Shares of Netflix, Inc. (NFLX) slipped 2.7% after the company slashed its subscription rates in India. According to Reuters, Netflix aims to attract a broader customer base in one of the biggest markets for entertainment.

Netflix operates a subscription streaming service and has over 214 million subscribes worldwide as of October 31, 2021. Shares closed down 1.1% at $597.99 on December 14.

Revised Subscription Plans

In India, Netflix competes with major international players such as Disney+Hotstar which falls under The Walt Disney Company (DIS), Amazon Prime which falls under Amazon.com, Inc. (AMZN), and other national streaming service providers.

Netflix’s lowest monthly plan, which allows streaming on mobiles and tablets, is down to ₹149 from ₹199. Netflix introduced its cheapest plan ever to attract viewership during the COVID-19 pandemic.

Netflix’s “basic plan”, which allows access to one user to stream on all devices, has seen the biggest cut, to ₹199 from ₹499. Meanwhile, its premium plan rate, which is accessible by four devices at a time, has been cut to ₹649 from ₹799. Similarly, its standard plan, which allows access to two devices at a time, has been slashed to ₹499 from ₹649.

Management Comments

Monika Shergill, VP for content at Netflix India, said, “It’s a two-pronged offering for customers; we are reducing pricing and offering value. It also comes with a big content line-up. We have a big global slate with a big Indian slate.”

See Analysts’ Top Stocks on TipRanks >>

Analysts’ View

Last week, Morgan Stanley analyst Benjamin Swinburne maintained a Buy rating on the stock, with a price target of $700, which implies 17.1% upside potential to current levels.

According to Swinburne, both the broader media segment and Netflix are poised for long-term growth potential. The biggest factor in the company’s stock performance is its content leverage, which is better than its competitors. The analyst believes Netflix will face diminishing viewership with the slowing pace of the pandemic, and it can increase its gross margins by leveraging international production.

Overall, the stock has a Moderate Buy consensus rating based on 24 Buys, 4 Holds, and 3 Sells. The average Netflix price target of $677.76 implies 15.71% upside potential to current levels. Meanwhile, shares have gained 15.1% over the past year.

Website Traffic

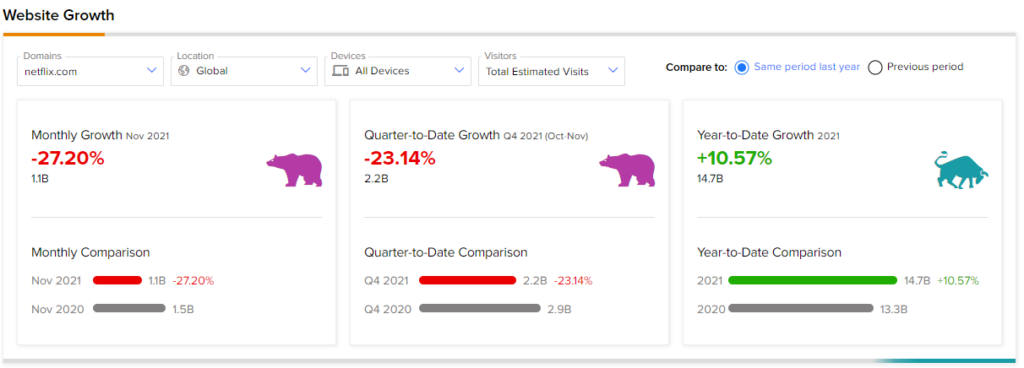

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into NFLX’s performance.

In November, Netflix website traffic recorded a 27.20% year-over-year decline in monthly visits. However, year-to-date website traffic growth increased by 10.57% compared to the same period last year.

Related News:

Meta Platforms Buys Name Rights for Meta

Starbucks China to Probe Expired Ingredients Usage

UBS Found Guilty in French Tax Case; Penalty Slashed to $2B