Walt Disney (DIS) said it raised $11 billion from a six-tranche bond deal to shore up its finances as the coronavirus pandemic led to a closure of its parks and disruption of most of its operations.

Proceeds from the sale are expected to be used for general corporate purposes including the repayment of its $55.5 billion of outstanding debt and commercial paper. The offering included six bonds with maturities ranging from 6 years to 40 years.

Disney has seen its profit plunge 63% in the first quarter as the coronavirus-related lockdown orders forced the entertainment and media giant to close its theme parks, suspend cruises and theatrical shows, and delay theatrical distribution of films, among others. To offset the financial revenue fallout, the company this month withdrew its semi-annual cash dividend for the first half of fiscal 2020, reduced executive compensation and furloughed over 120,000 employees.

“The coronavirus pandemic will materially weaken Disney’s operating and credit profile through the remainder of the company’s fiscal year 2020 and into its fiscal year 2021, with shortfalls driven primarily by the parks, experiences and products segment,” Fitch rating agency said in a report.

Fitch expects the park closures will likely be extended through Disney’s fiscal third quarter, resulting in significant revenue contraction and operating losses.

Overall, the rating agency said it viewed the debt issuance “positively”. Looking ahead to this month’s phased start of the reopening of its Shanghai Disneyland Park, Fitch is optimistic that the entertainment mogul can survive the coronavirus crisis.

“Disney’s liquidity position is strong and will position the company to withstand the coronavirus pandemic and related closure of its domestic parks business,” according to Fitch.

Disney shares have this year lost 31% of their value and were trading 1.6% lower at $102.92 in afternoon U.S. trading.

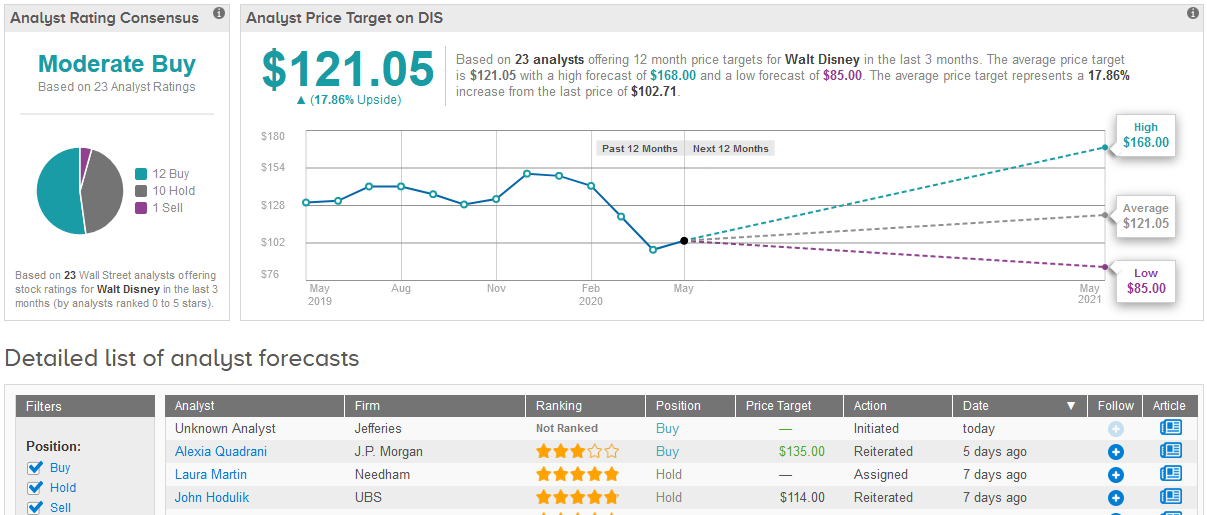

Wall Street analysts are cautiously optimistic about Disney shares. The stock’s 23 analyst ratings consist of 12 Buys, 10 Holds and 1 Sell adding up to a Moderate Buy consensus. The $121.05 average price target implies 18% upside potential in the shares in the coming year. (See Walt Disney stock analysis on TipRanks).

Related News:

Twitter Won’t Reopen Offices Before Sept., Allows Permanent Work From Home

Intel, Taiwan Semiconductor Said to Be in Talks with Trump to Build U.S. Plants

Uber Announces $750M Notes Offering, As GrubHub Takeover Reports Swirl