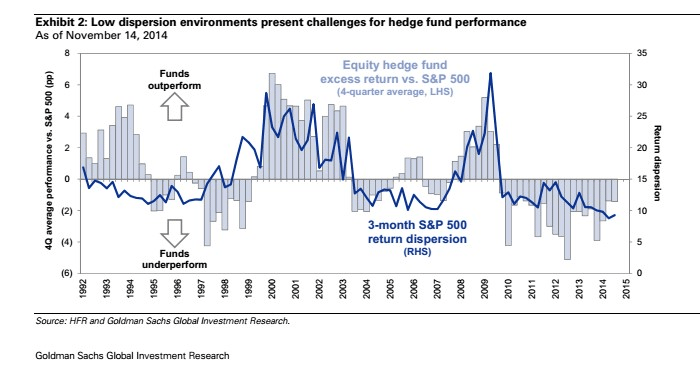

This has not been an easy year for hedge funds. The most popular hedge fund strategy, long/short equity, which usually churns out an above average gain every year, was not a winner this year. HFRX Equity Hedge Index and Event-Driven Index has returned 0.73% and -5.57% YTD, both strategies are a good proxy for judging gains of an average hedge fund trading stocks.

Nevertheless, some names in the hedge fund industry still managed to post impressive gains. Here is a look at the stocks that moved hedge fund returns for better this year.

Apple marks a winning year for hedge funds

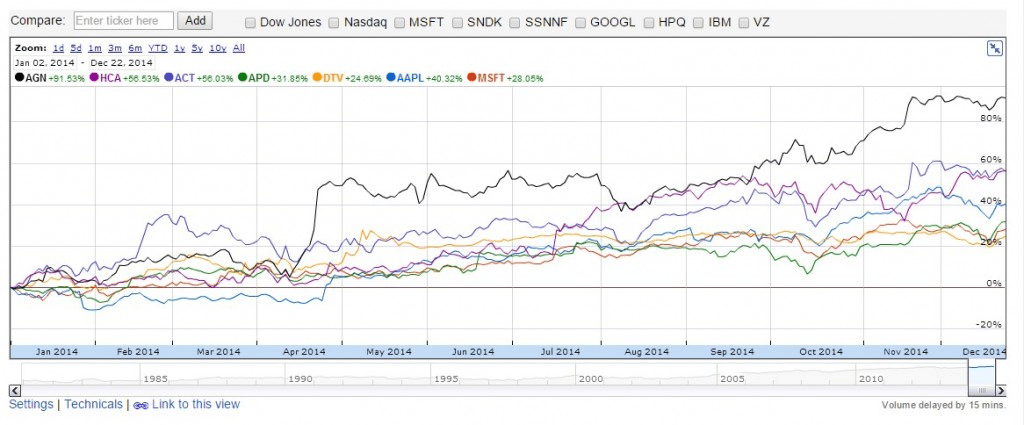

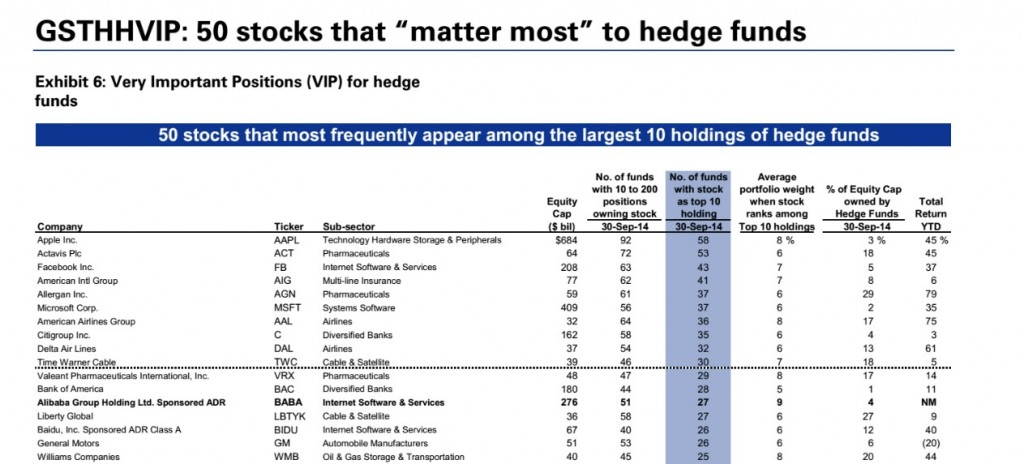

After a rather disappointing 2013, Apple Inc. (NASDAQ:AAPL) has generated a large return, nearly +40% this year. The company launched the iPhone 6 this year which set the record of highest number of orders over a month’s time. Apple shares gained further with the acquisition of Beats, the maker of headphones.

