Analysts came out with a few insights on the technology giant Apple Inc. (NASDAQ:AAPL) and electric car giant Tesla Motors Inc. (NASDAQ:TSLA), after the companies shed some light on their sales progress.

Apple Inc.

Apple has been in the news for its latest iPhone 6S and 6S Plus. The company sold 13 million units over the launch weekend; a 30% increase over the 10 million iPhone 6 and 6 Plus units sold a year ago. While these numbers are strong, this year’s figures also include sales from China, which were not included in the prior year. Subsequently, analyst Jim Suva of Citi weighed in with bullish sentiments.

Yesterday, Suva maintained a Buy rating for the stock with a price target of $145. However, Suva lowered his EPS estimate for the September quarter to $9.06 from the earlier estimate of $9.14 after he shifted some iPhone sales to the next quarter. For the September quarter, Suva estimates iPhone sales of 47 million, lower than the consensus estimate of 48 million because sales of only two days – Friday and Saturday – of the weekend launch will be counted in the current quarter.

Suva expects various other sell-side analysts to do the same and lower their estimates for iPhone sales in the September quarter. Apple is scheduled to report its earnings on October 27.

Suva also expects the volatility in Apple’s stock to continue. Given the limited upside potential of sales and earnings in the near term, he expects some investors to exit the stock.

Suva noted, “The investment thesis for Apple is likely to shift from an iPhone ‘beat and raise’ investment story to a gross margin upside story heading into a difficult comp year for iPhone 6S unit sales.”

The analyst concludes that any pullback from current levels will be a good buying opportunity for long-term investors.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Jim Suva has a total average return of 1.2% and a 43.1% success rate. Suva has a 3.6% average return when recommending AAPL, and is ranked #1731 out of 3822 analysts.

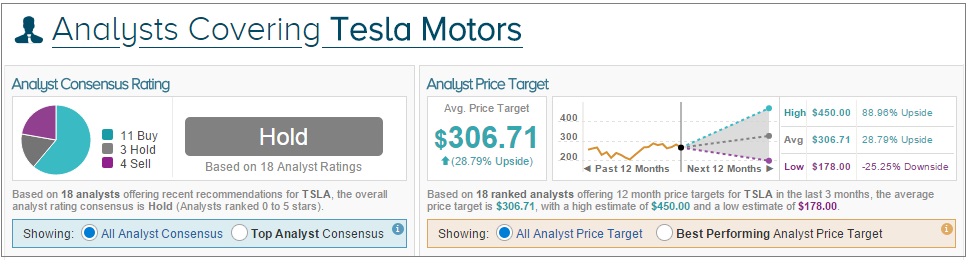

As per TipRanks’ statistics, out of 38 analysts who have recently rated Apple’s stock, 28 have rated it as a Buy, 9 have rated it as Hold, and only 1 has rated the stock as Sell. The average consensus price target for Apple is $147.26; marking an upside of nearly 33% over current levels.

Tesla Motors Inc

Tesla announced that 11,580 vehicles were delivered in the third quarter. This is a 49% increase year-over-year, and an increase of 48 vehicles from the previous quarter.

In reaction, analyst Ben Kallo of Baird maintained an Outperform rating on Tesla’s stock with a price target of $334. Kallo noted, “We see a string of positive catalysts ahead, we would be buyers and TSLA remains one of our favorite picks.”

As per the analyst, the 11,580 vehicles are in line with the guidance of approximately 11,532 units, which includes the first deliveries of Model X, the recently-launched all-electric SUV.

Elon Musk, Tesla’s CEO and Founder, said the company has experienced growing demand ever since they introduced the Model X.

Kallo commented, “We believe this shows there is pent-up demand for TSLA vehicles and many consumers were likely awaiting the launch of the X to decide which vehicle to order.” He added, “Since new Model X orders won’t be delivered until 2H:16, we are not surprised to see consumers deciding to order the Model S as the company works through its large Model X backlog.”

The analyst expects positive customer feedback to boost demand for Model X.

Tesla has set a target of selling 50,000-55,000 vehicles in the current fiscal; given the 11,580 vehicles sold in Q3, the company has to sell 16,883 vehicles if it has to meet its annual target.

According to TipRanks, analyst Ben Kallo has rated Tesla 38 times since 2013, earning a 67% success rate recommending the stock and a +27.2% average return per rating when measured over a one-year horizon and no benchmark.

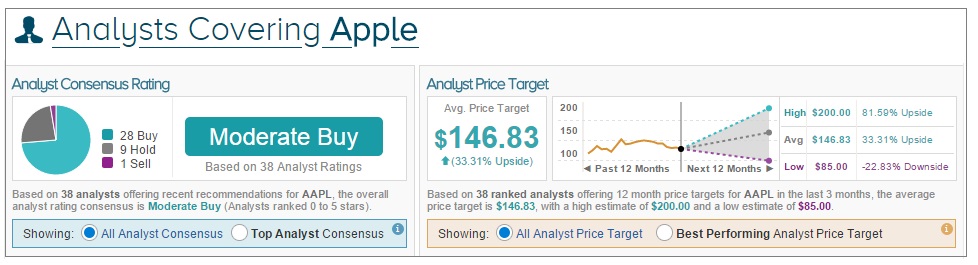

As per TipRanks’ statistics, out of 18 analysts who have recently rated Tesla, 11 have rated it as Buy and 3 have given it a Hold rating; 4 analysts have recommended to Sell the stock. The average consensus price target, based on targets set by these analysts over the past 12 months, is $307.79, an upside of roughly 25% over current levels.