Joe DiMenna has enjoyed quite a fast track to success, rising from active student reader of his mentor Martin Zweig’s newsletter, The Zweig Forecast, to becoming a full-fledged summer employee to jump-starting a joint venture together by 1984. Just a student in 1977 with an eye for sharp investment strategies, DiMenna’s incredible instincts have taken him far in the financial world, where he was easily able to dole out $5 million by 2010 to the New York Historical Society- the most substantial donation delivered in cash to any institution of the arts ever before.

One source praises the hedge fund tycoon to Businessweek with the utmost respect, declaring that hands down, “Joe DiMenna is the best stock-picker no one has ever heard of.”

So what does the famed “best stock-picker” make of heavy-hitter tech players like Advanced Micro Devices, Inc. (NASDAQ:AMD), Apple Inc. (NASDAQ:AAPL), and Micron Technology, Inc. (NASDAQ:MU)? Apparently all is not shining on the technology front from DiMenna’s eyes, as he has opted to diminish holdings in all three stocks in the fourth-qurter. Let’s take a closer look:

Advanced Micro Devices, Inc.

According to the latest SEC filing, Zweig-DiMenna cut back 20% of its stake in AMD to 872,671 shares worth $9,896k. Is DiMenna smart to veer on the side of caution? Though DiMenna shies away from the chip giant, a 20% step back is not an absolute surrender. There is still palpable chance left for DiMenna to get increasingly positive on AMD once again.

Glints of promise for the chip giant show the hedge fund guru could have simply been playing it safe. Buzz has hit the Street on AMD’s acquisition of Nitero, a fabless semiconductor company that could be a terrific foray to allow AMD a seamless transition into wireless virtual reality (VR) as well as augmented reality (AR) headsets. With other tech players coming out ready to capture VR and AR momentum, the chip giant’s M&A move is a savvy one that could position the giant for long-term success.

Stock giants are all raring to capture the AR/VR market, as the key to share gains down the line is maximizing strategy for the technology key to the future. AMD’s Nitero takeover is definitely a step in the right direction, and more moves like this one could bolster DiMenna’s conviction in the stock.

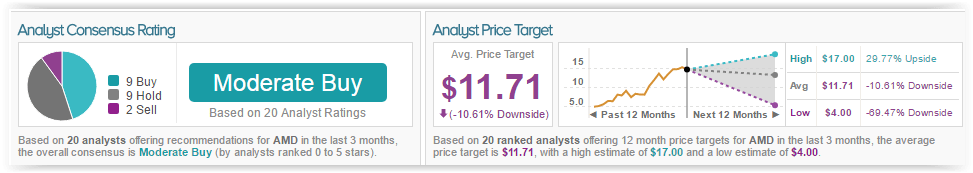

TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, highlights AMD as a Buy. Out of 20 analysts polled by TipRanks in the last 3 months, 9 are bullish on AMD stock, 9 remain sidelined, and 2 are bearish on the stock. With a loss potential of nearly 11%, the stock’s consensus target price stands at $11.71.

Apple Inc.

Though much of the industry’s focus has been on the iPhone X hype, DiMenna’s latest move was to backtrack, reigning in 38% of his hedge fund’s holding in Apple to 87,268 shares worth $10,107k.

However, don’t dismiss the tech giant with skepticism just yet, as the rumor mill is rumbling with Apple’s alleged new power management chip for the iPhone that sent chip maker stocks tumbling from the leaderboard.

Presently, Apple sources these chips from Dialog Semiconductor, whose stock took a 14% hit in Germany following the news. Should the rumors turn to reality, Apple’s battery-saving iPhone chip could spring into action perhaps by 2019. In effect, this would be knocking Dialog off track, as the tech giant dominated over 70% of the chip maker’s sales last year.

Bankhaus Lampe analyst Karsten Iltgen asserts, “In our view, there is strong evidence that Apple is developing its own PMIC and intends to replace the chip made by Dialog at least in part.” Moreover, there are whispers that Apple is “poaching like crazy” from Dialog’s engineering team in Germany.

The tech giant is clearly ready for the dawning of a new era once its heavily anticipated 10th anniversary iPhone model finally hits the market in the fall, including new power management chip strategy. Maybe there is room for Apple to impress DiMenna just yet by his next portfolio move.

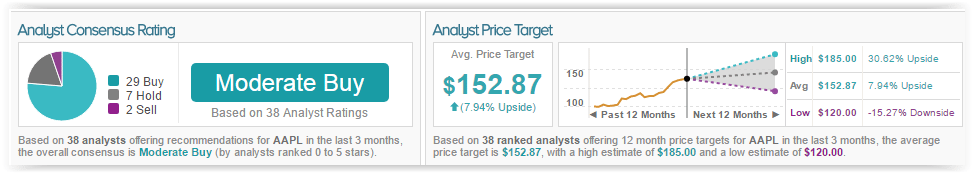

TipRanks analytics demonstrate AAPL as a Buy. Based on 38 analysts polled by TipRanks in the last 3 months, 29 rate a Buy on Apple stock, 7 maintain a Hold, while 2 issue a Sell. The 12-month average price target stands at $152.87, marking a nearly 8% upside from where the stock is currently trading.

Micron Technology, Inc.

Micron has recently soared on back of industry-positive DRAM trends, with many analysts across the Street cheering for the chip giant’s shining second fiscal quarter outclass for 2017. Yet, Zweig-DiMenna reduced 28% of its holding in MU to 587,697 shares worth $12,882k.

Conversely, UBS analyst Stephen Chin continues to highlight confidence in the chip giant, believing that earnings could escalate even higher. Therefore, following a meeting with the giant’s management, the analyst maintains a bullish forecast for Micron, reiterating a Buy rating on shares of MU with a $32 price target, which represents a just under 17% increase from current levels.

Chin notes, “We met with management and remain comfortable with our thesis that Micron has some more company specific trends that it can control which may enable the stock to outperform if it executes. We believe part of Micron’s strong May-17 quarterly guidance is industry related as DRAM prices in PC have increased c.60% yoy and evidence of DRAM content despec’ing by OEMs remains limited in mobile as prices are only up c.8% yoy.”

“But, we believe Micron’s NAND gross margin in the Feb-17 quarter of 31% (up 800bps qoq) shows that the company is executing well. We estimate Micron has the ability to increase NAND gross margin further into the 40% range longer term if it can continue to ramp its 3D NAND tech and implement 4bit/cell QLC in gen 2 or gen 3 products. We believe company specific areas that Micron can execute include more optimized sales mix exposure to cloud/data center and a greater range of eMCP offerings in mobile,” contends the analyst.

While there could be a base case regarding Samsung’s boosting of 30k to 40k wpm of DRAM capacity to counteract node migration-impacted wafer outs, Chin sees no reason to retreat on Micron any time soon.

According to TipRanks, five-star analyst Stephen Chin is ranked #145 out of 4,560 analysts. Chin has a 70% success rate and garners 16.0% in his annual returns. When recommending MU, Chin gains 39.7% in average profits on the stock.

TipRanks analytics show MU as a Strong Buy. Out of 18 analysts polled by TipRanks in the last 3 months, 17 are bullish on Micron stock while 1 remains sidelined. With a return potential of nearly 33%, the stock’s consensus target price stands at $36.12.