Billionaire Ken Griffin, otherwise known as Illinois’ richest man, has made some drastic changes to his chip stock holdings in the second-quarter. Griffin manages the massive $30 billion Citadel fund, based in Chicago. And now just-released 13F forms reveal that Griffin has significantly increased the fund’s Micron (NASDAQ:MU) holding, while exiting Advanced Micro Devices (NASDAQ:AMD) entirely.

This is big news given that Griffin’s trades tend to be on the money. Indeed, Citadel is currently outperforming both the broader markets and the industry so far this year.

According to Bloomberg’s sources, Citadel’s multi-strategy Wellington fund was up 8.79% during the first half of the year. Plus, all five of the strategies (namely equities, commodities, credit, fixed income and quant) are all in the positive for 2018. Most interestingly, on the stocks front, the firm’s Citadel Global Equities was up 5.24% in 1H18. This is double the returns of the S&P 500 in the same period.

It’s no surprise, therefore, that Griffin himself boasts a personal wealth of $9.1 billion. This places him at an impressive No. 172 on Forbes’ 32nd Annual World Billionaires List. To be fair, Griffin has always demonstrated a passion for investing and the stock market. He began trading in his Harvard dorm, back in 1987, with a specially-installed satellite dish providing real-time stock quotes.

With this in mind, let’s take a closer look at his most recent chip moves:

Griffin’s Citadel Triples Stake in Micron

For Q2, Griffin ramped up the fund’s Micron holding by a whopping 199%. He snapped up 5,643,853 shares taking the fund’s total stake in the chip giant to 8,480,541 shares valued at $444.72 million.

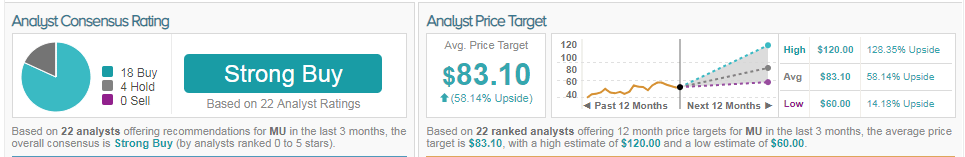

Luckily for Griffin, the sentiment on the Street is very bullish on the chip giant right now. In the last three months, 18 analysts have published Buy ratings on the stock vs just 3 Hold ratings. This is with an average analyst price target of $83.10, indicating massive upside potential of 58% (shares are currently trading at just $53).

One analyst firmly in the bull camp is top JP Morgan analyst Harlan Sur. According to Sur, cloud data infrastructure spends are very encouraging for MU. Cloud data spending is growing strongly (~+50%) this year and targeted to grow at a low-double-digit % growth rate over the next few years.

And as a result, Sur now believes that server/cloud DRAM will overtake PC DRAM to become the 2nd largest driver of DRAM demand (~25% of overall DRAM shipment demand versus just 8% 10 years ago). The result of this diversification of demand is the reduction of cyclical volatility of the industry. Good news for MU as the fear of a cyclical downturn is a big driver of bearish sentiment on the stock.

As Sur explains: “This bodes well for OW-rated MU as server/cloud DRAM is the largest segment for Micron’s DRAM segment (~30% of sales in F1H18).” And even better is the fact that profitability in this segment is higher given that ASPs [average selling prices] are higher. Specifically, Sur is predicting a 20% ASP premium in server DRAM versus PC DRAM. Note that Micron’s DRAM business is crucial to the company as it accounts for ~70% of total sales.

Consequently, this top analyst reiterated his Buy rating on the stock with an $84 price target. He also made a 5%-6% upward revision to revenue and shipment estimates for server DRAM demand in 2018-19 versus prior estimates. (To watch Sur’s track record, click here)

Goodbye to AMD

In the second quarter, Griffin sold the fund’s entire stake in AMD. This equated to 6,131,968 shares worth approximately $91,918,200.

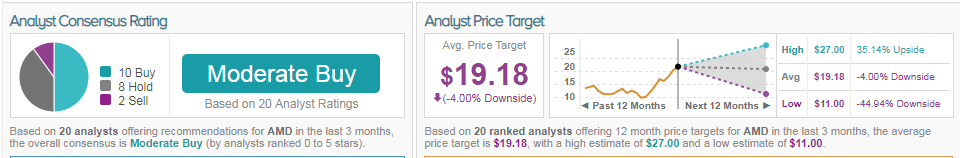

Looking at the Street AMD outlook, this decision certainly makes sense. Although the stock has a cautiously optimistic Moderate Buy consensus, the break down is more troubling. In the last three months, 10 analysts have published Buy ratings on the stock. But at the same time, AMD has also received 8 Hold ratings and 2 Sell ratings. This comes with a $19.18 average analyst price target, which actually suggests 4% downside from the current share price of $19.98.

Indeed, top Barclays analyst Blayne Curtis has a Sell rating on AMD with a bearish $15 price target (25% downside potential). Interestingly, however he has just ramped up his price target from just $9 previously (over 50% downside potential).

But Curtis is at pains to point out that- despite the price target change- he is still very skeptical on AMD’s potential. He tells investors: “There are no material changes to our estimates, but we are now using a higher multiple to reflect a wider range of outcomes for Epyc server traction.” Indeed, he is now modelling for $1-$1.5 billion vs a prior estimate of $500 million.

Not that he has seen any evidence to support these bullish levels from actual forecasts – far from it. Curtis simply notes that the market is much more optimistic on the stock’s growth as reflected by the stock’s appreciation- and the new price target now reflects that.

As Curtis writes “AMD has effectively reduced the discussion of future server performance to process technology but the lack of response from Intel following the multiple 10nm push outs leaves little reason for investors to believe differently.”

Plus other concerns include: upcoming headwinds to AMD GPUs from rival Nvidia’s Turing; and on the CPU side, limited traction for Ryzen desktop which does not bode well for Ryzen mobile.

Ultimately Curtis is sticking to his Sell rating because the current share price already factors in substantial gains across all of AMD’s businesses but “third part data shows gains have actually been limited and we look for the stock to reflect the reality.”

To find the top 25 hedge fund managers and know exactly what is going on with their portfolios, click here.