GameStop Corp. (NYSE:GME) investors are having a rough day after the retail game giant released a disappointing holiday sales report, sending shares down nearly 9% to $22.58.

GameStop reported that global sales for the holiday period fell 16.4% to $2.50 billion, while total comparable store sales declined 18.7%. As a result of the holiday performance, management lowered Q4 SSS midpoint to -17% from -9.5%, but maintained its Q4 EPS outlook of $2.23-$2.38 due to a favorable Q4 tax rate.

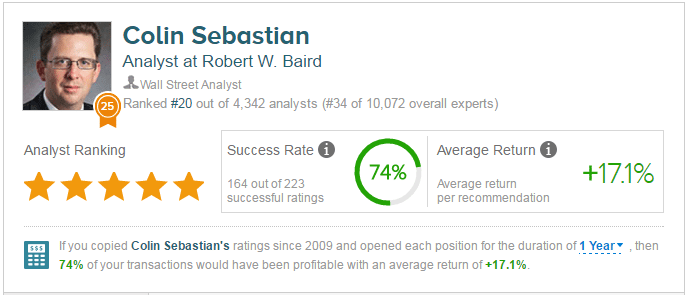

In reaction, Baird’s top analyst Colin Sebastian reduced his price target for GME to $24 (from $25), while reiterating an Outperform rating.

Sebastian wrote, “SSS declines (-18.7% Y/Y) were primarily driven by lower ASPs (discounting) without a corresponding increase in unit volumes. Consistent with our prior field checks, Black Friday/Thanksgiving-weekend promotions were heavier than anticipated, reflecting slow category sales of both hardware and software. While growth trends improved to some degree in December, store traffic did not improve to the degree necessary to offset the November shortfall.”

“We are adjusting Q4 and 2017 estimates to reflect the updated guidance and a more conservative outlook for 2017. Specifically, we are lowering our Q4 revenue and EPS estimates to $3.07B and $2.26, respectively, from $3.3B and $2.27. For 2017 we are assuming comp store sales decline of 5.1% and EPS of $3.60 (down from $3.80), although we believe the company could accelerate SG&A reductions,” the analyst added.

Analyst Colin Sebastian is a top-ranked performer on TipRanks, with a 74% success rate and an average return of 17.1%. Sebastian has a 15% average return when recommending GME, and is ranked #20 out of 4342 analysts.

![]()