- Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) weekly options are pricing in a move of +/- $10 with Implied VOL currently in the 28th percentile over the past 52-week’s. This exposes investor’s to significant risk should tomorrow’s AdCom not go precisely as expected by the market.

- We suggest moving to the sidelines until after the event as Implied VOL is significantly undervaluing the risks and doesn’t present an attractive risk-defined setup.

- Bernstein’s suggestion for GILD to buy VRTX represents only a cosmetic solution that fails to address GILD’s chronic problem; No innovation engine or discovery platform.

- The FDA’s briefing documents suggest skepticism on the clinical evidence supporting the combination of Ivacaftor (VX-770) and Lumacaftor (VX-809) FDC (Orkambi) in F508del Cystic Fibrosis patients who are > 12-years old is justified in our view.

- We share their skeptical views on the clinical utility of the combination, and despite the option to address the potential benefit of Lumacaftor (VX-809) over Kalydeco alone through a post-marketing study; this would be an overhang on the stock and interject binary-risk.

- Additionally, the benefit on secondary endpoints such as the change on BMI and the CFQ-R, a quality of life questionnaire that “failed to show substantial evidence of a treatment effect.” Additionally, the response rate and pulmonary exacerbations were not statistically significant despite a “trend” toward improvement.

- The FDA has questioned the clinical meaningfulness of the 3% (statistically significant) improvement in FEV1, with higher incidence of dyspnea, and this may require further examination on the suitability of Orkambi for all homozygous F508del patients, thus potentially shrinking the overall market opportunity modeled by analysts.

- But even if approved, we have doubts on what the justifiable reimbursement for Orkambi would be. The Sell-Side (as always models sky-high pricing), somewhat justifiably in this case given CF is already an orphan indication, but the most prevalent disease-causing CFTR mutation is the F508del segment that leads to a different functional defect than the G551D mutation that Ivacaftor (VX-770) is approved to treat.

- In light of recent trends with drug pricing, as exemplified by ABBV/ESRX & GILD, payer’s appetite to reimburse extreme drug pricing is increasingly based on the clinical benefit and the total per patient treatment costs, and ignores the “long-term clinical benefit to prevent long-term costs.” The cost of a lung transplant is estimated to be ~$1M, if Orkambi pricing is >$350K per year, than payers will institute a lifetime treatment cap on costs, or high upfront payments followed by smaller residual payments over a patient’s lifetime.

- VRTX’s pricing strategy for Orkambi could provide an opportunistic competitor to enter and steal all of VRTX’s market share, the clinical benefit of Orkambi provides a very low hurdle rate to overcome. Ivacaftor (Kalydeco) monotherapy in the F508del population was studied in a Phase 2 trial previously.

- The safety profile of ivacaftor was comparable to that of the placebo. The overall adverse event frequency was similar in the ivacaftor (87.5%) and placebo (89.3%) groups through 16 weeks.

- The difference in the change of FEV₁ % predicted from baseline through week 16 (primary end point) between the ivacaftor and placebo groups was 1.7% (P = .15).

- Sweat chloride, a biomarker of CFTR activity, showed a small reduction in the ivacaftor vs placebo groups of -2.9 mmol/L (P = .04) from baseline through week 16.

- No new safety signals were identified. The changes in FEV₁ or sweat chloride in part A were not sustained with ivacaftor treatment from week 16 to week 40.

VRTX’s combination delivered a placebo-adjusted improvement in FVC of only +2%.

In the short term Vertex has dominance in the Cystic Fibrosis market, which has given them a market cap around $30B. Orkambi is designed to treat patients with F508d mutations, the largest population of CF (~8,500-15,000 homozygous patients in the US, 20,000 WW), but still considered an orphan indication. It will likely gain FDA approval, but there is strong criticism on just how efficacious Orkambi is and the incremental improvement in clinical outcomes. We believe this exposes VRTX to long-term competitive threats & much lower long-term pricing power than what consensus believes.

Hence, the sell-side’s peak sales estimates seem high on 2 counts:

- Fails to address potential long-term competition, which we think will develop over the next 5-7 years.

- Fails to acknowledge the limited clinical benefit for Orkambi, and is premised on the tolerance of payer’s from times past, not today.

