Yahoo! Inc. (NASDAQ:YHOO) and SanDisk Corporation (NASDAQ:SNDK) are two leading names in the technology space. Analysts weigh in on each company as Yahoo reports disappointing earnings and Sandisk reveals a M&A deal.

Yahoo! Inc.

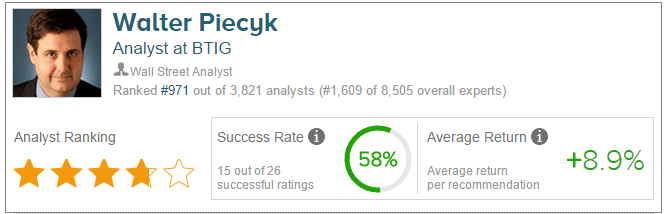

Yahoo’s stock saw a major drop after the company announced disappointing results for Q315 on Tuesday. Non-GAAP revenues were just over $1 billion; 8.3% lower year-over-year. Following the earnings announcement, Oppenheimer’s Jason Helfstein weighed in on the stock, maintaining an Outperform rating though lowering his price target to $49 (from $56). Helfstein’s investment thesis is based on the belief that Yahoo’s shares are undervalued due the valuation of Alibaba and Yahoo Japan.

The analyst says while the Alibaba spin-off is expected to complete in January, he’s concerned about IRS uncertainty. Also, the company’s new partnership with Google, which garnered a lot of positive media attention, is not exclusive and is subject to regulatory approval. Furthermore, Yahoo’s guidance for Q4 is also not looking too bright. Q4 net revenue guidance of 13% and EBITDA guidance of 35% is below Street expectations for reasons including lower search performance, comping ½ quarter of BrightRoll, and higher operating expenses.

According to TipRanks, out of 17 ratings on Yahoo’s stock, Helfstein has a success rate of 54% and his average return on stock is 3.5%. Out of 26 analysts who have recently rated Yahoo’s stock, 18 have rated it as Buy and 8 have rated it as Hold; none of the analysts have recommended to Sell the stock. The average consensus price target for Yahoo’s stock is $43, an upside of nearly 38% over current levels.

SanDisk Corporation

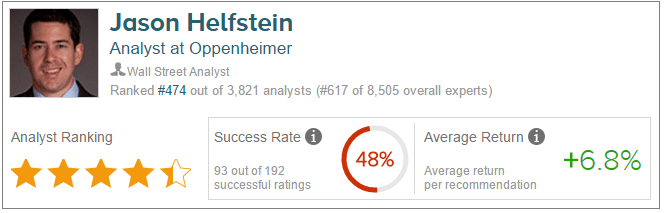

Sandisk is set to be acquired by Western Digital in a $19 billion deal. In response to the announcement, Walter Piecyk from BTIG weighed in, upgrading the stock from Sell to Neutral. The analyst doesn’t expect the transaction to hit any regulatory hurdles.

This rating follows Piecyk’s rating in April when he had downgraded the stock to sell because of weak Q1 results and guidance. In his recent report, Piecyk says that he had mentioned the risk of Sandisk being acquired while downgrading it; however, he acknowledges he should have upgraded SanDisk’s stock a little earlier when it hit their target during the recent sell-off.

Piecyk does not assign price targets to Neutral rated stocks. However, he is expecting “the stock [to] trade at a larger than normal discount” because of factors such as the complexity of the transaction and the investment of Chinese-owned Unisplendour, which recently bought 15% of Western Digital.

In April when Piecyk had downgraded the stock, he had forecasted SanDisk to return to levels of accelerating revenue and EPS growth in 2016. At that time he had expressed concern about the “current execution of management and the changing dynamics of the industry.” He had also cut his EPS estimates and said, “Our cuts to EPS are a function of both lower revenue and lower margin estimates, which is not a good combination in tech. With an EPS estimate of just $3.15 in 2015, which reflects 45% decline, we think there is still considerable downside in the stock.”

According to TipRanks, Walter Piecyk has a success rate of 58% and his average return per recommendation is 8.9%. Out of 21 analysts who have recently rated SanDisk’s stock, 8 have rated it as Buy and 13 have rated it as Hold; none of the analysts have rated it as Sell. The average consensus price target for the stock is $70.54, a downside of -8.13%.