Philip J. Hempleman colloquially known as ‘Phil’ is the founding partner of Ardsley Partners and current Managing Partner. He oversees all investment activities- so no doubt he had a direct hand in the latest moves involving red-hot chip stock Advanced Micro Devices (NASDAQ:AMD) and Alibaba (NYSE:BABA).

The hedge fund legend once managed portfolios for the Oppenheimer Target and Special Strategies, where the firm’s Target Fund became the strongest performing mutual fund from 1981 to 1982. This was before he turned to setting up his own fund back in 1987.

Now, with assets under management of $895.315 million, Ardsley splits its investments across four key strategies. The most well-known is the long-biased flagship strategy. This lucrative approach uses a concentrated book approach with the top ten holdings representing Ardsley’s best ideas and 40-50% of the portfolio.

Returns are enhanced by the short portfolio and by the opportunistic trading of stocks and options. According to the fund “Sector specialist analysts use a fundamental, bottom-up research approach to identify rapidly growing companies for core portfolio investments.”

Let’s take a closer look at these two bullish plays now:

Time to Play AMD

Hempleman is putting his dollars behind chip stock AMD. In Q2 he ramped up the fund’s AMD position by a whopping 720% with 370,000 new AMD shares. Post-purchase, the fund now boasts a total AMD holding of 420,000 shares valued at approx. $6.296 million. Bear in mind, AMD stock has climbed over 143% year-to-date- and no doubt Hempleman wants a slice of the action.

Luckily, this fund manager isn’t the only bull in AMD’s corner. Five-star Rosenblatt Securities analyst Hans Mosesmann has just boosted its price target from $27 to a new Street-high price target of $30. The new target indicates 20% upside potential lies ahead. He cites higher conviction of sustained double-digit growth, market share gains, and gross margin expansion. (See Stock Recommendations from Hans Mosesmann)

Mosesmann has just held meetings with institutional investors, that, like Hempleman are showing a fresh interest in AMD’s potential- boosted by the company’s impressive focus and execution under the helm of CEO Lisa Su. These ‘deep dives’, on the back of ‘many years of disregard’ have left the analyst with an upbeat approach to AMD’s prospects. “We view heightened interest within the industry to desire to be at AMD is a good indicator for investors to consider going forward” stated the analyst.

That’s not all. Aside from the investor interest, Mosesmann also noted that rival Intel is experiencing delays in its 10-nanometer chip process. While Intel is now set to launch the chips in the 2019 holiday season, AMD will release its equivalent offering by the end of this year. This gives the company a ‘historical window of opportunity’ cheers the analyst. AMD now has a very valuable first-mover advantage in both CPUs and datacenter GPUs (6 months+ vs Nvidia).

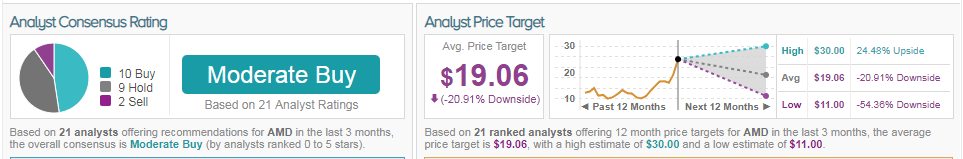

Overall, the stock scores a more cautious outlook from the Street- with a Moderate Buy consensus. This breaks down into 10 buy ratings vs 9 hold ratings and even 2 sell ratings. However, the most worrying aspect is the average analyst price target. At $19.06 the target indicates that prices could fall over 20% from the current share price of $25.05. (See AMD’s price targets and analyst ratings on TipRanks.)

Alibaba – Still A Winner

For the second quarter, Hempleman took a plunge into Chinese e-commerce champion Alibaba. He snapped up 75,000 BABA shares valued at $13.922 million. Alibaba is boasts over half the market share of China online shopping, while generating profits exceeding Amazon and eBay combined.

Hempleman’s move into BABA certainly makes sense from a Street perspective. BABA is consistently one of the Street’s favorite stocks. If we look back at the last three months alone, Alibaba has received no less than 16 consecutive Buy ratings. This is with a bullish average analyst price target of $238 (33% upside potential).

One of the stock’s most fervent supporters is five-star Stifel Nicolaus analyst Scott Devitt. He has a confident $256 price target on the stock right now (44% upside potential from current levels). Despite a challenging near-term environment, due to FX headwinds and higher investments to sustain superior growth short/medium terms, the outlook remains firmly positive. (See Stock Recommendations from Scott Devitt)

Alibaba has just reported solid F1Q:19 results showing that revenue increased 61% y/y (49% organic growth). Active customer growth and mobile MAUs were again strong in the quarter due to investments in customer acquisition and user experience. Cloud revenue grew 93% Y/Y driven by higher-value products and paying customers. Plus, even though strategic investments are pressuring margins, ultimately these investments should both expand Alibaba’s addressable market and strengthen the company’s competitive position.

The bottom line: core commerce is still strong. “Our positive view on Alibaba is unchanged and the company remains one of our top picks in our coverage universe” Devitt gushed in his investor report on August 23. He adds that international expansion is still in the initial stages and presents an attractive near/ intermediate term opportunity. Also keep an eye out for the formation of a new holding company that will house local services businesses Ele.me and Koubei.

This company will be separately capitalized by Alibaba, Ant Financial and third parties with over $3B of new funding already secured, including an investment from Softbank.