Both Valeant Pharmaceuticals Intl Inc (NYSE:VRX) and OvaScience Inc (NASDAQ:OVAS) have been the source of investor concern. Valeant has been battling fraud allegations and been at the center of negative press regarding drug price hikes. OvaScience, on the other hand, had a disappointing drug launch. Despite these events, these analysts remain bullish on both companies.

Valeant Pharmaceuticals Intl Inc

This morning, analyst Raghuram Selvaraju of Rodman & Renshaw initiated coverage on Valeant Pharma with a $150 price target, calling the company a “beleaguered giant on the comeback trail.” The analyst believes shares of the company have been unfairly beaten down due to fraud allegations regarding the company’s relationship with specialty pharmacy Philidor; negative press surrounding the company’s expensive drug prices; and the hospitalization of its CEO due to pneumonia complications.

Selvaraju explains, “In our view, these factors have been overstated and over-emphasized in the investment community, while we believe that the fundamentals of the Valeant business model remain intact.” The analyst is bullish on the pharmaceutical company due to its growth success story, which he attributes to acquisitions and tax arbitrage. He explains that Valeant has diversified offerings and is safe from pending patents expirations.

The analyst is bullish on Valeant’s recent deal with Walgreens; a 20-year agreement that will enable Valeant to “grow revenue on the basis of volume, rather than price increases.” Selvaraju goes on to highlight Valeant’s rapidly growing eye care business and its gastroenterology franchise. The analyst comments, “Valeant could generate $7B in EBITDA next year on sales of roughly $12.7B, and that the firm could grow revenues to over $15.6B by 2018.”

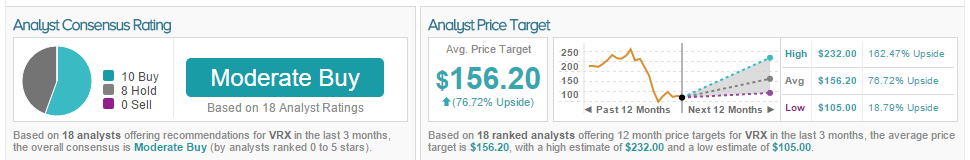

According to TipRanks, 10 analysts are bullish on Valeant while 8 remain neutral. The average 12-month price target for the stock is $156.20, marking a 77% potential upside from where shares last closed.

OvaScience Inc

While many are shying away from OvaScience due to the disappointing launch of Augment, the company’s flagship product to bolster egg health in women trying to conceive, Andrew Fein of H.C. Wainwright remains bullish on the company ahead of its analyst day. This morning, Fein maintained his Buy rating on the stock but lowered his price target to $15.

Heading into analyst day, Fein expects to gain clarity on plans to expand (geographically) the Augment launch, especially in Japan “where the addressable market is 1.3x the addressable market in the other geographies.” The analyst elaborates, “With about 600 fertility clinics and hospitals in operation nationwide, approximately 1 in 6 couples suffering from infertility and 1 in 27 children in Japan born through IVF, we believe that penetration and launch of Augment in the Japanese market remains a crucial component of Augment’s valuation.”

Fein will also be listening for news on OvaPrime and OvaTure regarding the commercialization timeline for both. OvaPrime is a pipeline drug that increases a woman’s egg reserve, while OvaTure is an IVF treatment in preclinical development. The analyst comments, “Overall, we believe that the company’s growing visibility among the general public, continued live birth announcements, the slow build of an international registry… and pipeline prospects for continuous upgrade of commercial technology, all bode well for an eventual return to value despite the share price destruction of the past 12 months.”

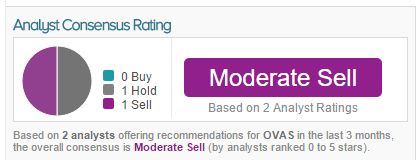

According to TipRanks, one other analyst is bearish on OVAS and one is staying on the sidelines.