The market at large has been responding negatively to the decline in oil related equities. When a large part of both the TSX and the S&P500 are made up of companies that produce commodities this makes sense. However many companies and industries are now poised for success given this low price environment. In this article we will briefly touch on some of the big winners.

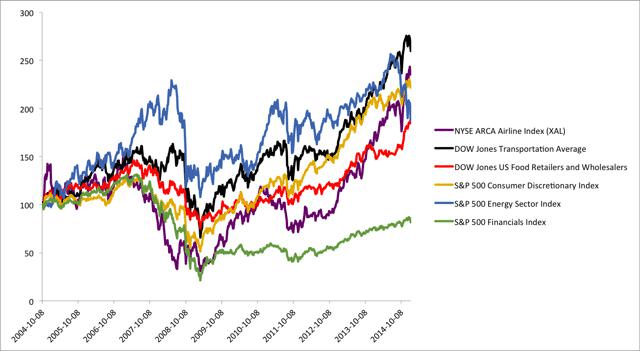

Shown below are indexes that will serve as a proxy for industry comparison. Covered in this article will be both the transportation and consumers sectors with subsectors including airlines and food retailers.

(Data from Bloomberg)

Since 2008, all indexes have risen dramatically, aside from the S&P500 Financials Index, which has only had modest increases, below the S&P 500 as whole. Financials may also continue to suffer as many are tied to the energy industry.

Transportation

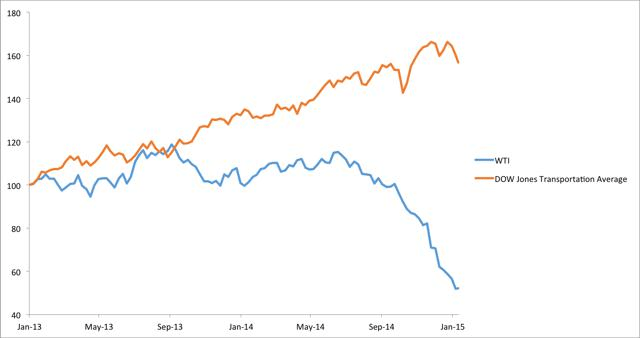

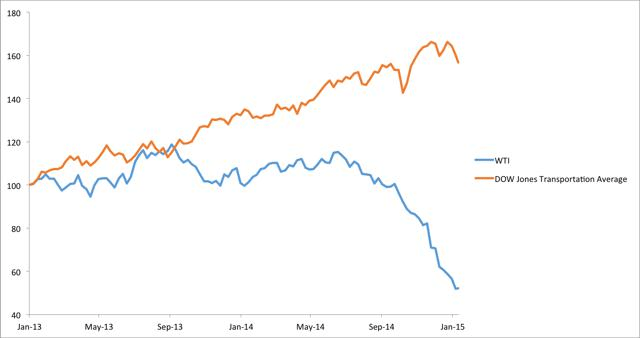

The transportation industry is one of the first that comes to mind for investors in terms of industries that are poised for success. Crude oil is often one of the most crucial inputs within this industry and any reduction in this cost can often lead to a dramatic increase of earnings. Seen below has been in the change in the Dow Jones Transportation Average in comparison to the price of West Texas Intermediate Crude.

(Data from Bloomberg)

Since the decline in WTI started in September, transportation equities have changed in the opposite directions. Below we can see airlines in particular and how they’ve changed in the face of lower commodity prices. The number one input for airlines happens to be jet fuel. In fact, 31% of the overall cost of doing business for airlines is attributed to fuel. A 50% drop in crude prices can lead to a ~15% increase in net earnings holding all factors constant. Since the downturn in prices in the summer the NYSE airlines index has increased over 50% reflecting the change in the cost inputs of companies.

(Data from Bloomberg)

A further decrease, or a period of longer low prices will further increase the values of these stocks. Companies to watch include Delta Air Lines (NYSE:DAL) and American Airlines (NASDAQ:AAL).

Consumer Products

The catalysts for this industry are two fold. Decreased input costs, and an in increase in disposable income for consumers. Virtually all consumer products are connected to oil in some way or another. Food products require oil to transport across countries and continents and packaged goods require oil to create plastic packaging. Decreased oil prices decreases input and operating costs. Shown below is the comparison between WTI and the S&P 500 Consumer Discretionary Index over the past year. It’s interesting to notice that this index has stayed relatively stable over the past year, not benefiting from oil declines. Consumer discretionary is broad category that involves many different kinds of companies, but one subset of this index is benefiting in particular.

(Data from Bloomberg)

The second part for the consumer products industry change has been the increase in disposable income for consumers. According to an article in the economist, the average consumer in the United States will be saving up to $800 a year at current prices from savings in filling up their vehicles. While, some of this will be spent on increased driving and saving, a large portion will be added back into the economy through increased spending on consumer products such as food. Companies to watch in this period are food wholesalers. This subset of the consumer product industry has increased close to 50% since the summer (seen below through the Dow Jones US Food Retailers and Wholesalers Index). In particular Costco (NASDAQ:COST) and Loblaw Companies Limited (OTCPK:LBLCF) have faired well and will continue to benefit with lower commodity prices.

The Bottom Line

Economics 101 seems to suggest that the price of oil is likely to remain low, even decline further, in the one to two year horizon, as companies and countries refuse to change production. Without a dramatic unforeseen shift in dynamics the price of oil looks to have little upside until US shale oil producers and global demand dramatically change.

In this current state airlines and food retailers look to be among the biggest winners. Investors who expect the price of oil to stay relatively low should look to add to their weightings in these sectors as they are among the biggest winners in this price environment.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, blogger Vuru has a total average return of +7.7% and a 66% success rate. Vuru is ranked #562 out of 4128 bloggers