Analyst Jason Ader from William Blair weighed in on Cisco Systems, Inc. (NASDAQ:CSCO) and data storage company Nimble Storage Inc (NYSE:NMBL) following an acquisition announcement and Q3 earnings release respectively. The analyst is bullish on Cisco, providing positive sentiment about the Acano acquisition announcement. He changes his tone on Nimble due to miscalculated management decisions and increased competition.

Cisco Systems, Inc.

Analyst Jason Ader from William Blair weighed in on Cisco Systems, reiterating an Outperform rating, following the company’s announcement that it will acquire Acano for $700 million. Acano is a U.K based hardware and software firm that provides cloud-based VMRs (virtual meeting rooms). These VMRs enable customers to hold virtual meetings and invite other users to join through e-mail invites (schedules or ad hoc). This technology is available through all standard browsers and is part of Cisco’s collaboration segment which accounts for 10% of the company’s overall revenue.

Ader believes that this acquisition is a “double dip” for Cisco, as it only enhances Cisco’s product portfolio. Although “Acano is not a needle mover for Cisco from a top-line perspective,” the analyst believes the company is well positioned in Cisco’s portfolio. He states that this technology can offer the company “more of a cloud video play” than its old Codian bridge model. Ader believes that as a result of this acquisition, Cisco’s subsidiary, Polycom, will suffer. He states, “We believe the big loser here will be Polycom (PLCM $13.41; Underperform), as we expect Acano under Cisco will accelerate share gains on Polycom’s RMX bridging products, which represent approximately 15% of Polycom’s revenue.”

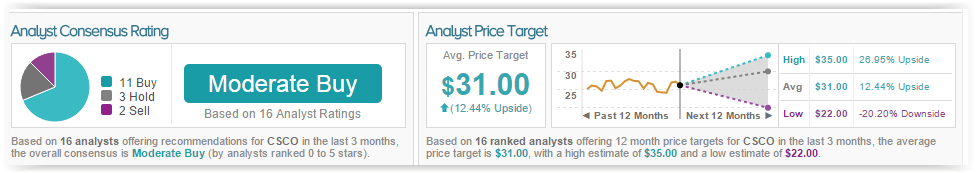

According to TipRanks’ statistics, out of the 16 analysts who have rated Cisco in the last 3 months, 11 gave a Buy rating, 2 gave a Sell rating, and 3 remain on the sidelines. The average 12-month price target for the stock is $31.00, marking a 12% potential upside from where shares last closed.

Nimble Storage Inc

Analyst Jason Ader also weighed in on Nimble Storage, downgrading it to Market Perform from Outperform due to a disappointing third quarter. Management stated that this quarter’s losses stemmed from an increase in competition and an “ill-advised pullback in investment in pursuit of profitability.” The impact of this decision was more powerful than the analyst expected, noting he was skeptical of the “pursuit of breakeven at such a critical juncture.” Management stated that competition is elongating sales cycles and impacting high end close-rates. Similarly, the cut back in investments and a move towards larger enterprises has adversely affected the company’s previously strong midsize customers. To combat the effects of this decision, management is “reaccelerating investments in sales and marketing and R&D.”

The analyst believes that even if management implements this plan and it follows expectations, the company will not see progress for the next several quarters, suspending profitability. The analyst believes the more likely scenario of Nimble’s top competitors engaging in a price war, while smaller startups, who have less of a concern for profit margins, will “continue to be disruptive to the landscape.” The analyst continues, “Either way, the storage market is overcrowded and increasingly desperate, and we are finding the competitive heat is too hot for Nimble (and us) to handle. As a result, we are moving to the sidelines.”

According to TipRanks’ statistics, out of the 19 analysts who have rated Nimble Storage in the last 3 months, 9 gave a Buy rating, 1 gave a Sell rating, and 9 remain on the sidelines. The average 12-month price target for the stock is $24.73, marking a 146% upside from where shares last closed.

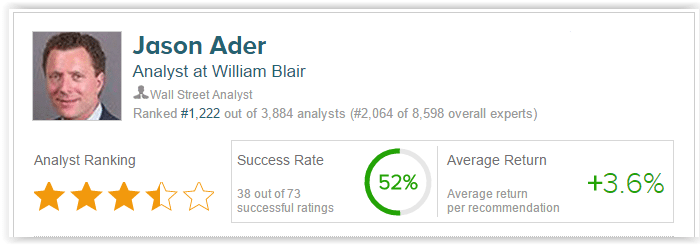

Overall, analyst Jason Ader has a 52% success rate recommending stocks with an average return of 3.6% per recommendation, according to TipRanks.