Kalydeco monotherapy was priced around $250-$300,000 a year, however the improvement seen in patients with compatible mutations was clinically significant. On average Kalydeco improved absolute lung function by 10%. Orkambi only improved lung function by 3.3% (or 2% placebo-adjusted), which according to pulmonologists we’ve spoken with that “this result is not clinically significant” in their opinion, and even though they “would likely still use it” they explicitly stated that “it most likely would be a complete medical waste.”

In our opinion, this dynamic will truly not slide with payers over the next decade where a significant clinical benefit must be unambiguous and uncontested to allay payer concerns. We caution investors from following the crowd on VRTX.

However, a disparity exists between our research and sell-side research. Increasingly, there appears to be a perception gap between KOLs and community or academic center based pulmonologists. For example, in direct contradiction to the pulmonologists we spoke with one KOL expressed that “the demonstrated safety profile and improvements in clinical outcomes in the TRAFFIC and TRANSPORT Phase 3 studies support a favorable risk/benefit profile for the combination therapy.” He added that he thinks, “Statistical significance of the 3% improvement in FEV1 is more important. Given the disease modifying properties of Orkambi, a lower FEV1 improvement could be less relevant than the overall benefit for the patient.”

- This physician noted that he would use the combination therapy in all of his F508del patients, noting that he “does not expect the FDA to raise concerns on any subgroup analysis,” and he expects full FDA approval with a broad label.

- He argued that Orkambi provides a therapeutic option that “could help avoid lung transplants, which typically cost upwards of $1M.” However, we interject that the lifetime treatment costs would need to be less than a lung transplant.

- Therefore, payers would have to assess the time gained until a lung transplant with the cost of Orkambi. Therefore, it would be reasonable to expect pricing that would be capped per patient on the combination until transplant.

The clinical consequences of the F508d in Cystic Fibrosis lead to the inability for the CFTR protein to fold and to function properly. Vertex’s combination employs a “corrector” and “potentiator” to address this issue. Given the low efficacy, not only will Vertex most likely face criticism by the Adcom panel, the bar is not very high for other companies to develop an asset with greater efficacy. In fact there are several companies such as ProQR and Galapagos that are on the verge of initiating clinical trials or already in clinical trials for the F508d population. Therefore, the long term ROI with Vertex may be missing, and we believe the retention bonuses for VRTX executives based on Orkambi approval also speak to this fact.

In short, although VRTX is an attractive company with upside in the near term, the current valuation is already pricing in significant M&A premium that may never come and in our view, unrealistic pricing assumptions for Orkambi. The long-term outlook faces uncertainty in light of a narrow pipeline and with competitors nearing late stage clinical development with promising compounds.

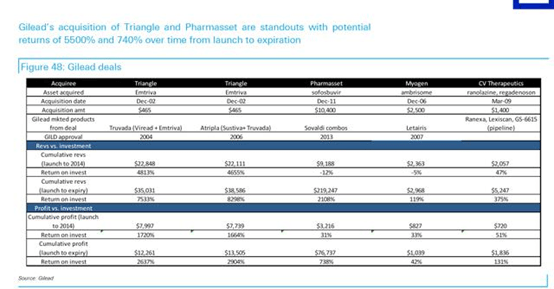

Thus, Vertex would only serve as a stopgap for GILD, however, VRTX does little past a 3-5 year time frame. One could envision a piece-meal approach from GILD in which they purchase smaller earlier stage biotech with little premium if they were interested in CF at all. And we highlight GILD’s disciplined approach to Business Development that likely requires certain, but undisclosed internal ROI that have led to it becoming the most profitable biotech (see figure below from Deutsche Bank and GILD).

In spite of the clear benefit with Kalydeco, Vertex had difficulties in pricing and faced backlash, similar to Gilead Sciences, Inc. (NASDAQ:GILD) in HCV. However, Orkambi’s pricing estimates have been on par with Kalydeco, which may prove unrealistic and will most certainly face backlash at best and reimbursement/prescription issues at worst. Consequently, we believe a real simplistic pricing model for Orkambi based Kalydeco would be ~$25,000/1% improvement in lung function, and should expect the combination to be priced no higher than $350,000/patient.

