KaloBios Pharmaceuticals Inc (NASDAQ:

KBIO) soaring 30% in early morning trading, adding to their 20% rise after Friday’s news that the company appointed Martin Shkreli as its CEO. Last week, Shrkreli acquired 70% of the company’s outstanding shares after the company announced it would wind down some of its operations due to a lack of cash. Following this announcement, KBIO’s stock soared over 400%. Shkreli, founder of Turning Pharmaceuticals AG, has made headlines in August after acquiring the rights to parasitic drug Dapaprim and raising the price from $13.50 to $750 per pill. Subject to shareholder approval, Shkreli as well as other investors will provide an equity investment of $3 million, in addition to a separate $10 million equity financing plan. TipRanks’ new newsletter, the Daily Insider, recommended to buy this stock last week.

According to TipRanks’ statistics, Martin Shkreli has a 46% transaction rate (profitable transactions) and an average return of 61.6% per transaction.

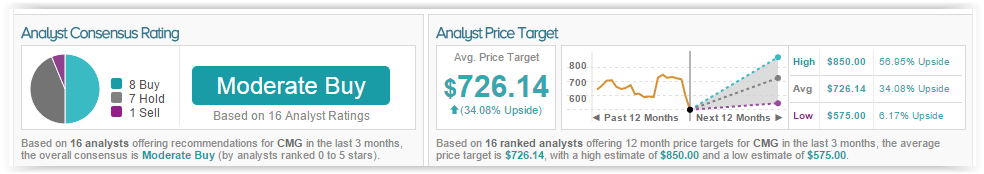

Chipotle Mexican Grill, Inc. (NYSE:CMG) is up almost 5% in early morning trading, despite analyst downgrades and bearish sentiment. The downgrades come after Friday’s news that the E.coli outbreak had spread from the its stores in the Pacific Northwest to other states. In total, 45 people have been affected by the bacteria with 43 stating they ate at a Chipotle a week before they noticed symptoms. The company has been in hot water since October, when the E Coli news was first linked to the company, forcing it to close 43 of its stores. Analyst Nicole Miller Regan from Piper Jaffray weighed in on the stock, reiterating an overweight rating and a price target of $737. She believes that other companies, with similar history of food borne illnesses, suffered from declining revenues and Chipotle is not immune to these affects. Analysts from Sterne Agee and BofA/Merrill lynch also expressed bearish sentiments and downgraded the stock.

According to TipRanks’ statistics, out of the 16 analyst who have rated CMG in the last 3 months, 8 gave a Buy rating, 1 gave a Sell rating, and 1 remains on the sidelines. The average 12-month price target for the stock is $726.14, marking a 34% upside from where shares last closed.

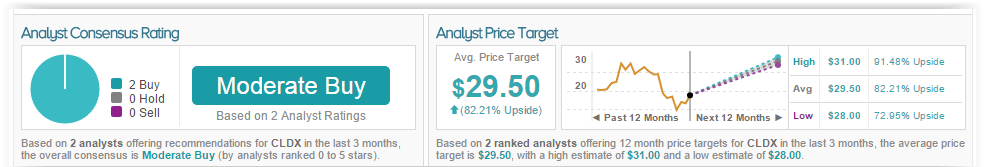

Celldex Therapeutics, Inc. (NASDAQ:

CLDX) shares are up 10.75% this morning following Friday’s news that its brain cancer vaccine improves survival changes for patients with reoccurring cancer. The data indicated that 25% of patients given the vaccine and Avastin together “were alive after 2 years, compared with no survivors in the group of patients given only Avastin.” Dr. David Reardon, the study’s lead investigator, stated “”The long-term survival benefit observed in this study is unprecedented”. According to

TipRanks’ statistics, out of the 2 analyst who have rated CLDX in the last 3 months, both gave a Buy rating. The average 12-month price target for the stock is $29.50, marking an 82% upside from where shares last closed.

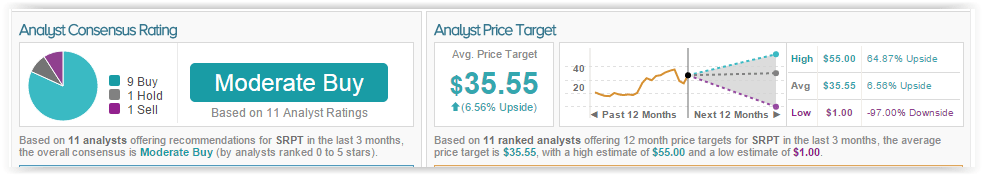

Sarepta Therapeutics Inc (NASDAQ:SRPT) shares rose 5% this morning, adding to their 28% rise following Friday’s news that the FDA released a hostile review of competitor BioMartin Pharmaceuticals DMD drug drisapersen. The report highlighted safety concerns about the drug, stating that some patients “experience severe toxicity across many organ systems while using the drug.” Sarepeta is also currently developing a DMD drug, directly competing with BioMartin over which company can bring the treatment to market. The FDA is set to make an approval decision for BioMartin later this week. Although Serepta’s clinical trials were not also flawed, one of the company’s drugs will gain approval due to the high demand for DMD treatments.

According to TipRanks’ statistics, out of the 11 analysts who have rated SRPT in the last 3 months, 9 have a Buy rating, 1 gave a Sell rating, and 1 remains on the sidelines. The average 12-month price target for the stock is $35.55, marking a 6% upside from where shares last closed.