It was a busy week for biotech investors as several players released earnings, for better or worse. Namely, all eyes were on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and MannKind Corporation (NASDAQ:MNKD) as two biotech companies struggle to regain public favor. How did the earnings play out? Let’s take a closer look:

Valeant Pharmaceuticals Intl Inc

After much delay, Valeant reported its Q4:15 earnings on Tuesday before market open. The company reported revenues of $2.79 billion, compared to consensus estimates of $2.75 billion and earnings of $2.50 per share, compared to consensus estimates of $2.61 per share. Valeant also posted weaker than expected guidance for FY16, about $2 billion less than originally forecasted. The company had a rough fourth quarter marked by an SEC investigation and a congressional probe regarding high drug prices for its heart medications.

Following disappointing earnings, analyst Shibani Malhotra of Nomura weighed in on the stock, downgrading it to Neutral from Buy and decreasing the price target from $175 to $60. She states, “We do not expect Valeant shares to outperform the market near term, as we have lost confidence in management’s ability to understand its own business and to provide reliable guidance.” She continues, “The company clearly does not have a handle on its business performance given the steep reduction in guidance over merely three months.”

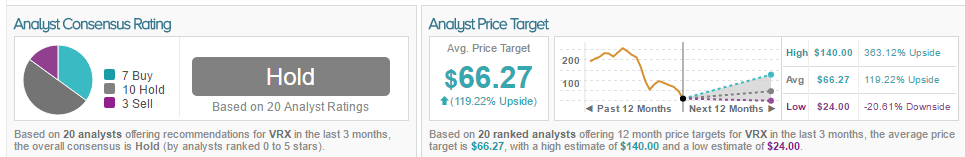

It seems that Malhotra is not along. Following a slow of ratings after earnings, 7 analysts remain bullish on Valeant, 3 are bearish, and 10 are neutral. The average 12-month price target between these 20 analysts is $66.27, marking a 120% potential upside from current levels. Malhotra has a 41% success rate recommending stocks with a 7% average one-year loss per rating.

MannKind Corporation

MannKind reported fourth quarter earnings on Tuesday. For the fourth quarter, the company reported a net loss of ($277,018) and a loss of ($.66) per share, compared to consensus estimates of a ($0.05) loss per share. The company blamed the earnings miss on weak Afrezza sales, made worse by partner Sanofi-Aventis backing out of the licensing and collaboration agreement in early January. The company is also facing debt struggles, as it has $120 million in long term debt vs. $33 million in cash. Many investors had their hopes pinned on Afrezza becoming the next blockbuster drug as the first inhable insulin for adults with diabetes, but the drug failed to bring in meaningful revenue and gain traction in the commercial arena.

After earnings, RBC Capital analyst Adnan Butt weighed in on the stock with an Underperform rating and a $0.15 price target, commenting on a lack of strategy to relaunch Afrezza and the subsequent drop in market share following the partnership termination with Sanofi. He states, “While MNKD has an approved diabetes drug in its hands in Afrezza and technosphere platform could have value in future drug development, we would like to see execution on four fronts before becoming constructive: 1) Afrezza sales ramping up into the tens of millions; 2) technology partnerships or a fast-to-market proprietary drug; 3) path to breakeven; and 4) improved balance sheet.”

According to TipRanks, Butt has a 39% success rate recommending stocks with a 14.3% average loss per rating. Out of the 5 analysts who have rated the stock in the last 3 months, 1 remains bullish, 1 is neutral, and 3 are bearish. The average 12-month price target is $0.10, marking a 94% downside from where shares are currently trading.