Mark Zuckerberg-led Meta Platforms (FB) offers social media services through brands such as Facebook, Instagram, and WhatsApp. It also develops virtual reality systems through its Oculus unit. The company currently draws the vast majority of its revenue from advertising.

For Q4 2021, Meta reported a 20% year-over-year rise in revenue to $33.7 billion, surpassing the consensus estimate of $33.4 billion. It posted EPS of $3.67, which dropped from $3.88 in the same quarter the previous year and missed the consensus estimate of $3.84.

Building the metaverse has become a priority for Meta, making it one of the most closely watched metaverse stocks.

With this in mind, we used TipRanks to take a look at the risk factors for Meta.

Risk Factors

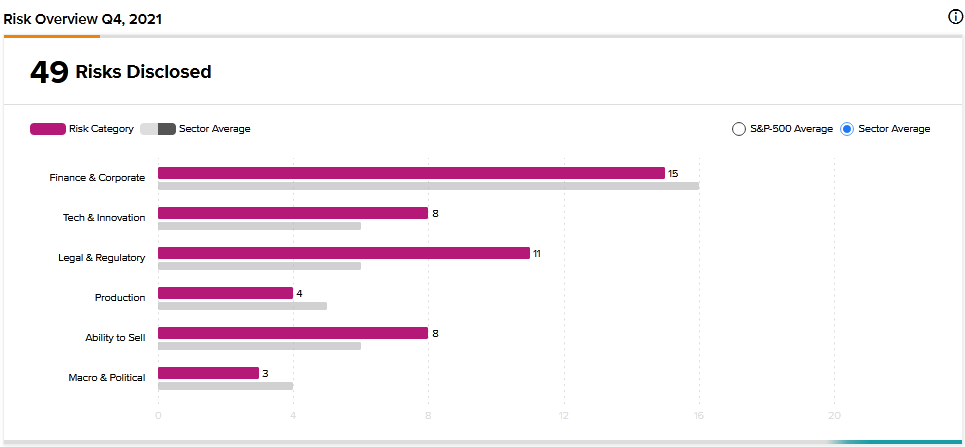

According to the new TipRanks Risk Factors tool, Meta Platform’s top risk category is Finance and Corporate, containing 15 of the total 49 risks identified for the stock. Legal and Regulatory and Ability to Sell are the next two major risk categories, with 11 and 8 risks, respectively. Meta has recently updated its profile with one new risk factor and revised a number of previously highlighted risks.

The newly added risk falls under the Finance and Corporate category and relates to the metaverse project. The company cautions that its metaverse strategy may be unsuccessful and that failure of the strategy could adversely affect its business, financial results, and reputation. Meta mentions that building the metaverse will be a complex initiative requiring significant investments. Therefore, funding the project will depend on the company’s ability to generate sufficient profit from its existing businesses. The metaverse initiative may also subject the company to new regulations, which could increase its operating costs.

Meta has revised the risk factor related to acquisitions to stress the uncertainties in the strategic transactions it makes and how they could end up with undesirable outcomes. As part of its business strategy, Meta explains that it acquires other companies to obtain specialized talent or add complementary products and technologies.

It also enters into joint ventures from time to time. While the strategic transactions may require spending huge amounts of cash or taking on debt to fund, Meta cautions that they may not deliver the anticipated benefits. As a result, the company’s financial condition and operating results may be adversely impacted if the strategic transactions fail to meet expectations.

In another revised risk factor, Meta emphasizes the regulatory challenges it faces given the nature of its business. It explains that sometimes governments in various countries decide to restrict access to its products for reasons that range from trade disputes to public safety. It mentions China, North Korea, and Iran as some of the countries where access to its products has been restricted and cautions that other countries could do the same.

While Facebook’s social app may be inaccessible in China, Meta explains that it still generates substantial revenue from advertisers based in China. But it cautions that the Chinese government may decide to block its access to advertisers in the country, which could result in advertising revenue loss.

Analysts’ Take

China Renaissance analyst Ella Ji recently downgraded Meta Platforms stock to a Hold from a Buy. The analyst also cut the stock’s price target to $280 from $415. Ji’s reduced price target still suggests 18.10% upside potential. The analyst mentioned increasing competition and Apple’s iOS privacy changes as some of the reasons for the downgrade.

Consensus among analysts is a Moderate Buy based on 31 Buys, 10 Holds, and 1 Sell. The average Meta Platforms price target of $330.35 implies 39.34% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Carrier to Buy Toshiba’s Stake in TCC

Hertz Names New CEO; Shares Pop

Kohl’s Initiates Poison Pill to Stop Hostile Takeover; Shares Jump