As two biotech companies continue announce pipeline progressions, for better or worse, analysts weigh in on Celldex Therapeutics, Inc. (NASDAQ:CLDX) and Invivo Therapeutics Holdings Corp (NASDAQ:NVIV). Below, analysts explain why they remain bullish on both biotech companies in light of new developments.

Celldex Therapeutics, Inc.

Celldex announced that it is discontinuing the Phase III trial of Rintega, causing the stock to lose half of its value yesterday. Rintega, a pipeline cancer therapy, was discontinued after the Data Safety and Monitoring Board (DSMB) determined that the study would not reach its primary endpoint. In light of this decision, analyst Jonathan Aschoff of Brean Capital reiterates a Buy rating on the stock with a $24 price target.

The analyst remains bullish on the company despite the trial failure given that he had already removed the drug from his model late last month. Aschoff explains, “We continue to believe that, given the catalysts coming in 2H16 and 2017, Celldex can be valued substantially higher than the present value without Rintega.” The analyst explains that the company no longer needs to burn cash on Rintega, allowing it to preserve its cash runway, which was last valued at $290 million at the end of the fourth quarter.

Aside from Rintega, the company highlighted glemba on its conference call. Aschoff explains, “Celldex confirmed it is on track to report data from its Phase 2 trial with glemba for metastatic melanoma in 2H16.” Glemba, in testing to treat breast cancer (TNBC), has the potential to receive accelerated approval if the Phase 2 trial is successful.

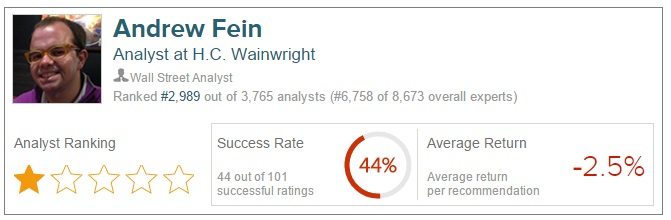

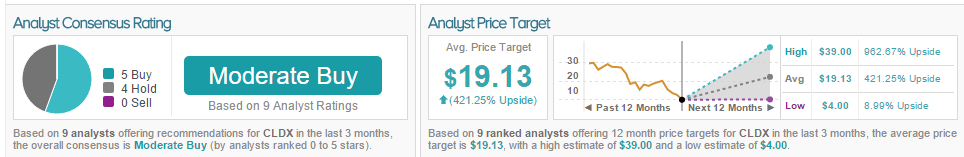

Jonathan Aschoff has a 31% success rate recommending stocks with an average loss of 11.9% per rating according to TipRanks. Five analysts are bullish on the stock while 4 remain neutral. The average 12-month price target on the stock is $19.13, marking a 404% potential upside from current levels.

Invivo Therapeutics Holdings Corp

In light of the recent successful implementation of the Neuro-Spinal Scaffolds in its sixth patient, Invivo’s stock price appreciated sharply by 60% last week. This increase is also attributed to the company reaching 25% OPC (Objective Process Criterion) and the continuation of the submission process with the FDA. Thanks to these positive catalysts, H.C Wainwright analyst Andrew Fein reiterates a Buy rating on the stock with a $25 price target.

Fein elaborates on the company’s efforts to increase the OPC of the study, noting, “This is a low mountain to climb, especially given the beneficial contribution of myelotomy surgery alone compared to historical controls as noted in literature.” The favorable view isn’t only a positive projection of the process alone, AIS A conversions (the mitigation of spinal cord injury pains) seem to have improved as well.

The analyst explains, “In our opinion, the most important of all the news, is the definition of the OPC at 25% of patients demonstrating a AIS A conversion at the 6-month mark, compared to the historical rate of spontaneous AIS A conversions of 16%.” Fein believes that if Invivo achieves three more patients with AIS conversions, “the company is likely to go to the agency ahead of the full study completion.”

Andrew Fein has 44% success rate recommending stocks with an average loss of 2.5% per recommendation. According to TipRanks, Fein is the only analyst, so far, to be bullish on the stock; his target price sets a 150% upside mark from current levels.