Technology companies Intel Corporation (NASDAQ:INTC) and Palo Alto Networks Inc (NYSE:PANW) host conferences to address the public’s concerns for both companies’ futures. Intel presented its new technologies and partnerships, while Palo Alto is expected to regain investor confidence by elaborating on new strategies. Analysts from UBS and Morgan Stanley weigh in with great detail.

Intel Corporation

Intel’s Cloud Day provided insights into the company’s new technologies and partnerships. UBS analyst Stephen Chin explains why such an event sparks positivity in his eyes, leading him to reiterate a Buy rating with a 12-month price target of $35.

The analyst’s optimism stems from the noteworthy improvements in Intel’s current server chips and processors, and Intel’s sales effort to potentially deliver rewards for the company. The new 14nm process based Xeon e5 2600 v4 is aimed at growing enterprise customers, and Chin sees this as a huge improvement to Intel’s offerings. He states, “We believe the performance increase of up to 44% over prior gen platforms along with new Resource Director Tech feature … should continue to drive server upgrade cycles that have been declining from 5+ years to c.4 in recent years.”

Chin then points to the company’s potential growth in sales and the growing demand. He comments, “The fact that over 55% of enterprises have a private cloud deployed plus the natural desire to keep sensitive data internal to the company lead us to believe there is much room for enterprise customers (c.36% of DCG sales) to upgrade or further add to existing server infrastructure.” On that note, the analyst believes the company will make the most of this growth, explaining, “We remain positive on Intel’s ability to continue growing Data Center sales at a mid- teens CAGR given a maturing private/hybrid cloud ecosystem that could lead enterprise customers accelerate adoption of new server chips.”

According to TipRanks.com, Stephen Chin’s prediction succeed 54% of the time, ultimately delivering a one-year average return per recommendation of 6.6%. Among Stephen Chin, in the past three months, 21 additional analysts gave INTC a Buy rating, 7 remained on the sidelines, and 3 analysts ranked the company a Sell rating. All recommendations amounted to a 12-month average price target of $36.70, marking a 13% upside from where shares last closed.

Palo Alto Networks Inc

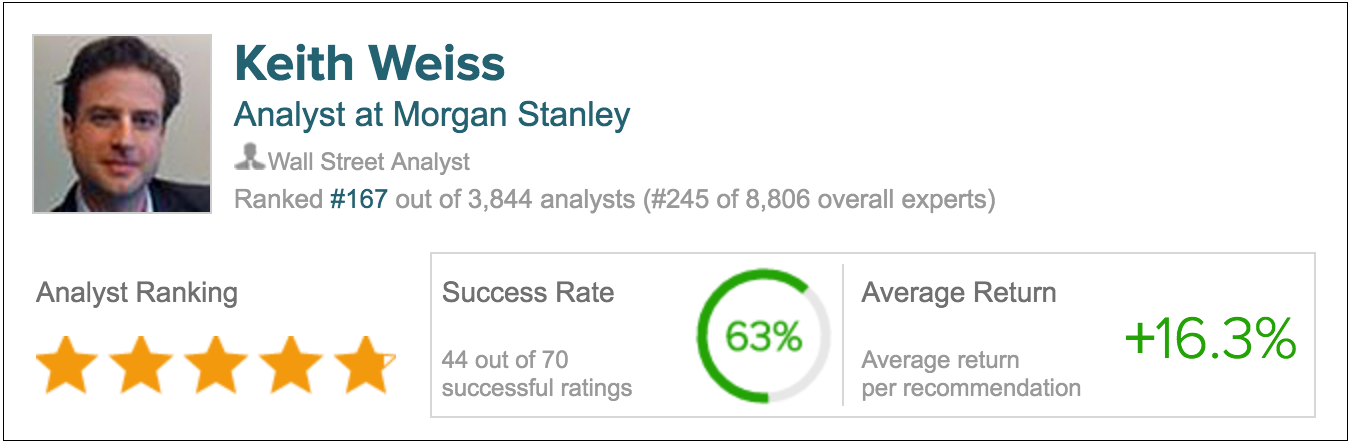

Expectations are building up towards today’s Palo Alto Networks’ Analyst Day, as analysts including Keith Weiss of Morgan Stanley are awaiting clarifications on several key subjects regarding the company’s future. According to Weiss, the subjects expected to be debated are the Security Spending Cycle, Total Addressable Market (TAM) expansion, and Free Cash Flow and Operating margins’ long term movements. The analyst remains positive on the Palo Alto and reiterates a Buy rating with a price target of $171.00.

The analyst speaks briefly about his firm’s view on each of the aforementioned investor debates, starting with the company’s security spending cycle growth concerns. Billing growth decreased by 6% from Q3 to Q4, however, investors are asking if this trend will continue through this year as well. Weiss believes the contrary, stating, “We do not believe that security spending will move lower, given its heightened priority, but incremental dollars will likely shift towards more strategic security solutions.”

Weiss also comments on the company’s sustainable growth management despite concerns of the security spending cycle. Weiss refers to the refreshing of the company’s installed base, noting that this will add about 17% of incremental product revenue growth in 2016. Weiss notes the company has potential to upsell and to explore new markets. He reports, “Palo Alto is addressing new markets beyond network security with its TRAPs solution addressing the $4.4B endpoint market and AutoFocus addressing the $3.7B security analytics market.”

Another key element in today’s event is the company’s ability to expand its TAM. Weiss believes the company is well prepared to obtain more market share with a larger product portfolio. He states, “We see Palo Alto Networks as better positioned to address the wider network security and endpoint security market ($15B).” Lastly, regarding the company’s FCF margins, Weiss sees the company improving margins towards 40% and highlights today’s debate around this subject. More specifically, the analyst sets his expectations for PANW’s revenue growth. He adds, “We look for subscription revenue to grow 43% in FY17, FCF margins at 39%, and operating margins at 21% in FY17.”

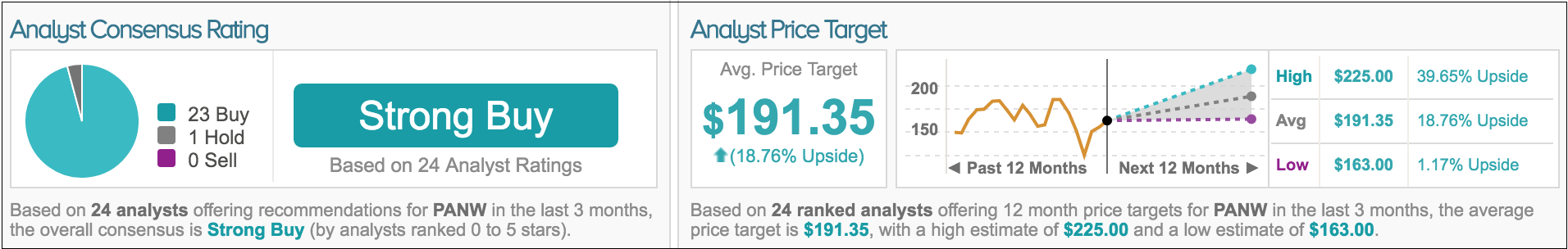

According to TipRanks, Keith Weiss has a 63% success rate and provides a 16.3% average return per recommendation. Among Weiss, in the past three months, 22 additional analysts gave the company a Buy rating and one remained on the sidelines. Overall, the ratings altogether set an average 12- month price target of $191.35, marking a 18.76% upside from where last shares closed.