts who have rated Sarepta in the last 3 months, 10 gave a Buy rating while 2 remain on the sidelines. The average 12-month price target for the stock is $40.33, marking an 8% upside from where shares last closed.

HP Inc (NYSE:HPQ) shares fell close to 14% in early morning trading after the company released its Q4/2015 earnings release yesterday after market close. The combined company reported $25.7 billion in revenue and earnings of $0.93 per share, below analyst estimates of $26.36 billion in revenue and $0.96 per share. These declines stem from decreased sales of PC’s, printers, commercial software, and tech services. Specifically, PC sales were 14% lower y/y. HP Inc’s Chief Executive Dion Weisler stated, “Looking ahead, we expect the PC market to remain challenged for more quarters to come.”

Following earnings, analyst David Rold of Needham weighed in on the stock, downgrading it to Hold from Buy and maintaining his price target of $14.50. The analyst commented, “Our upgrade on 11/2 was predicated on the notion that valuation (then having closed in the low/mid $12 range trading at a steep discount to peers) was compelling enough to outweigh even known headwinds facing both PC’s and Printing, especially given the attractiveness of a 3-4% dividend yield. However, as some of the valuation argument has played out, we believe further upside will require real improvement in the underlying business. The sharp turn of the Printing market (and delay in improvement that results) in just 2-3 months since last speaking with the Street warrants caution given the segment’s roughly 80% contribution to operating profit dollars.”

According to TipRanks’ statistics, out of 18 analysts who have rated HPQ in the last 3 months, 9 gave a Buy rating while 9 remain on the sidelines. The average 12-month price target for the stock is $23.31, marking a 59% upside from where shares last closed.