Analysts weigh in on Ulta Salon, Cosmetics & Fragrance, Inc. (NASDAQ:ULTA) and Chipotle Mexican Grill, Inc. (NYSE:CMG) following an earnings release and a promotional deal, respectively. Below, analysts describe how Chipotle’s sales will be impacted from its Raincheck Promotion and why Ulta’s sales are poised for growth.

Chipotle Mexican Grill, Inc.

Peter Saleh of BTIG reiterated a Buy rating on Chipotle with a $530 price target following an analysis on the company’s traffic trends in light of its Raincheck Promotion. In an effort to bring back customers after the chain was associated with an E. Coli outbreak, customers were invited to have a free burrito after texting “rain check” to a specified number.

The analyst explains that sales increased during the promotional period in February, peaking at a 22% increase in lunch time sales. However since the promotion has ended, lunch time sales have decelerated. Saleh explains that the promotion helped drive traffic to Chipotle locations, but did not necessarily bolster same-store sales. He elaborates, “Due to the nature of the promotion… we expect the company to recognize greater transaction volumes but at a significantly lower average check. When (and if) Chipotle provides any intra-quarter sales results, we expect significant improvement in transactions, a decline in the average check and modest improvement (lesser decline) in same-store sales.”

Saleh goes on to explain that the long-term goal of the promotion is to regain consumer trust. The analyst explains, “We believe Chipotle’s promotional strategy was designed to re-establish trust with customers so that they would return to the brand in March, April and beyond with their own dollars.”

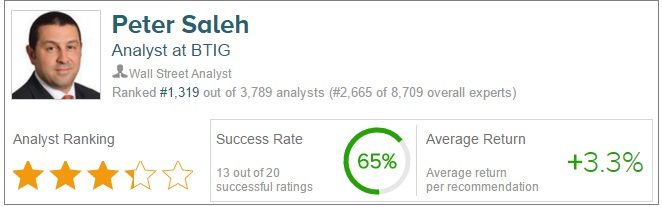

According to TipRanks, Peter Saleh has a 65% success rate recommending stocks with a 3.3% average return per rating. According to the 25 analysts polled in the last 3 months, 10 are bullish on the stock, 2 are bearish, and 13 remain neutral.

Ulta Salon, Cosmetics & Fragrance, Inc.

William Blair analyst Daniel Hofkin recently shared his insights on Ulta in light of its recent earnings report. The analyst reiterates his Outperform rating on the stock due to what is viewed as a defensible valuation and the likelihood of further sales.

The company posted fourth quarter EPS of $1.69, exceeding the analyst’s estimate of $1.54. Total sales increased 21.1% year-over-year to $1,268.3 million, which exceeded the analyst’s expectations of a 9.8% increase and exceeded the 8%-10% increase guided by the company. Additionally, comp sales and gross margin offset SG&A expense which ended up being much higher-than-expected. Hofkin explains, “comps were led by prestige and mass color cosmetics. We gather that comps were once again solidly above plan across all ages of stores.”

The analyst believes the company is doing exceedingly well, thanks to key developments such as “ULTAmate Rewards” loyalty program trends, the launch of nationwide TV and radio advertising, and the continued product company rollout of Benefit, Lancome, and Clinique with in-store presences. Ulta’s aggressive growth can also be attributed to the underlying beauty industry growth as a whole.

Hofkin increased his 2016 EPS estimate by 20% and his 2017 EPS by 23%. With the likelihood of further sales, margin expectations, and opportunities to gain substantial market share over the upcoming years, Hofkin expects “shares to trade up nicely on the release, while Ulta’s share price continues to discount further upside to near-term consensus expectations.”

According to TipRanks, Daniel Hofkin has a 71% success rate with an average return of +9.8%. Out of 11 analysts who have rated the company in the last 3 months, 9 gave a buy rating and 2 gave a hold rating. The average 12-month price target for the stock is $197.64, marking a 3.14% upside from where shares last closed.