Oil and gas major Exxon Mobil Corporation (NYSE: XOM) has posted mixed results for the quarter ended December 2021, as the company’s earnings surpassed but revenues missed estimates.

Following the earnings, however, shares of the company rose 6.4% on Tuesday. The stock pared its gains slightly to close at $80.81 in the extended trade.

Revenue & Earnings

Exxon Mobil reported quarterly revenues of $84.97 billion, up 82.6% from the previous year. However, the figure missed the consensus estimate of $90.17 billion.

The company’s earnings per share (EPS) for the quarter stood at $2.05, which denotes a quantum jump from the previous year’s figure of $0.03 per share. Further, the figure surpassed the consensus estimate of $1.84.

Share Buyback

In the first quarter of 2022, the company commenced its previously announced share repurchases of up to $10 billion, which will continue over the next 12 to 24 months.

CEO’s Comments

The CEO of Exxon Mobil, Darren Woods, said, “Our effective pandemic response, focused investments during the down-cycle, and structural cost savings positioned us to realize the full benefits of the market recovery in 2021. Our new streamlined business structure is another example of the actions we are taking to further strengthen our competitive advantages and grow shareholder value. We’ve made great progress in 2021 and our forward plans position us to lead in cash flow and earnings growth, operating performance, and the energy transition.”

Stock Rating

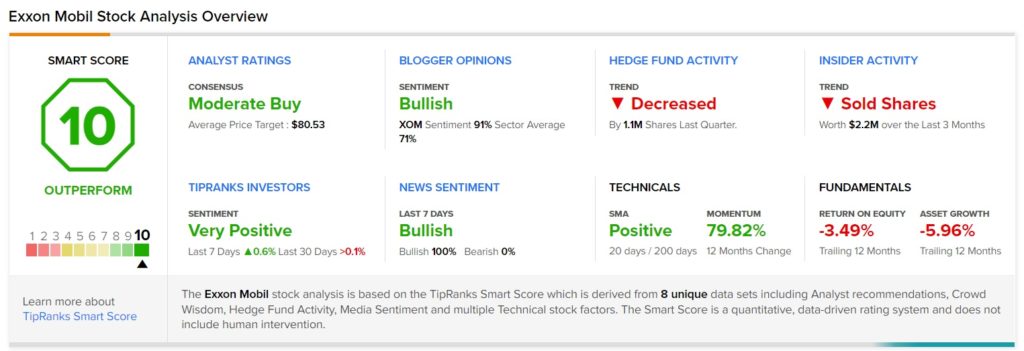

On February 1, Credit Suisse analyst Manav Gupta reiterated a Hold rating on the stock. The analyst, however, raised the price target from $76 to $85, which implies 5.2% upside potential from current levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 8 Buys and 7 Holds. The average Exxon Mobil stock price prediction of $80.53 implies that the stock has 0.37% downside potential from current levels.

Smart Score

Exxon Mobil scores a “Perfect 10” on TipRanks’ Smart Score rating system. This implies that the stock has strong potential to outperform market expectations. Shares have gained about 77.1% over the past year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Sony Acquires Bungie for $3.6B; Shares Up 4.5%

Boeing Wins $34B Order from Qatar Airways; Shares Pop 5%

Block Completes Afterpay Acquisition; Stock Jumps 11%