Biopharm companies Incyte Corporatoin (NASDAQ:INCY) and LOXO Oncology (NASDAQ:LOXO) released recent successful study results. Analysts weigh in with bullish ratings on both.

Incyte Corportatoin

On Sunday, Incyte Corporation reported data from its fourth successful Phase 3 study of baricitinib at the American College of Rheumatology (ACR). Yesterday, analyst Christopher Marai from Oppenheimer reiterated his Outperform rating on the stock, raising his price target to $129.00 (from $121.00).

Incyte reported Q3 2015 earnings on November 3, followed by epacadostat data at SITC. Marai remarked, “We are updating our valuation and estimates for INCY following 1) epacadostat SITC data; 2) baricitinib updates at ACR this weekend; and 3) 3Q15 earnings.” He further added, “Following Friday’s correction and broader investor focus on valuation during the quarter, we also provide a deep dive into our valuation for INCY, laying out our assumptions, expectations and upside.” According to the analyst, Incyte’s valuation is approximately divided into 2 parts. Jakafi, Incyte’s lead drug, represents 50% of the valuation while the other half is represented equally by baricitinib and epacadostat.

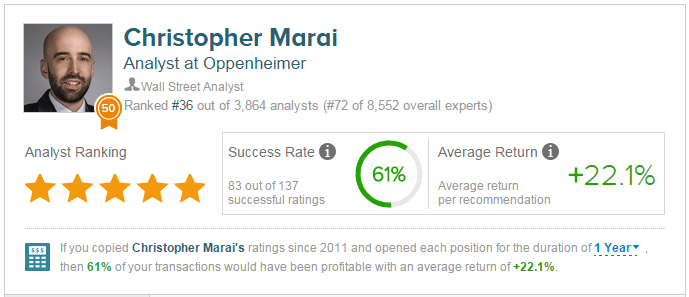

According to TipRanks, Christopher Marai has rated Incyte 3 times with a success rate of 67% on the stock and an average return of 10% per recommendation on the stock.

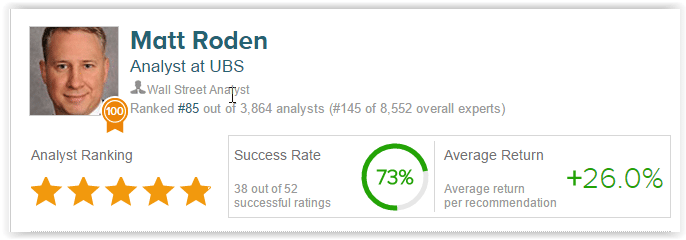

Yesterday, UBS analyst Matt Roden also weighed in on Incyte, reiterating a Buy rating with a price target of $135. That analyst stated that Incyte’s data on epacadostat working beyond melanoma is positive and essentially good. He commented, “The firm realizes that in the current market environment stocks are sold on any news.” Matt Roden has rated Incyte 7 times with a success rate of 57% on the stock and an average return of 22% on the stock.

According to TipRanks, out of the 9 analysts who have rated Incyte in the past 3 months, all 9 gave a Buy rating on the stock. The average 12-month price target for the stock is $131.13, marking a 23.47% potential upside from current levels.

Loxo Oncology Inc

Shares of Loxo Oncology soared 19% to $27.68 on Monday, reaching a 52-week high of $29.99 earlier that morning, after the company released results for its Phase 1 testing of LOXO-101. The oncology giant is known for developing drugs to treat genetically defined cancers. Currently in the pipeline are drugs to combat cancers that stem from single gene abnormalities.

The company presented findings Sunday that LOXO-101, a TRK (tropomyosin receptor kinases) inhibitor, generated responses from 3 out of 6 patients in the study. TRK genes play a key role in the development of the nervous system, becoming dormant after birth. However, if they are abnormally fused with other genes, the TRK genes cause cells to grow irregularly, leading to cancer. Although half the patients responded to the drug, the other half only recently enrolled in the study and therefore can only be evaluated after more time passes. This means that 3 out of 3 patients who participated in the study for its defined period of time responded well to the drug. Additionally, mild side effects were reported. According to LOXO CEO Dr. Josh Bilenker, these results “demonstrate Loxo-101’s ability to effectively target these genetically defined tumors”.

Following this announcement, analyst Chris Marai of Oppenheimer gave LOXO an Outperform rating, raising his price target to $30 from $25. He credits his positive rating to “objective responses in three of three valuable patients with TRK fusion mutations” noting that “the responses happened rapidly.” He continues, “we view this data positively and are raising our price target to $30 from $25”.

Analyst Chris Marai of Oppenheimer has rated LOXO 3 times since 2014. He has a 67% success rate on the stock and an average return of 62.2% on the stock. Overall, Marai has a 61% success rate recommending stocks with a 22.19 average return per rating.

According to TipRanks statistics, of the 2 analysts who have rated LOXO in the past 3 months, both have issued a Buy rating. The average 12-month price target for LOXO is $30.00, marking a 8% potential upside from where shares last closed.