Gilead Sciences, Inc. (NASDAQ:GILD) shares tumble nearly 5% in pre-market trading Friday, as Q1:16 was not one of GILD’s best. The biotech giant reported quarterly results with total top-line revenues of $7.6 billion missing consensus of $7.7 billion. Non-GAAP EPS of $3.03 was below consensus $3.13 estimates. Revenue miss was driven primarily by HCV.

Piper Jaffray analyst Joshua Schimmer comment: “GILD 1Q16 earnings were fairly sloppy as a somewhat expected miss on the U.S. HCV franchise couldn’t be offset by performance ex-U.S., an exceptional Genvoya launch and high share repurchase. EPS was light by 6 cents, although relative to our own assumptions, the quarter was better than expected. But just like with the strong quarters, still all that matters is GILD’s ability to gradually convince investors there is a tail to its HCV/HIV franchises and also leverage its balance sheet to deliver a stronger LT earnings growth outlook through M&A. We’re rather disappointed GILD didn’t pick up Stemcentrx, but there are still assets out there for the company to step up to the plate and convince investors it hasn’t lost its mojo.”

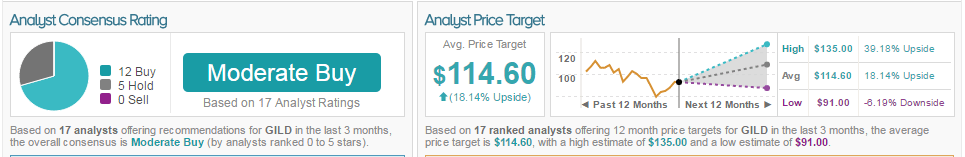

According to TipRanks, out of the 17 analysts who have rated the company in the past 3 months, 12 are bullish, and 5 remain on the sidelines .The average 12-month price target for the stock is $114.60, marking a 18% upside from where shares last closed.

Seadrill Ltd (NYSE:SDRL) shares jumped nearly 15% in pre-market trading, after the oil and gas rig maker announced that it has reached agreement with its banking group to extend its three nearest maturing borrowing facilities and amend certain covenants across its secured credit facilities, as the first phase of a broader plan to refinance and recapitalize the business.

The Company has agreed a set of milestones which provide a timetable for advancing discussions around a longer term solution. The Company has agreed not to draw any of the US$467 million available to it under its revolving credit facilities and to an increase in the minimum liquidity covenant contained in its secured credit facilities from US$150 million to US$250 million during the negotiating period.

According to TipRanks’ statistics, out of the 7 analysts who have rated the company in the past 12 months, 5 gave a Sell rating, while 2 remain on the sidelines.

Amazon.com, Inc. (NASDAQ:AMZN) shareholders can start celebrating this morning, after the online retail giant surprised the market with an exceptionally strong quarter with revenue of $29.13 billion, +28% YoY, accelerating from 26% in 4Q15.

Axiom analyst Victor Anthony comment: “The outperformance vs. our estimates was driven by faster North America and International electronics sales, and continued strong AWS growth. CSOI margin of 5.7% was 161bps ahead of our estimate and expanded by 260bps, aided by higher North American segment margins, slight international profitability, and high AWS profitability. The midpoint of the revenue guidance was 5.4% ahead of our estimate. The results, should, in part, allay investor concerns that Amazon is embarking on another aggressive investment cycle tied to a logistics service […] We increased our 2016 revenue and CSOI estimate by 3.6% and 3.4%, resp. The changes increased our price target to $811 from $797, previously.”

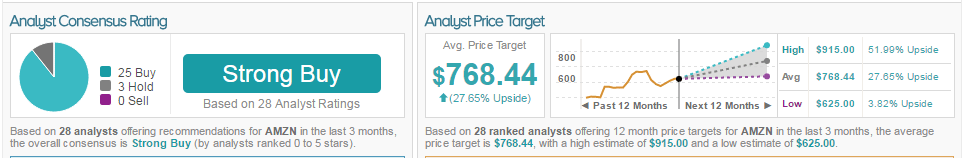

According to TipRanks, 25 analysts currently recommend buying AMZN while 3 are neutral. The average 12-month price target between these analysts is $768.44, marking a 28% potential upside from current levels.

Expedia Inc (NASDAQ:EXPE) shares are up over 10% in pre-market trading Friday, after the travel service leader released first-quarter results, which were solid and above Street expectations on both top and bottom lines.

Cantor analyst Naved Khan comment: “We’re maintaining our positive view and $180 PT to reflect a) strong momentum in core led by room nights growth; b) potential of upside to numbers from greater-than-expected synergies from Orbitz (post integration); c) promising start to HomeAway’s transition to a transaction-driven business, and d) potential for leverage in Trivago longer term […] We are adjusting our FY16 estimates to $8,931M in revenues, $1,652M in EBITDA and $4.76in NEPS, from $8,706M, $1,1650M and $4.62, previously. For 2Q, we expect $2,284M, $339M and $0.87, vs. $2,240M, $399M and $1.10, with EBITDA and EPS more accurately reflecting the HomeAway transition and timing of OWW synergies.”

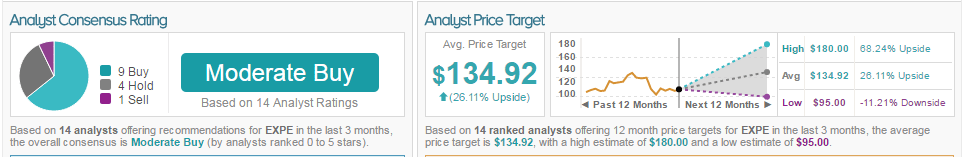

According to TipRanks, out of the 14 analysts who have rated the company in the past 3 months, 9 gave a Buy rating, 4 gave a Hold rating, and 1 remains on the sidelines. The average 12-month price target for the stock is $134.92, marking a 26% upside from where shares last closed.