We expect payers to institute some novel strategies to control costs. For example, a lifetime cap on drug costs for each patient. Recall, lung transplant’s cost ~$1M, but wait-lists and supply are obstacles. Thus, if Orkambi is priced at $350-$500K per patient, we would expect a cap to be implemented somewhere below the cost of a lung transplant.

Alternatively, payers could pay a high upfront price for Orkambi, followed by much lower annual treatment costs presenting a similar bear thesis that was presented on GILD last year on sustainability, or “a really high, but rapid peak.” To us, this directly contradicts any potential acquirer motive , and would only transiently address GILD’s chronic sustainability problems that would also prevent GILD from remaining flexible to pounce on future opportunities.

Bernstein’s M&A thesis:

“There are only five independent biopharmaceutical companies in the $10-$35bn market cap range (MDVN, INCY, BMRN, VRTX and ALXN). Vertex makes the most sense, because its future is wholly dependent on CF, where Gilead already has a product (Cayston) and commercial infrastructure. Vertex’s greatest challenges are in the development and commercialization of complex multi-drug combinations, which is something Gilead knows a thing or two about.”

Our Rebuttal:

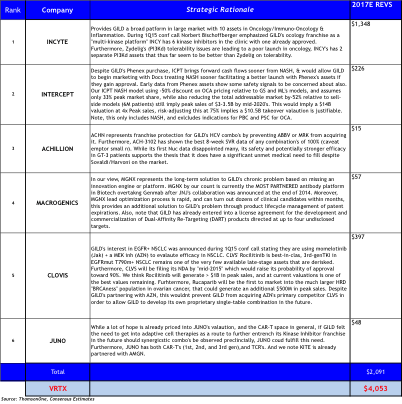

- Size may or may not matter, GILD’s business development activities thus far heave been for <$250M, signaling that GILD appreciates maintaining balance sheet flexibility to act on multiple opportunities over time. We continue to favor a roll-up strategy for GILD focused in Oncology, NASH, fibrosis, and HCV.

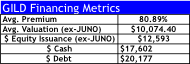

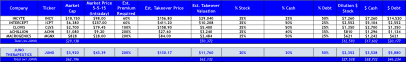

- Our list of potential M&A targets presented on the following pages would allow GILD to deploy ~$50B over the next 2-years without dilution given the remaining $15B in share repurchases. We estimate GILD could use 60% of annual FCF of $20B over the next 2-years ($24B), issue ~$12.6B in equity, and $14-$20B in debt to finance its buying spree. Note, GILD’s FCF is likely to be at a $4-$5B quarterly run-rate (possibly a lot more) that would facilitate both a debt-free and non-dilutive route to acquiring these 5-6 companies over 2-years.

- Cystic Fibrosis + an unappealing pipeline presents risk and confines GILD’s M&A ability for the next 3-5 years. A VRTX acquisition by GILD for $45-$55B would likely be its first M&A blunder, especially if one considers the opportunity cost restricting GILD’s ability to act big on potentially better acquisitions over a 4-5 year window (immuno-Oncology for example).

- “Gilead already has a product (Cayston) and commercial infrastructure.” True, but this was <$168M in 2014 sales or <1%, and even with a commercial infrastructure in place, it would incur huge R&D expenses over the long-run to maximize the approvability of VRTX’s CF pipeline. Hardly, a strong foundation to base a thesis. For perspective, Zydelig is likely to surpass Cayston in annual sales this year already, and given that GILD has 30 clinical trials in Oncology (10 Phase 3) the weight of evidence would suggest GILD has a stronger strategic incentive to build, protect, and differentiate its Oncology franchise than bet $45-$55B on a company whose history has been one of poor execution.

- GILD is squeamish about integrating a large company like VRTX with 1,830 employees (26% of GILD’s current headcount), something GILD has NEVER done, and in our view, likely never will. But GILD would require retaining a significant portion of the VRTX staff due to its lack of R&D in CF. In our humble opinion, GILD doesn’t want to integrate another large commercial organization, they want assets that require little additional infrastructure or people, and more importantly, they are looking for “assets that have synergies with our current pipeline.”

