As Shopify Inc (US) (NYSE:SHOP) and Glu Mobile Inc. (NASDAQ:GLUU) ready to release second quarter earnings next Tuesday, analyst Darren Aftahi of Roth Capital dives in to find out what is driving these major players of the eCommerce and gaming industries. Whereas SHOP is devising new merchant solutions and developing new partnerships with kings of online shopping, Amazon and eBay, meriting a price target boost, GLUU continues strong with Aftahi angling for a quarterly booking trouncing.

Let’s explore (To view Aftahi’s track record, click here):

Shopify Headed for Another Killer Quarter

Since February Shopify shares have increased by 75%, which is a strong lead into the company’s release of second quarter earnings next Tuesday. Based on surveying merchant businesses and projected growth in subscription solutions, Aftahi believes that the eCommerce mogul will report another impressive quarter. Even if there are some slowdowns in merchant solutions revenue, the analyst still surveys a compelling stock with growth prospects worth the investment.

Mostly aligning with consensus in his expectations, the analyst calls for $143.4 million in sales against consensus of $143.6 million, $2.9 million in operating income compared to consensus of $2.7 million, and $0.06 in EPS, just a cent below consensus of $0.07. All things considered, the analyst sees SHOP as “the best top line growth story in our coverage area,” going as far as to venture, “we believe risk/reward may be more attractive on a meaningful pullback in shares.”

Throughout June and July, Aftahi surveyed 104 SHOP merchants to better understand trends on the ground and build expectations for 2Q results. The analyst notes, “Of those we surveyed, the median growth respondents saw in 2Q17 for their respective businesses was ~44% y/y, with the range being 21%-219%. Range of sales income varied from tens of thousands to three with over $500k, and three with seven figure annual sales, although responses to this question were not 100%. Average time sellers have been using SHOP averaged approximately 26 months. Approximately 8% of those we spoke with were internationally domiciled with the remainder being domestically domiciled.” Additionally, while it is too early to draw conclusions, the company has also begun Amazon integration (14 merchants have already joined) and will also begin partnering with eBay in Fall 2017. These partnerships are important considering that 60% of SHOP merchants sell on multiple platforms.

Based on these findings, Aftahi anticipates, “higher margin subscription business to ~80%, while merchant solution gross margins improve ~400bps to ~34%, driven by assumed increased penetration of shipping solutions.” Moreover, Aftahi expects revenue to remain strong at 77% year over year, despite falling short of revenue this time last year, which saw 120% annual growth. In regard to operations, which includes costs like the Unite Conference, the company is expected to lose $6.8 million. However, these losses are offset by growth investments like new products and updates, which will keep growth up and income loss down year over year. Aftahi forecasts that EBTIDA will reach $7 million by 4Q17.

The analyst maintains a Buy rating on SHOP while lifting the price target from $92 to $101, implying a potential upside of near 13% from where the shares last closed.

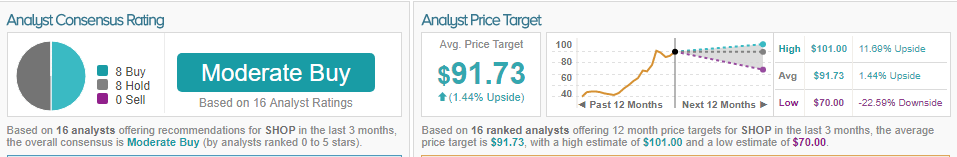

TipRanks analytics reveal SHOP as a Buy. Out of 16 analysts polled by TipRanks in the last 3 months, 8 are bullish and 8 neutral on Shopify. With a potential upside of 1%, the stock’s consensus target price stands at $91.73.

Glu Stays a Top Pick of 2H17

Glu Mobile, a major player in the gaming industry, is likewise gearing up to post its second-quarter print come next Tuesday. It is noteworthy that company shares hit above $2.75 yesterday, the highest peak achieved since April of 2016. To better estimate how 2Q will pan-out, Aftahi analyzes GLUU game rankings in both the United States and China by comparing them to past quarters, finding that the top six games tracked 2% ahead of this time last quarter. Therefore, the analyst is predicting a booking outclass to kick off August, and moreover, this momentum will flow through the back half of the year. For investors cautiously eyeing cash burn, which the mobile game maker saw a tune of $29 million in the first quarter, the analyst says not to fear, as he is eyeing an improvement in the forthcoming financial results.

In terms of solid gaming performance, the analyst attributes this to the success of Design Home, currently averaging 57% higher quarter over quarter. Based on proprietary findings, Aftahi projects bookings to rise 12% above his initial estimates reaching $81 million, set to beat guided expectations estimating a range of $71 million to $73 million.

Leverage will be crucial to Glu, argues the analyst, elaborating: “We believe improvement in operating leverage (and improved cash burn) going forward is key for shares. 3Q is off to a strong start with continued acceleration from DH and a KKH turnaround.” Additionally, the analyst also pointed to cash burn is a key interest to investors noting “In addition to strength in bookings, we believe investors are keenly focused on cash burn, which we expect to improve from the $29M burn level we saw in 1Q. A portion of this burn was related to the prepayment of royalties related to its legacy celebrity strategy. Improvement in this metric (or lack thereof) could be a directional catalyst for shares.”

Aftahi assumes EBITDA will hit ($11.9 million), due to increased marketing in relation to Design Home (DH) users, but expects for numbers to improve throughout 2H17 “as bookings begin to drive operating leverage, with lower assumed UA spend.” As such, the analyst holds “FY17 bookings guidance remains conservative given 2Q assumptions and 3Q QTD strength. GLUU remains one of our top picks for 2H17.”

The analyst reiterates a Buy rating on GLUU with a price target of $3.75, implying a potential upside of 36% from where the shares last closed.

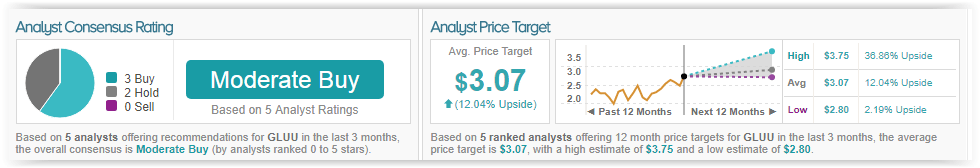

TipRanks analytics reveal GLUU as a Buy. Out of 5 analysts polled by TipRanks in the last 3 months, 3 are bullish and 2 neutral on Glu Mobile. With a potential upside of nearly 12%, the stock’s consensus target price stands at $3.07.