Welcome to the world of quant. David Siegel and John Overdeck are two of the founders of the unique, and highly successful, Two Sigma fund. In the second quarter, the billionaires appear to have taken a bullish turn on fintech platform Square (NYSE:SQ) and e-commerce giant Amazon (NASDAQ:AMZN).

“We’re not your typical investment manager. We follow principles of technology and innovation as much as principles of investment management,” states the fund. This means placing great emphasis on tools like machine learning and distributed computing. In fact, the fund was founded on the belief that innovative technology and data science could help discover value in the world’s data.

And this approach certainly appears to be working: the fund has experienced a rapid explosion from just $6 billion in 2011 to $52 billion today due to its highly successful computer-powered investment strategies.

Indeed, both Siegel and Overdeck are recognized pioneers in the fields of technology and investment management. David Siegel, for example, received a PhD in computer science from the Massachusetts Institute of Technology, where he conducted research at the Artificial Intelligence Laboratory. Meanwhile John Overdeck, an award-winning mathematician, rose through the ranks to make it to Managing Director of the DE Shaw fund, and subsequently VP of Amazon, before founding the Two Sigma fund with Siegel and Mark Pickard.

With this in mind let’s take a closer look at two of the fund’s key moves:

Square: The Rally Isn’t Over

Two Sigma took a massive bet on mobile payment stock Square in Q2. With the purchase of 634,900 shares, the fund ramped up its position by a whopping 2894%. Post-purchase, the fund now holds 656,844 Square shares valued at $40.488 million.

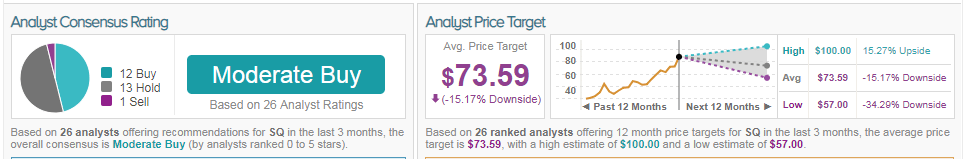

No doubt this move makes sense in the eyes of top-ranked Guggenheim analyst Jeff Cantwell. He has just set the markets buzzing following the release of an extremely bullish report on Square. The report comes with Square’s highest price target yet of $100 (17% upside potential)- up from $75 previously. (See Stock Recommendations from Jeff Cantwell)

This is significantly above the rest of the Street. For comparison, the next highest price target only stands at $86 (from Nomura’s Dan Dolev). Note that Square shares have already put on a remarkable performance with a 147% gain year-to-date, rising to 242% on a one-year basis.

That’s not all though; Cantwell also singles out Square as his new ‘best idea’ in fintech right now. He made the move following a meeting with Square CFO Sarah Friar- and his excitement about Square’s CashApp. This is the company’s rapidly growing peer-to-peer payments app. Interestingly, this isn’t the first time Square has been highlighted by the firm. Cantwell notes that he had previously picked Square as his highest conviction stock two years ago now before it was replaced by Global Payments and subsequently Worldpay.

“We look for companies that we believe have a combination of a strong fundamental outlook and upside to consensus forecasts” explains the analyst. As for Square specifically, he expects a strong rate of revenue growth for SQ which should drive further share price appreciation. For example, his subscription and services-based revenue forecast for ’19E is 17% above consensus ($1.02B vs. $868M) and represents rapid growth of 78% YoY.

The three key reasons why revenue will be stronger than expected are as follows: 1) it’s already happening 2) Cash App has an emerging ‘butterfly effect’ as it serves a key role in providing services to the underbanked, and 3) on a longer-term horizon, a further buildout of CashApp’s services into areas like consumer finance, investing, and potentially cross-border money transfer. Indeed, Cantwell notes that Cash App has numerous ‘initial reasons’ for users to download the app. And once they are in, they are hooked by an ever-increasing number of service offerings that monetizes these users over time.

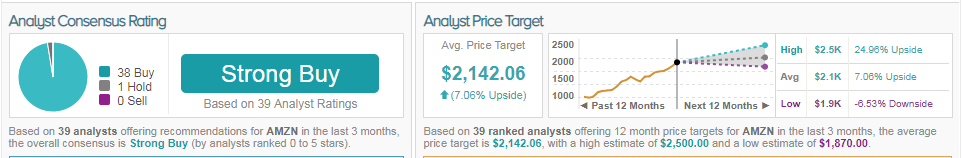

Stepping back, we can see that the Street stands divided on the stock’s outlook. In the last three months, the stock has scored 12 buy ratings vs 13 hold ratings and even 1 sell rating. This gives it a ‘Moderate Buy’ consensus. But most worrying is the average analyst price target of $73.59. From current levels of over $85, this suggests prices could potentially plunge over 14%. (See SQ price targets and analyst ratings on TipRanks.)

Amazon: Cruising Towards $1 trillion

In Q2, Two Sigma displayed a clearly bullish attitude towards Amazon. The fund boosted its position by 153% with an additional 195,400 shares. This brings its total AMZN holding to 323,383 shares worth around $549.686 million.

And it’s possible that Two Sigma made the move just before Amazon enters the elite trillion-dollar club. This is according to the recent price target ascribed to the stock by top JP Morgan analyst Brian Nowak. He has just taken his price target to from $1,850 to an incredibly confident $2,500. (See Stock Recommendations from Brian Nowak)

Not only is this the Street’s highest Amazon price target yet, but it would also indicate a massive $1.2 trillion market cap for the e-commerce giant. Right now, with shares trading just shy of $2,000, AMZN’s market cap stands at $971.96 billion.

So what led to this shift in Novak’s sentiment- from bullish to even more bullish? “We have increasing confidence that Amazon’s rapidly growing, increasingly large, high-margin revenue streams (advertising, AWS, subscriptions) will drive higher profitability and continued upward estimate revisions,” explains the analyst.

Specifically, Novak sees an explosion in Amazon’s cloud unit, Amazon Web Services (AWS). He sees AWS combined with paid subscriptions and advertising netting Amazon a sweet $45 billion in profit by 2020. This represents a significant increase from current profit levels, estimated at $25 billion for 2018. Plus the analyst takes hope from the fact that for the last three earning quarters, AMZN has easily beat the top-end of its operating-profit guidance by an average of 60%.

Bear in mind, this is a five-star analyst with a killer track record on Amazon stock specifically. Over 36 ratings in the last year, 92% were profitable with a very strong average return of 41.7% per rating.

Indeed, Amazon is still one of the Street’s hottest stock picks. In just three months, AMZN has picked up no less than 38 buy ratings. Only one analyst has stayed sidelined. Meanwhile the average analyst price target of $2,142 indicates 7% upside from the current share price. (See AMZN’s price targets and analyst ratings on TipRanks.)