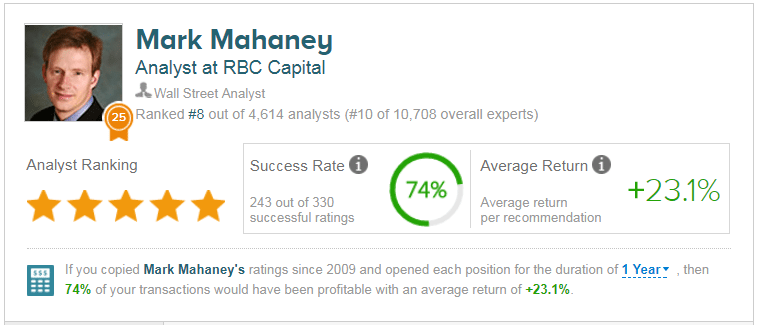

Mark Mahaney of RBC Capital rates stocks in the internet sector and is one of the top 20 analysts rated on TipRanks.

Yesterday, Mahaney raised his price target on Alibaba Group Holding Ltd (NYSE:BABA) to $185 (from $160), after the Chinese e-commerce giant reported yet another blockbuster quarter, surpassing Wall Street estimates. Specifically, Alibaba reported revenue of $7.4 billion, beating the consensus estimate of $7.1 billion. In addition, the company reported adjusted earnings of $1.17, beating the consensus estimate of 92 cents.

Mahaney commented, “Fundamental trends remain impressive – particularly premium organic growth rates (56% Y/Y) in the Core Commerce segment, as brands/merchants ramp advertising spending on BABA’s massive platform. Further, Cloud continues to demonstrate increasing scale (1MM+ customers) and hyper-growth (96% Y/Y) while inching closer to breakeven. Finally, BABA continues to demonstrate high levels of profitability (63% EBITA margins in Core Commerce). These trends are impressive and appear sustainable. We view BABA as a PremiumGrowth/Premium-Profit Asset and view the run-up in shares YTD as fully warranted given fundamental trends and growth runway.” Mahaney currently rates BABA an Outperform.

Out of the 27 analysts polled in the past 12 months, 24 rate Alibaba stock a Buy, while 3 rate the stock a Hold. With a downside potential of 9%, the stock’s consensus target price stands at $152.13.![]()