Boeing (BA) builds aircraft used for commercial flights, defense, and space exploration applications. Based in Illinois, Boeing was founded in 1916 and first joined the S&P 500 index in 1957.

For Q4 2021, Boeing reported a 3% year-over-year drop in revenue to $14.8 billion, falling short of the consensus estimate of $16.9 billion. It posted an adjusted loss per share of $7.69, which narrowed from a loss per share of $15.25 in the same quarter the previous year but missed the consensus estimate of $0.30 loss per share.

Boeing has launched a new cargo jet named the 777-8 Freighter and signed Qatar Airways as its launch customer, with an order for up to 50 jets worth about $20 billion. It says the jets will enhance profitability and business sustainability for customers because they offer enhanced payload capacity and improvements in operating costs, fuel efficiency, and emissions.

With this in mind, we used TipRanks to take a look at the risk factors for Boeing.

Risk Factors

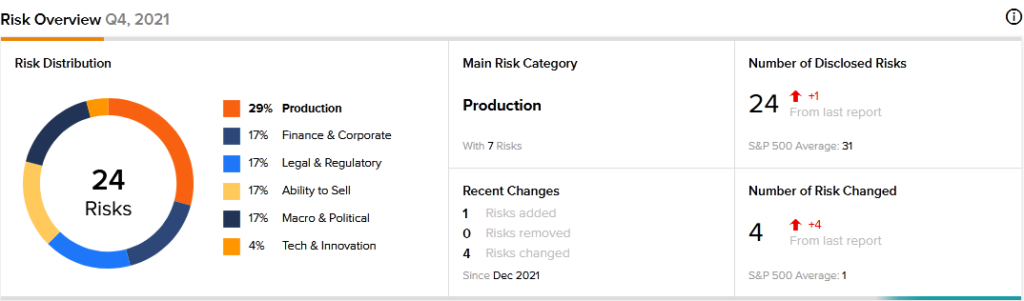

According to the new TipRanks Risk Factors tool, Boeing’s main risk category is Production, representing 29% of the total 24 risks identified for the stock. Finance and Corporate and Legal and Regulatory are the next two major risk categories, each accounting for 17% of the total risks. Boeing recently added one new Legal and Regulatory risk factor and updated several previously highlighted risk factors.

In the newly added risk factor, Boeing explains that regulatory and market responses to climate change may adversely affect its business. It mentions that changes in environmental regulations may subject it to additional operational restrictions and require additional investment in product designs. Furthermore, increasing requirements on emissions could limit the company’s ability to manufacture certain products at acceptable costs. Moreover, Boeing cautions that failure to achieve its sustainability commitments could adversely impact its reputation and access to capital.

In an updated Tech and Innovation risk factor, Boeing emphasizes that its information systems face certain security threats. It cautions that a breach of its systems could result in significant financial loss and damage to its reputation.

In an updated Production risk factor, Boeing explains that it continues to face many uncertainties related to the 737 MAX. It mentions the timing and conditions of regulatory approvals for the return of the jet to service in various markets and the potential outcomes of outstanding legal proceedings.

The Production risk factor’s sector average is 15%, compared to Boeing’s 29%. Boeing stock has gained about 3% over the past 12 months.

Analysts’ Take

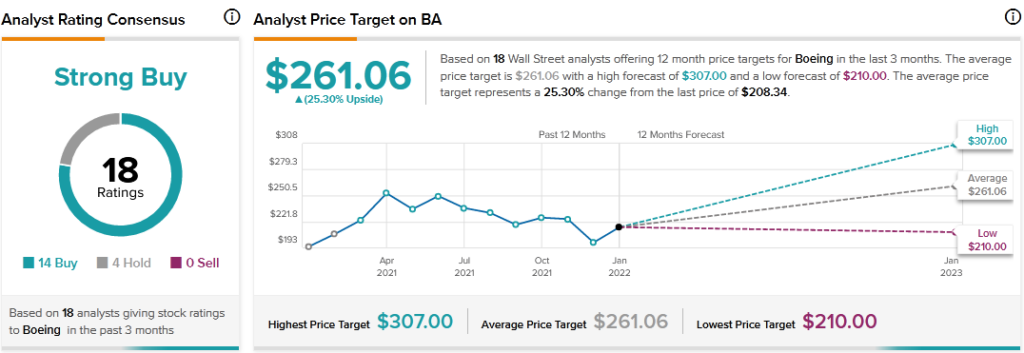

Jefferies analyst Sheila Kahyaoglu recently reiterated a Buy rating on Boeing stock but lowered the price target to $270 from $300. Kahyaoglu’s reduced price target still suggests 29.60% upside potential. The analyst cited Boeing’s cash flow outlook, noting that near-term free cash flow is mostly tied to the 787 and 737 MAX delivery programs. However, some factors affecting the programs, such as China’s recertification of the MAX and the FAA’s approval to resume 787 flights, are outside Boeing’s control.

Consensus among analysts is a Strong Buy based on 14 Buys and 4 Holds. The average Boeing price target of $261.06 implies 25.30% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Mark Zuckerberg’s Meta to Buy Greek Startup Accusonus – Report

Alphabet: Upbeat Q4 Results; 20-for-1 Stock Split in the Works

ELMS Stock Plunges 28.4% After CEO, Chairman Resign