New insights emerge in the biotech sector as Valeant Pharmaceuticals Intl Inc (NYSE:VRX) continues to be clouded by fraud allegations and Celgene Corporation (NASDAQ:CELG) deals with the repercussions of F/X headwinds. Let’s take a closer look as analysts weigh in on both biotech giants:

Valeant Pharmaceuticals Intl Inc

Several questions surround Valeant as the embattled pharmaceutical company quells investor concerns regarding fraud allegations and a congressional hearing. The company came under fire for its questionable relationship with specialty pharmacy, Philidor, and is taking the heat from congress as pricing practices from drug companies come under scrutiny. David Risinger of Morgan Stanley maintains an Equal-Weight rating on the stock as he updates investors on the status of the Philidor investigations.

The analyst explains that the public still does not know “what really happened at Philidor.” There is an ad hoc committee currently reviewing the allegations, but Risinger explains the investigation may be limited “because Philidor was independent,” even though the analyst sees this statement as a “gray area.” He explains, “Valeant paid $100M in late 2014 for an option to acquire Philidor for $0, yet the company stated in slide 21 of its October 26, 2015 presentation ‘We do not own or control Philidor.’” Because of the premise that Valeant does not own Philidor, the ad hoc committee’s investigation will be narrow in scope, meaning the relationship between the two entities will remain unknown until the government investigation is complete, which could take one to two years.

Aside from the Philidor investigations, Risinger explains that although many investors believe it is “safe to go back into the water,” Valeant continues to be the bearer of bad news. He explains, “just over the weekend, Bloomberg carried an article that Sprout investors are concerned that Valeant has failed to successfully commercialize Sprout’s female libido pill Addyi.” Furthermore, the analyst warns that Valeant intends to release its 10-K by April 29, but may request an extension. Risenger explains that investors will be looking for “any additional restatements or new disclosures, such as write-offs, emerging business risks, and lawsuits,” in the 10-K, in addition to further details on the Philidor investigation.

Because of all the unanswered questions surrounding Valeant, Risinger believes it is too soon for investors to return to the stock. He reiterates an Equal-weight, or “hold,” rating on the stock with a $39 price target, marking a 35% potential upside from current levels.

According to TipRanks, Risinger has a 54% success rate recommending stocks with a +0.4% average return per rating. Analysts seem to be divided on the stock as 7 recommend buying shares of Valeant, 4 recommend selling, and 11 remain on the sidelines. The average 12-month price target between these 22 analysts is $54.88, marking a 90% potential upside from current levels.

Celgene Corporation

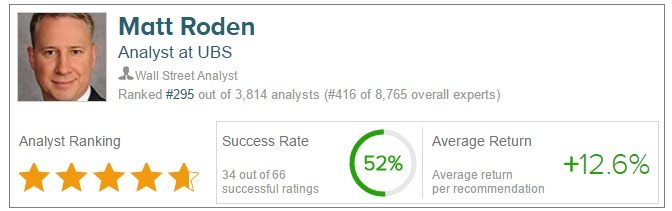

After analyzing the potential impact that F/X will have on Celgene’s 2017 earnings figures, Matthew Roden of UBS remains bullish on the biotechnology company.

The $800 million F/X headwind will affect the company’s figures through 2017. Roden believes that Celgene management could revise its 2017 EPS estimate from $7.25 down to $6.75. The analyst explains that although there is a 50 cent potential downside to his 2017 EPS target, this may already be reflected in the stock. He explains, “Indeed, the stock is already at <15x the downside 2017 EPS of $6.75 despite retained 20%+ 5yr fwd growth and multiple pipeline readouts 2H16-2018e.”

Roden points to two factors that explain the stock’s recent underperformance. First, “uncertainty over the magnitude of downside to 2017 guidance and the potential stock impact” and second, “the lack of visibility as to what the extraordinary deal-related GAAP/nonGAAP reconciliations in 2015 mean for ongoing non-GAAP EPS.”

Despite short-term headwinds, Roden assures that Celgene’s long-term growth “appears to be 5x more valuable than the [short-term] growth.” Roden reiterates a Buy rating on the company, but lowers his price target from $145 to $135.

According to TipRanks, Matt Roden has a 52% success rate recommending stocks with a +12.6% one-year average return per rating. He is the only analyst recommending a “hold” rating on Celgene while 13 others are bullish on the stock. The average 12-month price target is $147.80, marking a 49% potential upside from current levels.