Analysts take a deeper look at discount retailer J.C. Penney Company Inc (NYSE:JCP) and tobacco maker Altria Group Inc (NYSE:MO). While one analyst upgrades JCP on the back of an attractive risk/reward outlook, the other shines light on recent price hike for cigarettes and smokeless products across the industry, and how this impact Altria Group

J.C. Penney Company Inc

Following a sharp pullback from March highs, Baird analyst Mark Altschwager upgraded J.C. Penney stock from Neutral to Outperform and raised the price target from $11.00 to $12.00.

Despite the challenge faced by brick and mortar stores, Altschwager believes J.C. Penny might be set for a comeback. The new CEO, Marvin Ellison, has solidified his management team and outlined a credible path to EBITDA recovery, the company has improved their balance sheet, and management has delivered relatively consistent results despite a “VERY” challenging apparel retail backdrop. Altschwager believes outperformance is possible achievable without “heroic valuation assumptions” as the EBITDA figure is recovering and the stock is well off highs.

Q1 sales and gross margin fell short of expectations; however, earnings beat and management maintained F2016 comp and EBITDA targets. The comp miss may be a cause of concern to some however, a stable earnings outlook is encouraging in the context of large guidance reductions seen across the sector in the past week. This supports Altschwager’s view that “controllable” initiatives rather than improving macro trends will drive this EBITDA recovery story.

Is it worth listening to this analyst? Check Altschwager’s past performance and ranking Here.

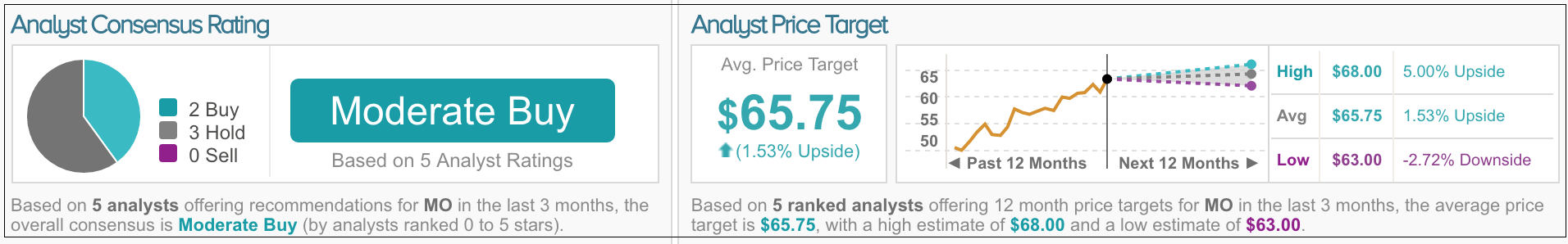

Out of the 18 analysts polled by TipRanks (in the past 3 months), 6 analysts are Bullish on J.C. Penny stock, while 9 analysts remain Neutral and 3 are Bearish on the stock. The stock’s consensus target price is $10.77, marking a potential upside of 45.74%.

Altria Group Inc

Following a price increase on cigarettes, Merrill Lynch analyst Lisa Lewandowski maintained a Neutral rating on Altria Group and provided a price target of $66.

On May 11, PMUSA announced a list price increase of $3.50 per 1000 sticks of cigarettes. The following day, RAI/RJRT/Natural American Spirit, ImperiaI/ITG and VGR/Liggett followed suit and raised their prices respectively. Lewandowski expects Japan Tobacco Intl and other small cigarette companies to follow suit. To respond to increasing prices Lewandowski believes that wholesalers/retailers will begin to reduce inventory levels for 1Q’s slightly elevated levels.

Lewandowski noted, “These pricing moves reinforce our belief that the US cigarette industry is in a very rational competitive state at present, with MO’s balance of profitability vs. share tilted towards profit growth. These announcements are a positive for MO, RAI and the category as a whole and are included in our current EPS estimates.”

According to TipRanks, analyst Lisa Lewandowski has a yearly average return of 12.5% and a 100% success rate. Lewandowski is ranked #1162 out of 3910 analysts.

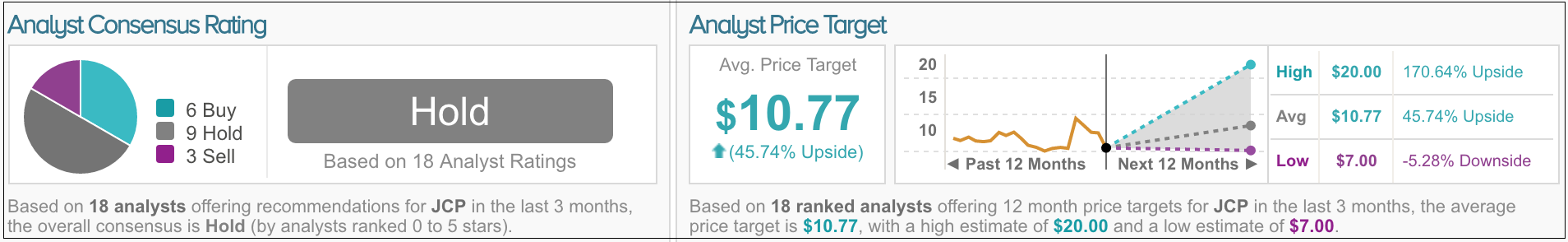

Out of the 5 analysts polled by TipRanks (in the past 3 months), 2 analysts rates Altria Group stock a Buy and 3 rate the stock a Hold. The stock’s consensus target price is $65.75, marking a potential upside of 1.53%.