Both Relypsa Inc (NASDAQ:RLYP) and Intercept Pharmaceuticals Inc (NASDAQ:ICPT) received welcome news recently as a competing drug to Relypsa’s Veltassa encounters some difficulties reaching commercialization and Intercept receives FDA approval for a new drug. While one analyst remains bullish on Relypsa, another continues to stand on the sidelines of Intercept despite the good news.

Relypsa Inc

Relypsa received some welcome news this week when pending competition ran into some speed bumps. Ed Arce of H.C. Wainwright weighed in on the biotech company following this development.

Relypsa is most known for Veltassa, its FDA-approved drug to treat hyperkalemia. When Veltassa was approved last year, it was lauded as the first new drug for hyperkalemia in 50 years. However, AstraZeneca soon entered the ring with ZS-9, a competing pipeline drug for hyperkalemia. Arce welcomed recent news that the FDA issued a Complete Response Letter, or CTR, raising concerns about the manufacturing practices surrounding the drug and calling for a delay in its ruling.

Arce weighs in on the manufacturing concerns surrounding the competing drug, noting, “While we are aware that some believe the manufacturing issues can be resolved within six months (as guided by AZN), we are not convinced by that assertion, especially given the issues were not specified.” The analyst continues, “Overall, we believe this CRL gives a big boost to the Veltassa commercial team as it is likely, in our view, to retain 100% share of voice in hyperkalemia for at least another year.”

In light of this promising news for Veltassa, Arce reiterates a Buy rating on Relypsa with a $32 price target, marking a 67% potential upside from where shares last closed.

According to TipRanks.com, which measures analysts’ and bloggers’ success rate based on how their calls perform, analyst Ed Arce has a yearly average return of 9.5% and a 43.2% success rate. Arce has a -11% average return when recommending RLYP, and is ranked #460 out of 3972 analysts.

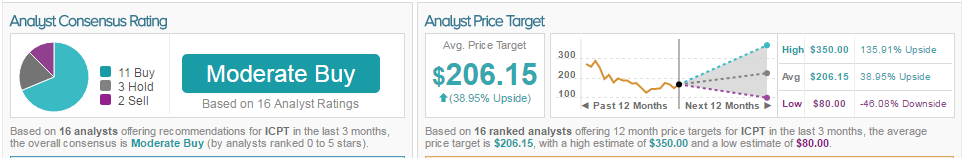

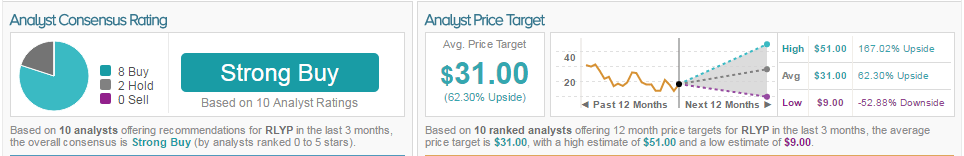

As of this writing, 80% of analysts are bullish on the stock and 20% are neutral. The average 12-month price target for the stock is $31, marking a 62% potential upside from current levels.

Intercept Pharmaceuticals Inc

Vernon Bernardino of FBR & Co. briefly weighs in on Intercept after the company received FDA approval for Ocaliva to treat liver disease primary biliary cirrhosis (PBC).

The analyst comments that the approval was expected since the FDA’s advisory committee for gastrointestinal drugs voted 17-0 to support the drug’s accelerated approval. Bernardino notes, “As a reminder, the GIDAC panelists concluded there was substantial evidence correlating a reduction in the surrogate endpoint of serum alkaline phosphatase (ALP) levels with a meaningful, positive effect on disease progression to death and/or liver transplantation in OCA-treated patients.”

Despite this good news, the analyst remains on the sidelines, maintaining a Market Perform rating on the stock without providing a price target. Bernardino remains cautious because he continues “to believe upside potential and downside risk for ICPT stock are evenly balanced.”

According to TipRanks.com, analyst Vernon Bernardino has a yearly average return of -15.6% and a 33% success rate. Bernardino is ranked #3864 out of 3972 analysts.

67% of analysts are bullish on Intercept, 20% are neutral, and 13%are bearish. The average 12-month price target between these analysts is $206.25, marking a 39% potential upside from current levels.