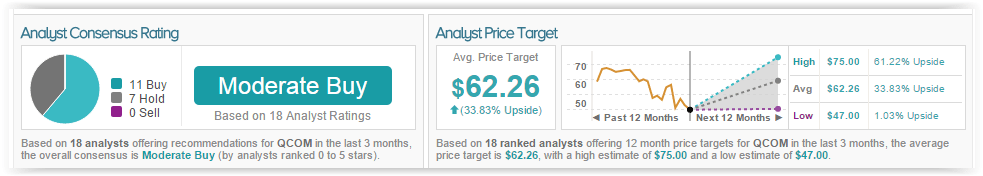

QUALCOMM, Inc. (NASDAQ:QCOM) is up over 1% in pre-market trading following an upgrade by Susquehanna analyst Chris Caso. The analyst upgraded the stock from Neutral to Positive and increased his price target to $60 from $53. He attributes his bullishness to Qualcomm’s royalty collecting success in China. He states, “QCOM has proven that they can collect royalties in China makes us incrementally more confident that they can continue to collect globally.” Additional reasons for his bullishness include the upcoming release of the Snapdragon 820 and the “compelling” risk reward ratio of the stock. Out of the 18 analysts polled by TipRanks who have rated the stock in the past 3 months, 11 gave a Buy rating while 7 remain on the sidelines. The average 12-month price target for the stock is $62.26, marking a 34% upside from where shares last closed.

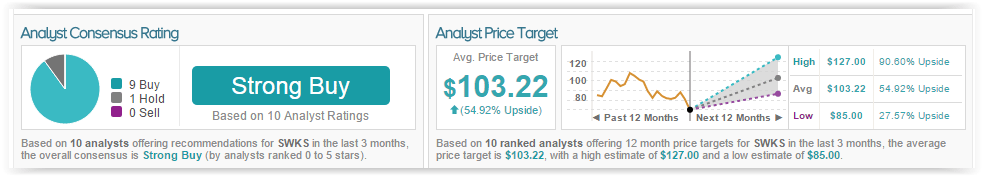

Skyworks Solutions Inc (NASDAQ:SWKS) fell 4% in pre-market trading down to $64 due to Qualcomm’s announcement that it will expand its efforts in the radio frequency chip area. Skyworks investors see this as a threat as Skyworks has already established itself in the RF market, making it a key player in the Internet of Things. At the same time, analyst Harsh Kumar of Stephens reiterated an Overweight rating on the company though lowered his price target from $120 to $90 due to near-term headwinds for Apple; one of the company’s largest customers. According to TipRanks, 9 analysts are currently bullish on SWKS while one remains neutral. The average 12-month price target between these 10 analysts is $103.22, marking a 55% potential upside from where shares last closed.

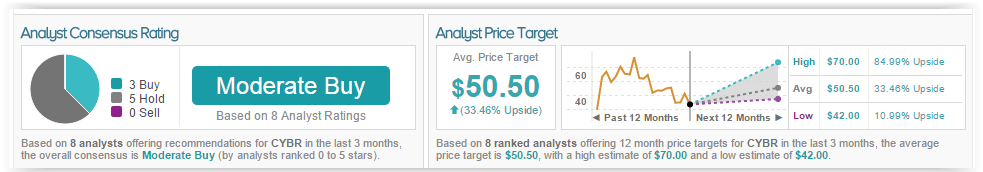

Cyberark Software Ltd (NASDAQ:CYBR) is up 12% in pre-market trading after news that cyber security firm Check Point Software is in talks to buy the company. As of this writing, officials declined to comment on the deal. If this acquisition is finalized, it would be Check Point’s largest yet. Last year, the company acquired Lacoon Mobile Security and Hyperwise. According to TipRanks’ statistics, out of the 8 analysts who have rated the company in the past 3 months, 3 gave a Buy rating while 5 remain on the sidelines. The average 12-month price target for the stock is $50.50, marking a 33% upside from where shares last closed.

Titan Pharmaceuticals, Inc. (NASDAQ:TTNP) is up a whopping 50% in pre-market trading this morning after the company received FDA advisory committee approval for Probuphine, a subdermal implant used to treat opioid addiction. The committee voted 12 to 5 in favor of approving the drug after a presentation regarding Probuphine’s safety, efficacy, and risk. The NDA for this drug was accepted by the FDA in September of 2015, with a target agency action set for February 27, 2016.