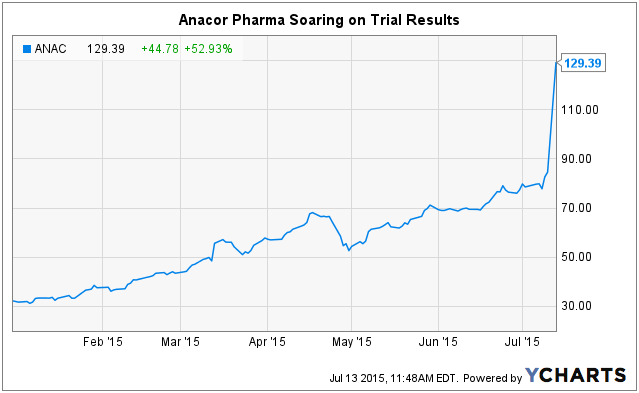

Shares of Anacor Pharmaceuticals Inc (NASDAQ:ANAC) are soaring thanks to some positive results in two late-stage (Phase 3) trials for a topical ointment to treat mild-to-moderate atopic dermatitis or eczema. Based on the positive results, the company will be filing a new drug application (NDA) with the FDA the first half of 2016.

The dramatic share price response is because the ointment, called crisaborole, has the potential to become a first-line treatment for a skin condition that is pretty common, affecting as many as 25 million patients in the U.S.

Currently the most widely prescribed therapies for this condition such as corticosteroids are quite limited. So this could be a blockbuster drug for the company with as much as $1 billion in potential net revenues. But even more promising is that crisaborole also shows future promise for the treatment of Psoriasis. Those trials are currently in Phase 2.

Anacor Pharmaceuticals is a biopharma company focused on small-molecule therapeutics. It is based in Palo Alto, California and was founded in 2000. It already received approval in July 2014 for another topical solution KERYDIN, for the treatment of toenail fungus.

Anacor’s drug platform is based on the use of boron chemistry. Remember boron from the periodic table of elements?

Anacor Pharma is hopeful that these boron based compounds will be effective in developing antibiotic and antifungal therapies that have become resistant to existing drugs. But even more exciting is their potential across multiple disease areas.

Obviously the area of drug development can be hit and miss and involves a lot of risk. However, at least based on these latest trial results, it appears that Anacor may have a “home run” drug on its hands.

So let’s take a close look at Anacor Pharmaceutical stock.

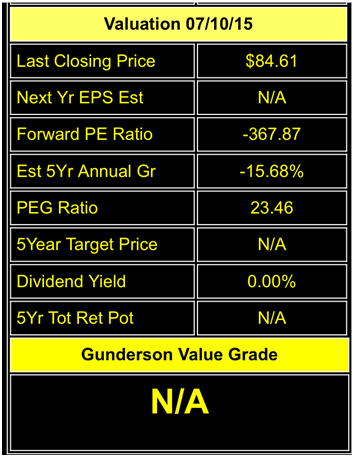

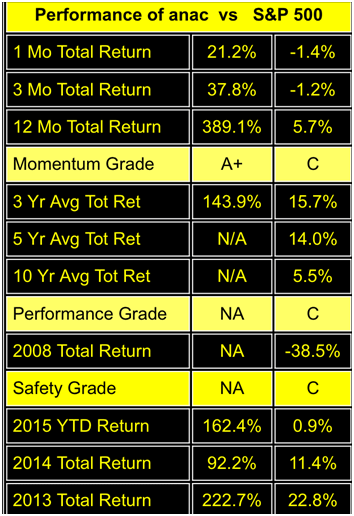

Data from Best Stocks Now app

Anacor Pharmaceuticals is a Small Cap stock with a market capitalization of $3.7 billion. Its risk profile is Aggressive and I own the stock in my Speculative Trading account.

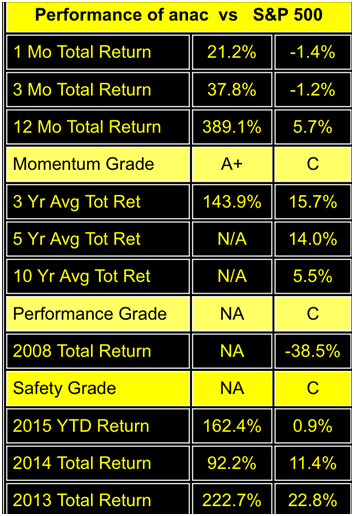

Data from Best Stocks Now app

The company has no earnings yet, so traditional valuation and profitability measures are not really applicable.

Data from Best Stocks Now app

Based on the prospects of its recent drug approval, promising trial data, and pending NDA filing, Anacor Pharma stock is up a whopping 162% YTD. Over the last few years, the stock has been quite a high-flyer. It receives a Momentum Grade of A+.

Data from Best Stocks Now app

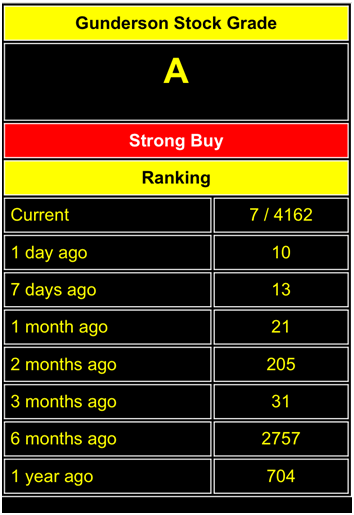

Anacor Pharma is ranked #7 out of the more than 4100 stocks in the Best Stocks Now universe. Its Stock Grade is A.

While it is never possible to know how biopharmaceutical research will pan out, Anacor’s boron based research platform has the potential to yield positive results across a span of disease applications. At the very least, its progress in the area of skin treatments looks quite promising based on the Phase 3 results for atopic dermatitis. And should it receive FDA approval, its first mover advantage should provide it with limited branded competition when it launches.