The upcoming iPhone models for Apple Inc. (NASDAQ:AAPL) and a visit to Walt Disney Co (NYSE:DIS) new Shanghai Disneyland causes mixed reactions from analysts. While both predict long term benefits for each stock, one analyst believes Apple’s strengths will outweigh a lackluster response near-term. On the other hand, another analyst predicts challenges for Disney’s stock price in light of this heavy investment.

Apple Inc.

In the wake of company updates at Apple’s WWDC and a leaked photo of the new iPhone 7, Credit Suisse analyst Kulbinder Garcha provided his views on how the iPhone 7 and 8 would affect the company both short and long term. The analyst believes that the iPhone 7, set to release in September, will be a “modest upgrade”, with more “significant innovations” coming in the iPhone 8. As a result, the analyst believes the near term replacement rate for the iPhone will remain at 32 months, predicting a decrease in new users. While the analyst predicts overall iPhone unit growth in the iPhone 7, “recover is likely to be more muted.”

Due to the analyst’s predicted lackluster response to the iPhone 7, he slighting decreases his CY16 EPS estimate to $7.80 and his CY16 estimate to $9.67. However, the analyst has a hopeful outlook on Apple’s long term earnings potential due to various strengths. He explains, “Given high retention rates, a superior ecosystem, a multi-product compute advantage and a growing services business, we believe FCF of ~$67bn should be sustainable LT.”

Regarding the iPhone 8, the analyst predicts more enhanced features such as and OLED scree, glass display, and an improved camera. The analyst believes the iPhone 8 is key to getting the company back on track. He explains, “These features…should drive an accelerated replacement cycle and draw in new users and should result in mix improvements.” As a result, the analyst predicts iPhone unit sales of 250 million in CY18, marking a 16.1% y/y increase, as well as CY18 EPS of $12.32.

Crediting Apple’s Services growth as well as the potential for the installed base to reach 1.4 billion long-term, the analyst does not believe near-term uncertainties will negatively affect the company. He states, “Acknowledging the higher level of uncertainty around the quality of the product cycle near-term, we still see solid risk reward arguments.”

Garcha reiterates an outperform rating on the company with a $150 price target.

According to TipRanks’ statistics, Kulbinder Garcha has a 54% success rate recommending stocks with a 7.2% average return per recommendation.

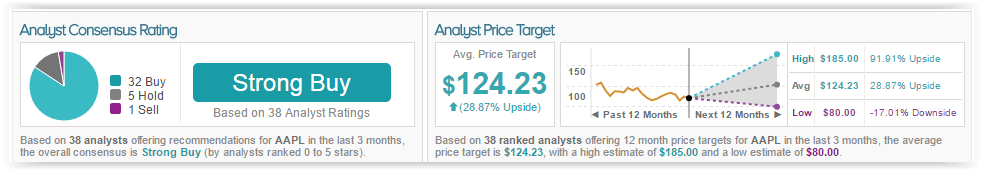

Out of all the analysts who have rated the company in the past 3 months, 84% gave a Buy rating, 3% gave a Sell rating, and 13% remain neutral. The average 12-month price target for the stock is $124.87, marking a 28% upside from where shares last closed.

Walt Disney Co

Wells Fargo analyst Marci Ryvicker provided her insights on Disney after visiting the company’s newest theme park, Shanghai Disneyland. The analyst is hopeful about the long term potential that the theme park represents for Disney, and believes the investment is worth the risk. Current capacity for the theme park is 45k visitors per day, but the company indicated this could go up to 60k. The analyst previously predicted a 100k capacity per day, resulting 22 million people per year. The new capacity results in only 7-17 million visitors per year, reducing her revenue estimates for the theme part to $0.8B-$3.1B from $1.7B-$5.1B. However, the analyst notes that “the financial impact of the park is small” relative to the company’s overall FY revenues of $52.5 billion. She states, “It’s really all about the LT opportunities.”

The analyst touches on how Disney plans to keep the park from overcrowding. The company will not only sell dated tickets but also price tickets from the lowest point of $57 to the highest point of $76 per ticket according to demand and seasonality. Ryvicker was also impressed by the “advanced technology” of the park, noting the upcoming utilization of mobile for MyMagic band. While some visitors may come from Taiwan and Hong Kong, the company does not believe there is a risk of cannibalization regarding its Tokyo theme park. Although the company is testing out Shanghai Disneyland before creating any new theme parks, management indicated that any new theme parks will be in China. Finally, the analyst believes the new theme park will boost products and retail.

The analyst reiterates a Market Perform rating on shares with a valuation range of $95-$105. She states, “We struggle with valuation at these levels given the potential downside risk to estimates both from continued sub losses at ESPN and a near-term drag from the new Shanghai Disneyland Park.”

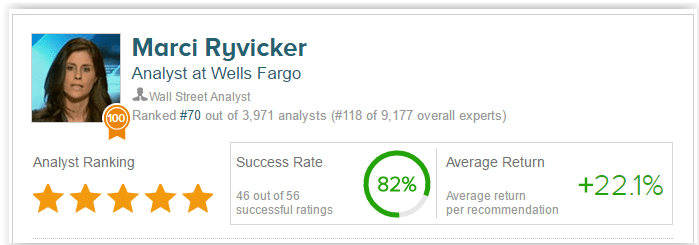

Marci Ryvicker is ranked #70 out of 3,971 analysts on TipRanks. She has an 82% success rate recommending stocks with a 22.1% average return per recommendation.

According to TipRanks, out of all the analysts who have rated the company in the past 3 months, 67% gave a Buy rating while 33% remain on the sidelines. The average 12-month price target for the stock is $114.69, marking a 17% upside from current levels.