- Our roll-up strategy of 4 separate companies equates to <1,200 current employees, and believe GILD would reduce headcount by 40% implying only an increase of 620 employees (<9% of GILD’s current headcount), or about one-third of VRTX.

- By acquiring VRTX, GILD may not be able to acquire potentially better CF assets as they enter the clinic that may be needed to develop the best “multi-drug combination’s.”

- GILD has the highest revenue, and net-income per employee in Biotech, and even if GILD could reduce head count at VRTX by 33% still implies an expansion of ~1,200 people. GILD would likely generate significantly more synergies from HCV, NASH, and Oncology acquisitions give they already have the infrastructure for both R&D, and commercialization.

- VRTX would likely become a blemish on GILD’s track record of high ROI deals. If we generously assume 80% margins on Bernstein’s lofty VRTX revenue assumptions GILD still wouldn’t break-even until 2023 on an EBIT basis, and on a sales basis by 2022.

- Simply assuming that because GILD has been successful developing combination therapies in HCV & HIV (virology, not genetic diseases like CF) that they too will be able to apply this strategy effortlessly for cystic fibrosis is erroneous.

- The risk of competitive threats over the long-term horizon is vital to appreciate here because GILD is not an “expert” in CF and as Bernstein argues that “Vertex’s greatest challenges are in the development and commercialization of complex multi-drug combinations, which is something Gilead knows a thing or two about.” This is an incredulous assertion. Developing combinations for a new therapeutic area, such as CF is determined by medicinal chemistry & pharmaceutics, as well as access to the right assets with the right intellectual property, not GILD’s management or R&D teams who has little experience in CF.

Briefly, in Oncology GILD could acquire multiple platforms from INCY, CLVS, and MGNX that would be able to replenish GILD’s pipeline over a ten-year period. While also addressing future product lifecycle concerns with follow-on products, and would be able to immediately improve its’ competitive positioning in Oncology.

CLVS may surprise people to be on this list, but is one of only a few SMID caps to have 3 late-stage, wholly owned oncology assets. But what provided the impetus was GILD’s 1Q15 conference call disclosing for the first time that GILD is initiating combination trials in EGFR+ NSCLC with momelotinib (JAKinh) + AZN’s MEK inhibitor. We briefly quote GILD from a follow-up conference call last week: “we do not ‘stuff’ our pipeline, if it is disclosed we have a strong interest in the area, and the preclinical evidence strongly support its development.”

Simultaneously, they could continue protecting their HCV franchise with RGLS or ACHN. In NASH, they could acquire ICPT facilitating first-to-market advantage and have several follow-on second-gen FXR agonists through their Phenex acquisition.

Collectively, our approach would require $50.3B (assumes GILD pays a 60-200% premium to current share prices using $12.5B in new equity issuance, $17.6B in Cash, and $20B in new debt financing). In our view, this would better address multiple strategic objectives for GILD to sustain growth over a 10-20 year horizon, a critical quality we believe vital to facilitate GILD’s P/E multiple to expand to the high-teens.