The stock has been a favorite among hedge funds for quite some time, but had lost some of its luster in the past year. However, Apple climbed once again to being the top holding of hedge funds at the end of the third quarter. Among the top holders of Apple is Carl Icahn. The aggressive activist holds 52.7 million shares of the iPhone maker. Icahn has made a whopping $1.5 billion in paper profits, making it his top gain of this year. David Einhorn’s Greenlight Capital is another winner, as the fund owns 9 million shares of the company. Einhorn has garnered a profit of nearly $300 million on this trade YTD. Greenlight Capital is up 9.7% for the year through November.

Philippe Laffont’s Coatue Management and Discovery Capital also own sizable stakes in Apple.

Allergan-Actavis top acquisition of 2014

Despite the high expectations for M&A activity from this year, things did not work out so well for the event-driven hedge funds. One blockbuster deal materialized towards the end of 2014, when Actavis plc (NYSE:ACT) announced that it would be acquiring Allergan in a $66 billion transaction. It looks as if Allergan will end the year by doubling its stock value. The pharmaceutical company is up by +90% so far and is closing in on the $219/share price offered by Actavis. Bill Ackman’s Pershing Square has cashed in the highest gain here. Before the acquisition, Ackman owned a 9.7% position (28.8 million shares) in Allergan, so his profits on paper easily exceed $2 billion. Pershing Square is up 36% for the year through mid December.

Other holders of Allergan who are counting their riches include John Paulson. Paulson & Co. owns 5.3 million shares. Despite the gains in some of Paulson’s holdings, his event-driven funds are doing poorly this year. Paulson Advantage and Advantage Plus are down 16.5%, and 22.7% YTD through the end of November.

Steadfast Capital, Eton Park and York Capital also own positions in Allergan. At the end of Q3, 29% of Allergan’s shares were held by hedge fund managers.

With a 58% gain, Actavis is also making it’s shareholders richer. Actavis is the second most popular holding among hedge funds according to Goldman’s quarterly review of 13f filings where 18% of its equity cap is owned by hedge funds. The largest shareholder among hedge funds is Dan Loeb’s Third Point with 2.8 million shares. Third Point has made a gain of 9% so far this year.

Andreas Halvorsen‘s Viking Global has a unique advantage, as the fund owns positions in both Actavis (2.5 million shares) and Allergan (2.2 million shares) and will, therefore, reap profits from both sides. Viking is up 13.3% through the end of November. Barry Rosenstein’s Jana Partners, Lone Pine Capital, Eton Park, Blue Ridge Capital, Discovery Capital, Glenview are also up on their Actavis holdings.

American Airlines rockets to new heights

American Airlines’s (NASDAQ:AAL) shares are touching the sky these days as the stock has jumped over 100% YTD. While the airline and airport industry has a number of gainers this year, AAL’s streak has no competition. York Capital owns 15.5 million shares of the company, followed by David Tepper’s Appaloosa holding 7.2 million shares. Tepper’s credit-focused Palomino Fund is not doing so well. Palomino was down 2.3% in the first ten months of 2014.

Dan Loeb‘s Third Point owns 2.75 million shares of the airline company. London-based hedge funds Egerton Capital and Marshall Wace also own positions in American Airlines. Marshall Wace’ flagship Eureka A1 is up 7.6% YTD till Dec 9 whereas MW Global Opportunities has gained 5% in the same period, according to HSBC Holdings plc (ADR) Hedge Weekly.

17% of AAL’s market cap was owned by hedge funds at the end of Q3, making it the seventh most popular hedge fund holding.

Facebook up 50%

Facebook Inc (NASDAQ:FB) rewarded many hedge funds which patiently stuck to their holdings after the 2013 IPO.The stock has gained 50% so far this year. Tiger cubs have ruled the day here; Lone Pine Capital, Coatue Management, Viking Global and Discovery Capital all made good profits in their Facebook holdings. David Tepper’s Appaloosa and JAT Capital also own positions in Facebook.

Even though only 5% of Facebook’s equity cap was owned by hedge funds, the social networking company adorns the top ten holdings list of over 40 hedge funds.

