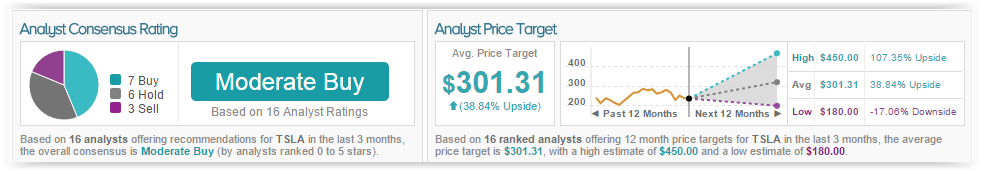

Tesla Motors Inc (NASDAQ:TSLA) traded down close to 0.5% in pre-market trading this morning to $216.00 after analyst Alex Gauna of JMP Securities initiated a Market Perform rating on the company. He attributes his rating to Tesla’s “blistering pace of innovation”, which keeps the company a key player among rising competition, high costs, and emerging legal risks. Tesla has been in the news recently due to a push for Apple to buy the electric car company. According to TipRanks’ statistics, out of the 16 analysts who have rated TSLA in the last 3 months, 7 gave a Buy rating, 3 gave a Sell rating, while 6 remain on the sidelines. The average 12-month price target for the stock is $301.31, marking a 39% upside from where shares last closed.

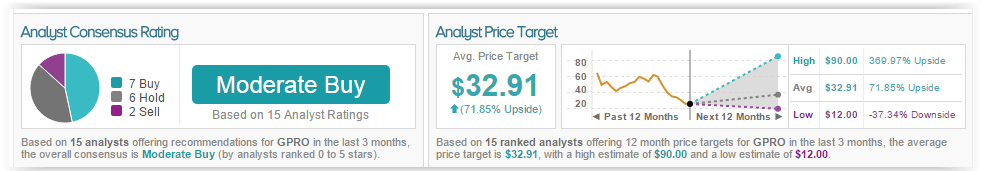

GoPro Inc (NASDAQ:GPRO) fell over 5% in pre-market trading this morning to $18.14 following a rating from analyst Kathryn Huberty of Morgan Stanley. The analyst downgraded the stock from Equalweight to Underweight and decreased her price target to $12 from $23. Despite this downgrade, shares have recently been going up due to anticipation for the company’s Karma drone. According to TipRanks’ statistics, out of the 17 analyst who have rated GPRO in the last 3 months, 7 gave a Buy rating, 2 gave a Sell rating, while 6 remain on the sidelines. The average 12-month price target for the stock is $32.91, marking a 72% upside from where shares last closed.

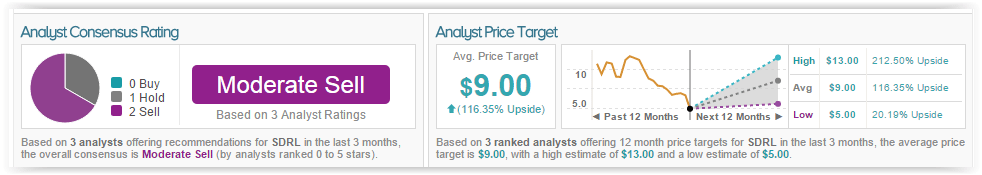

Seadrill Ltd (NYSE:SDRL) is down more than 8% in pre-market trading to $3.80 as crude oil dipped below $35 per barrel; exhibiting the lowest levels since February 2009. This price dip is one of many is a series of an unrelenting oil market that keeps pumping oil barrels into an already oversaturated market. Furthermore, oil analysts are bracing themselves for Iran’s sanctions to be lifted, allowing the country to contribute to the global supply glut. According to the 3 analysts polled by TipRanks in the last 3 months, 2 are bearish on the company and 1 remains on the sidelines. The average 12-month price target between these 3 analysts is $9, marking a 116% potential upside from current levels.

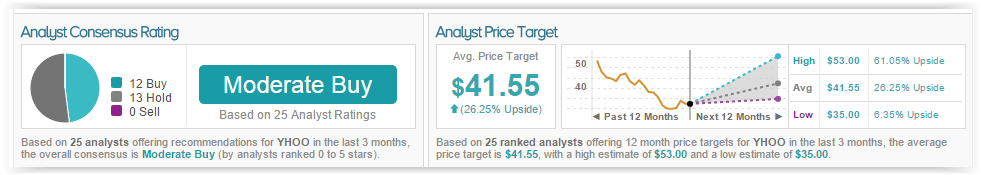

Yahoo! Inc. (NASDAQ:YHOO) traded down slightly in pre-market trading this morning after investor pressure to fire CEO Marissa Mayer and to find a buyer for its core Internet business as quickly as possible. Investment firms who own large parts of the company are frustrated with Mayers’ performance as of late and are disappointed with the company’s decision to spin off its stake in Alibaba. They believe this move is a way to push back a turnaround attempt that has not showed any progress. According to TipRanks’ statistics, out of the 25 analysts who have rated YHOO in the last 3 months, 12 gave a Buy rating while 13 remain on the sidelines. The average 12-month price target for the stock is $41.55, marking a 26% upside from where shares last closed.