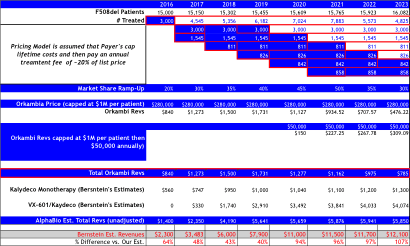

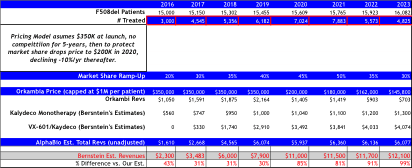

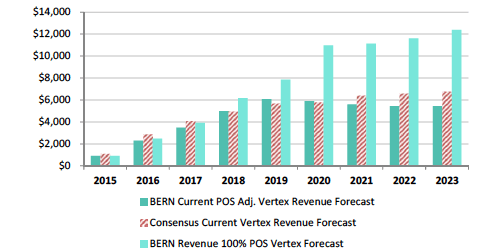

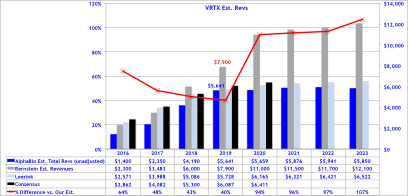

Bernstein’s revenue projections (figure below) forecast peak sales for VRTX in CF of $12B by 2023, and is based on 65% market share in F508del, which clearly assumes no competition emerges during their forecast period. We model 50% peak market share, use the same pricing assumptions, but add a cap to sales value per patient at 4-year of treatment at $280,000, capping sales at $1.12M, then sales adjust downward at ~20% of list price at $50,000 annually. Consequently, to our own surprise our estimates our capped below $6B in CF sales per year, -50% below Bernstein’s bullish view of $12B in 2023E.

Orkambi Pricing Model A:

Assumes $280,000 launch price (like Bernstein), but assumes payer’s cap lifetime treatment costs at ~$1.12M, followed by an annual treatment fee at $50,000 per year thereafter.

Orkambi Pricing Model B:

Assumes strong pricing power at launch of $350K, and then assumes competition enters by 2020 leading to pricing declines to $200K, followed by -10% declines annually thereafter.

Bernstein’s CF Forecast’s

Alpha BioPharma’s CF Forecast’s

We cite Bernstein’s own risk factors for VRTX’s valuation at the bottom of their report saying “Failure of Vertex to secure widespread reimbursement for Vx809 in the US and other markets at a price that is within 20% of Kalydeco.” In our view, this is a real risk that shouldn’t be stowed away, but should be fully anticipated by investors. While it may not be an immediate risk, if competition emerges this becomes significantly more probable.

Finally, driving our pricing scenarios for Orkambi we attended the Armada Specialty Pharmacy Summit where the unprecedented pushback on pricing for specialty drugs continues to dominate the discussion among manufacturers.

- There was a general skepticism on the blockbuster status of PCSK9’s due to extreme cost increase over standard therapies. We note that PCSK9’s lack (presently) evidence of Pleiotropic effects well established for statins. In cardiovascular disease it is vital for investors to not minimize the medical fact that LDL reduction is NOT the only benefit with Statin’s, but include effects such as reduced vascular inflammation, HDL increases, and several other beneficial effects. “Statins are pennies a year, by comparison to PCSK9’s that could be thousands of dollars.”

- Payers are likely to take a heavily gated, conservative approach to access to these drugs with step-edits or double step-edits for doctors, prior authorizations and clinical review by pharmacists.

- Strong effort will be made to narrow access to only patients for whom therapy is necessary and established.

- Orphan Diseases will continue to demand high prices, but pushback will come when competition emerges.

Our DCF valuation reflecting significant competition with VRTX in CF assumes 50% market share at peak, but declines to only 20% by 2024. On pricing we assume the same launch price as Bernstein ($280,000), but model two different pricing strategies implemented by payers discussed in previous sections (scenarios A & B). We risk adjust sales for Orkambi in homozygous F508d at 95% similar to sell-side, and discounted annually at 10%.

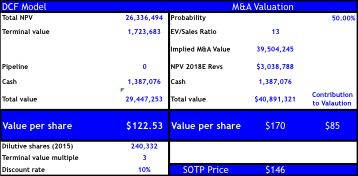

Our DCF PT implies $123 (~1-2% below current share price) reflecting strong competition emerging by 2020-2023 and/or significant price erosion or caps instituted by payers. For assessing the M&A valuation we utilize the BioPharma average (2007-2015 YTD) on EV/Sales of 13x on next-twelve month sales, but apply this ratio to the net-present value on our estimated 2018 FCF of $3B giving our M&A target price of $170 implying only +36% upside. Should the FDA’s skepticism grow on Orkambi after the AdCom, or delay approval the downside to our DCF implies $113 and only $136 for M&A.

In conclusion, we believe the future for the specialty drug market will require transformative therapies to continue to justify premium pricing, and incremental improvements will not secure the sustainability currently reflected in sell-side models. Our view is that Orkambi more closely reflects the latter than the former. This suggests that there are structural risks to biotech driven by generous pricing models from analysts that are setting expectations too high and do not reflect the fundamental changes in pricing and reimbursement dynamics with payers.