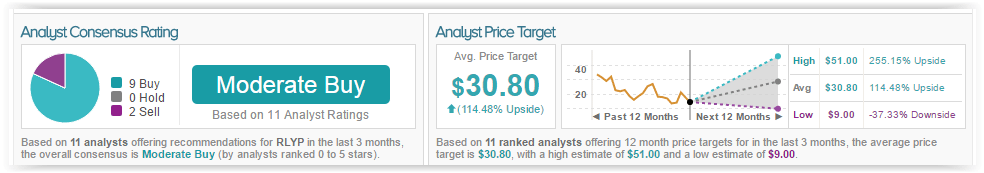

Relpysa Inc (NASDAQ:RLYP) is up over 5% after positive data from its hyperkalemia treatment, Veltassa. The company released data from analyses of studies regarding the effect of the Potassium Binding Polymer Patiromer on urine sodium excretion in healthy adults. The data indicated a mean decrease in urine sodium compared to the placebo when taken daily. In addition, none of the participants reported serious adverse events or discontinued treatment.

Chief Medical Officer Lance Berman, M.D., stated “Patients with heart failure and chronic kidney disease often have restricted fluid and sodium intake, as these may cause congestive symptoms. We presented new data suggesting Veltassa may bind and remove sodium as well as potassium in the gastrointestinal tract, which may be relevant for these patients.” He continued, “A separate analysis showed Veltassa controlled potassium levels for up to a year in hyperkalemic patients who were taking multiple blood pressure medicines. This is important because the use of certain types of blood pressure medicine is often limited due to the side effect of hyperkalemia.”

According to TipRanks, out of the 11 analysts who have rated the company in the past 3 months, 9 gave a Buy rating and 2 gave a Sell rating. The average 12-month price target for the stock is $30.80, marking a 106% upside from where shares last closed.

Seadrill Ltd (NYSE:SDRL) is down 3% as Brent crude prices are falling this morning to $47.87 a barrel due to Iran’s statement that it will not freeze its oil production or exports, marking the fourth consecutive day of oil price declines for the first time in a month. Iran’s Deputy Oil minister Rokneddin Javadi stated that the countries crude exports would rise from 2 million barrels per day to 2.2 million barrels per day by the middle of the summer. Many were hoping for an agreement to freeze OPEC oil production at meeting in Vienna on June 2. Furthermore, U.S rig counts are starting to steady following a decline, contributing further to global oversupply.

According to TipRanks, only one analyst has rated the company in the past 3 months with a Sell rating and no price target.

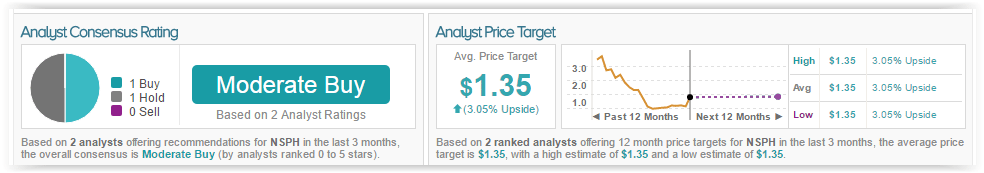

Nanosphere, Inc. (NASDAQ:NSPH) is up close to 27% in pre-market trading this morning after the company announced that it would be acquired by microbiology and molecular diagnostic leader Luminex. The company has upped its previous offer from $1.35 per share to $1.70 per share after a third party offered to buy Nanosphere for $1.50 per share. The transaction is worth about $77 million.

According to TipRanks statistics, out of the 2 analysts who have rated the company in the past 3 months, 1 is bullish while 1 remains on the sidelines. The average 12-month price target for the stock is $1.35, marking a 3% upside from where shares last closed.

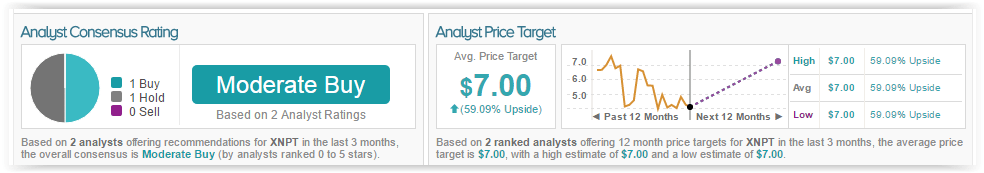

XenoPort, Inc. (NASDAQ:XNPT) is soaring more than 58% following news that the company will be acquired by Arbor Pharmaceuticals for $467 million. Arbor will purchase all outstanding shares of the company for $7.03 per share, with the transaction expected to close in the third quarter of this year. While the transaction was approved by both companies’ boards of directors, the U.S government still has to approve the merger under the Hart-Scott-Rodino Antirust Improvements Act.

CEO of Arbor Ed Schutter stated, “We are pleased to be adding HORIZANT and the XenoPort pipeline to the growing portfolio of Arbor products.” He continued, “We believe that XenoPort’s lead product HORIZANT offers patients and physicians a valuable treatment option for moderate-to-severe primary restless legs syndrome and post herpetic neuralgia.”

According to TipRanks, out of the 2 analysts who have rated the company in the past 3 months, 1 is bullish while 1 remains on the sidelines. The average 12-month price target for the stock is $7.00, marking a 59% upside from where shares last closed.