Lansdowne gains in Delta Air Lines

Delta Air Lines (NASDAQ:AAL) is among the top ten list of most popular hedge fund holdings. The airline company soared over 70% so far in 2014. Among top holders is London-based hedge fund, Lansdowne Partners. The fund holds 26.3 million shares of Delta and has made over half a billion dollars on this position. Lansdowne Developed Markets Fund is up 10% YTD, whereas the Global Financials Fund is down 9%.

David Tepper’s Appaloosa Management owns 7.5 million shares of Delta Air. Columbus Circle, Viking Global and Soros Fund also hold positions in the airline company.

In the sector, other than American Airlines and Delta Air, United Continental Holding, Southwest Airlines Co and Macquarie Infrastructure have also soared this year.

Jeff Ubben nabs a win in Microsoft

A quiet gainer, Microsoft Corporation (NASDAQ:MSFT) has climbed close to 30% this year. The company revamped itself with new management, which has rebooted Microsoft’s enterprise value. With growing revenue from its commercial cloud services and positive anticipation over the release of Windows 10, the company is slowly turning a new leaf. As for hedge funds who have benefited from Microsoft’s gain, Jeffery Ubben’s ValueAct Capital is the winner. ValueAct’s ownership in Microsoft exceed 74 million shares, and the fund also has representation on the board of directors. Others who have gained with Microsoft include Lone Pine Capital and Adage Capital.

Micron Technology, Klarman and Einhorn’s best bet

The semiconductor equipment company, Micron Technology (NASDAQ:MU), has rewarded its investors with a 60% gain this year. The company had a profitable year with increasing revenues and cash flow. Seth Klarman’s Baupost Group owns the largest stake of 51.6 million shares. The hedge fund has made a more than $600 million profit on paper in Micron. Greenlight Capital owns 30.4 million shares and is also sitting on a significant gain.

Viking Global owns 20.5 million shares, and Coatue Management, Discovery Capital, Lakewood Capital and Marshall Wace also own positions in Micron Tech. At the end of Q3, 22% of Micron’s equity cap was owned by hedge funds.

Cheniere Energy’s booming LNG business

Oil and gas has burned the portfolios of several hedge funds this year. A couple of names have managed to weather the beating in oil prices, a prime example is Cheniere Energy (NYSE:CQP). With 37% of its equity cap owned by hedge funds, Cheniere Energy is a popular name among hedge funds.

Baupost Group has made the most from Cheniere’s 60% rise this year. Seth Klarman’s hedge fund owns 11.2 million shares in the LNG business. Cheniere has managed to escape with a gain mainly because the bulk of its business involves the distribution of liquefied natural gas. The company is also going to be the first exporter of natural gas from the U.S.

Another natural gas company that has soared this year is Athlon Energy Inc. With return in excess of 90%, Athlon has made Chilton Investment Company reap high profits.

HCA Holdings, Air Products and DirecTV

HCA Holdings Inc (NYSE:HCA) Holdings Inc owns and operates hospitals and other medical facilities, and has gained over 50% YTD. The stock has made several hedge funds richer, including Glenview Capital, Appaloosa Management and Maverick Capital. Larry Robbins’ Glenview Capital was the star-performer of last year and has returned 12% YTD till November. Lee Ainslie’s Maverick Fund is up 8.35% through Dec 5.

Leon Cooperman and Viking Global also own positions in HCA Holdings. At the end of the third quarter, 14% of HCA’s equity cap was owned by hedge funds. Leon Cooperman’s Omega Overseas Partners is barely up by 0.8% YTD till November.

Air Products & Chemicals (NYSE:APD), a gas engineering company, was little known as a hot hedge fund holding until Bill Ackman snapped up a large stake. APD’s stock is up by 32% so far in 2014. With 20.5 million shares, Ackman’s profit exceeds $540 million.

Viking Global and Highfields Capital also own 3.5 million shares each of APD. Hedge funds owned 27% of Air Product’s and Chemical’s stock at the end of Q3, including the 9.5% stake held by Pershing Square.

DirectTV (NASDAQ:DTV) has gained 25% YTD, making a number of hedge funds happy. The largest shareholder is Warren Buffett‘s Berkshire Hathaway Inc. Among hedge funds, Highfields Capital and Paulson & Co own over 10 million share apiece. According to SEC 13f filings, 27% of DirecTV’s market cap is owned by hedge fund managers. Taconic Capital and Farallon Capital also own significant positions in DirecTV.

Overall, healthcare, airline companies and some technology names rewarded hedge funds the most this year. On the other hand, energy and consumer discretionary failed to produce great returns.