In light of an upcoming earnings results and a disappointing data readout, analysts weigh in on Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and Chimerix Inc (NASDAQ:CMRX). Both analysts remain neutral on the stocks, though analysts at large might not necessarily agree.

Valeant Pharmaceuticals Intl Inc

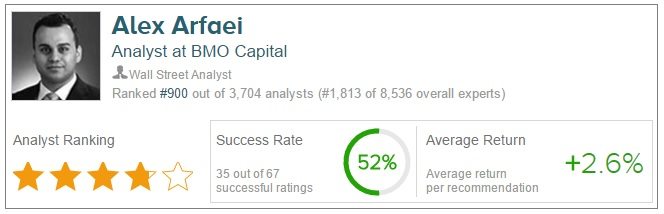

There hasn’t been a dull moment for Valeant in the last few months between fraud allegations, drug pricing scrutiny, and a CEO on medical leave. Ahead of Valeant’s Q4 earnings, scheduled to be released around February 29, analyst Alex Arfaei of BMO Capital is weighing in on the pharmaceutical company. The analyst does not think there will be many surprises in the company’s earnings since it reaffirmed previous guidance.

Arfaei expects the company to post revenue “on the lower half” of the recent estimate range of $2.7 billion to $2.8 billion due to his “more conservative expectations for Salix; a pharmaceutical company acquired by Valeant in April for nearly $11 billion. He states, “Although we are at the lower half of revenue guidance, we forecast that Valeant will finish 4Q15 at the top end of its EPS guidance, or exceed it.”

The analyst forecasts a ~3% same-store organic decline for the quarter due to lower U.S. sales of the company’s dermatology products as a result of its falling out with Philidor. “However,” he continues, “we expect FY2015 organic growth of ~10%; both in line with recent guidance.” Going forward, the analyst’s is “on the bottom end of 1Q16 revenue guidance, and below the company’s FY2016 revenue guidance because of [his] uncertainty regarding the Walgreens arrangement and headwinds in emerging markets, including FX.”

Due to his lackluster predictions, the analyst reiterated a Market Perform rating on Valeant with a $133 price target, marking a 60% potential upside from current levels. According to TipRanks, most analysts are bullish on Valeant. Out of the 17 analysts polled in the last 3 months, 10 are bullish; 1 is bearish; and 6 are neutral.

Chimerix Inc

Chimerix has been disappointing investors for some time as it has lost over 90% of its value in the last 6 months. The company already announced in December that SUPPRESS, a study on pipeline drug brincidofovir to prevent cytomegalovirus (CMV) in patients undergoing hematopoietic cell transplantation (HCT), had failed to meet its endpoint. Yesterday, Y. Katherine Xu of William Blair weighed in on the company as it discussed its plans to move forward.

Xu explains, “The failure of SUPPRESS appears to have been driven by high steroid use in the brincidofovir arm to treat presumptive GvHD (graft versus host disease). In our opinion, the oral formulation of brincidofovir is no longer viable in this indication.” The analyst explains that diarrhea is the main side effect of this drug due to its toxicity, but experts could not distinguish if this or GvHD was the main cause of the diarrhea. Regardless, the majority of doctors decided to treat the diarrhea with steroids, “despite the SMMP (safety monitoring and management plan) Chimerix put into place that instructed interruption of dosing first before treating with steroids.”

The analyst highlights two strategy changes outlined by the company: “Push the IV formulation into the clinic in second half 2016 to abrogate the diarrhea side effect and thereby any confusion with GvHD.” If this study goes well, the IV form will have several advantages to be competitive in the marketplace. Second, Yu explains, “Closing the Phase III SURPASS and SUSTAIN studies in the kidney transplant setting due to lack of impact on BK virus observed in SUPPRESS, and start Phase II studies to better characterize activity against BK.”

Yu has maintained her Market Perform rating but lowered her price target from $12 to $8. She explains, “Based on the strategic decision of terminating SURPASS and SUSTAIN, we have removed brincidofovir for the prevention of CMV in the solid organ transplant setting from our model, which is the biggest commercial opportunity.”

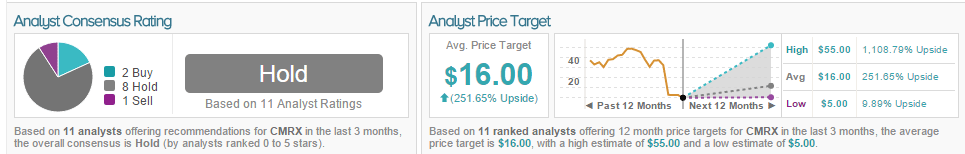

According to TipRanks, 2 analysts are bullish on the stock, 1 is bearish, and 8 remain on the sidelines. The average 12-month price target between these 11 analysts is $16, marking a 247% potential upside from current levels.